Aduro Clean Technologies: This Could Be The Biggest Green Winner

Equity research report

Pre-revenue companies are exciting to invest in for certain investors chasing a 10x or even 100x, as investors tend to feel that the upside potential can be extreme. However, how do you pick a winner for your portfolio among these companies? There are no historical financials to rely on, there’s an uncertain path to profitability and scale, and there is always the question of liquidity and survival.

Aduro Clean Technologies ADUR 0.00%↑ is one such company. The business operates in a rapidly growing landscape of sustainable chemical processing. In simple terms, they have developed a differentiated technology that can recycle plastics, among other materials, more efficiently than traditional methods and also more economically.

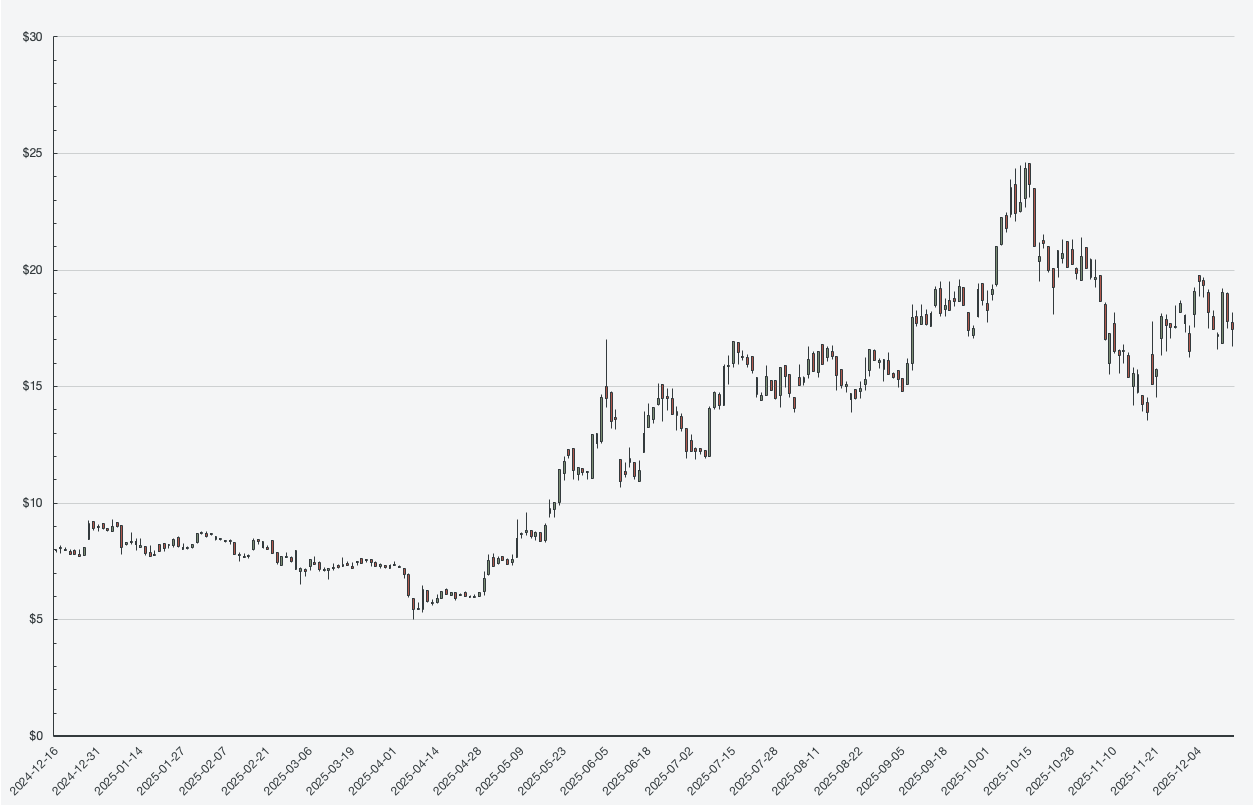

There is certainly excitement around the name, as the stock is up ~120% in the past year. The technology has passed several pilots, but the company still has no clear path to commercialization, scale, or ultimately, dominance. However, there are signs.

Price chart 1: Aduro Clean Technologies Inc., 1-year stock quote, CAD per share

Company profile

Theme: Recycling, Direction: Hold

Symbol: ACT, ADUR, Exchange: CSE, NASDAQ

Sector: Industrials, Industry: Pollution & Treatment Controls

Fair intrinsic value: $15.14 (-12.49%), as of December 17, 2025

Market capitalization: CAD 539 million

Pricing data: P/S 2,441x, P/E N/A

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

No financials, but there are other signs

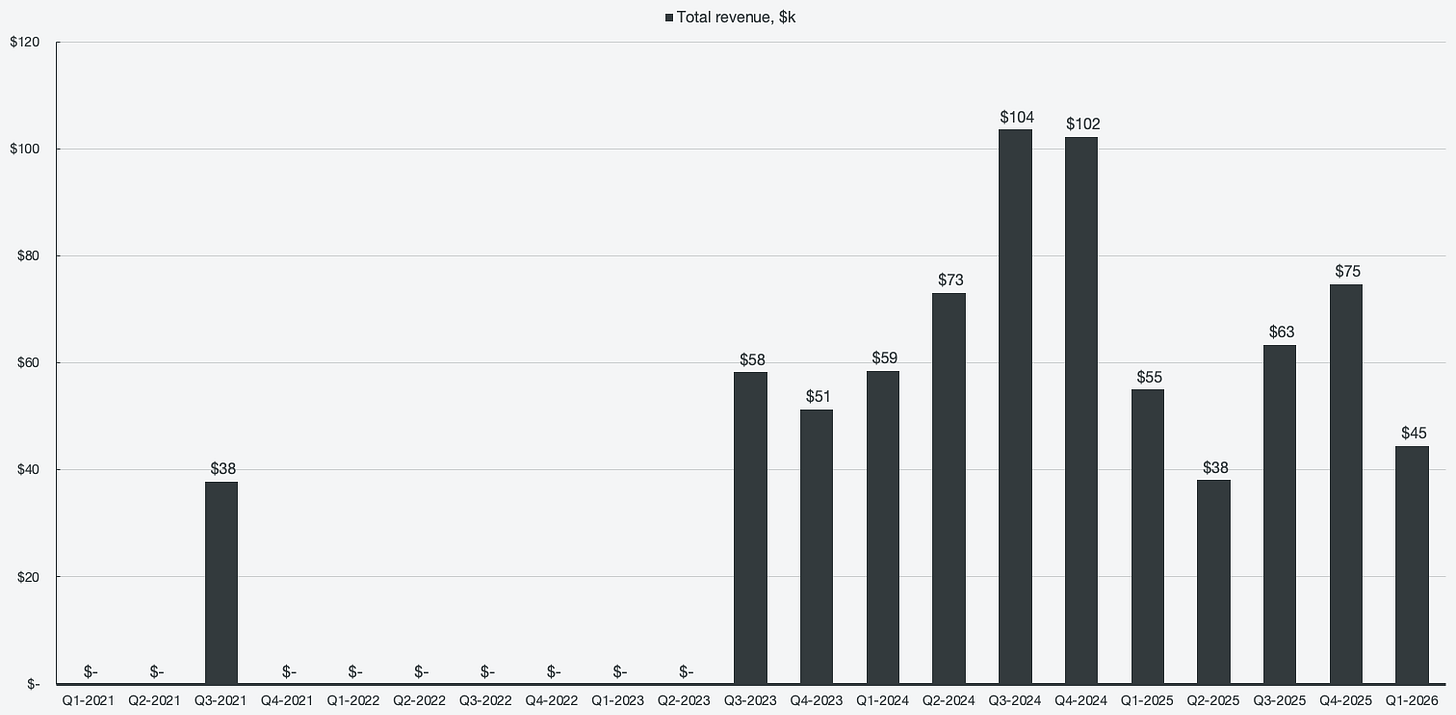

Most of you are familiar with a lot of charts in my research reports. Well, there simply are not many for Aduro to look at; it is that early still. That creates a whole new challenge for investors. However, there are some key metrics for investors to analyze. Revenue is not one of them, as the few thousand CAD they have received historically is from early customer engagements.

Figure 1: Total revenues

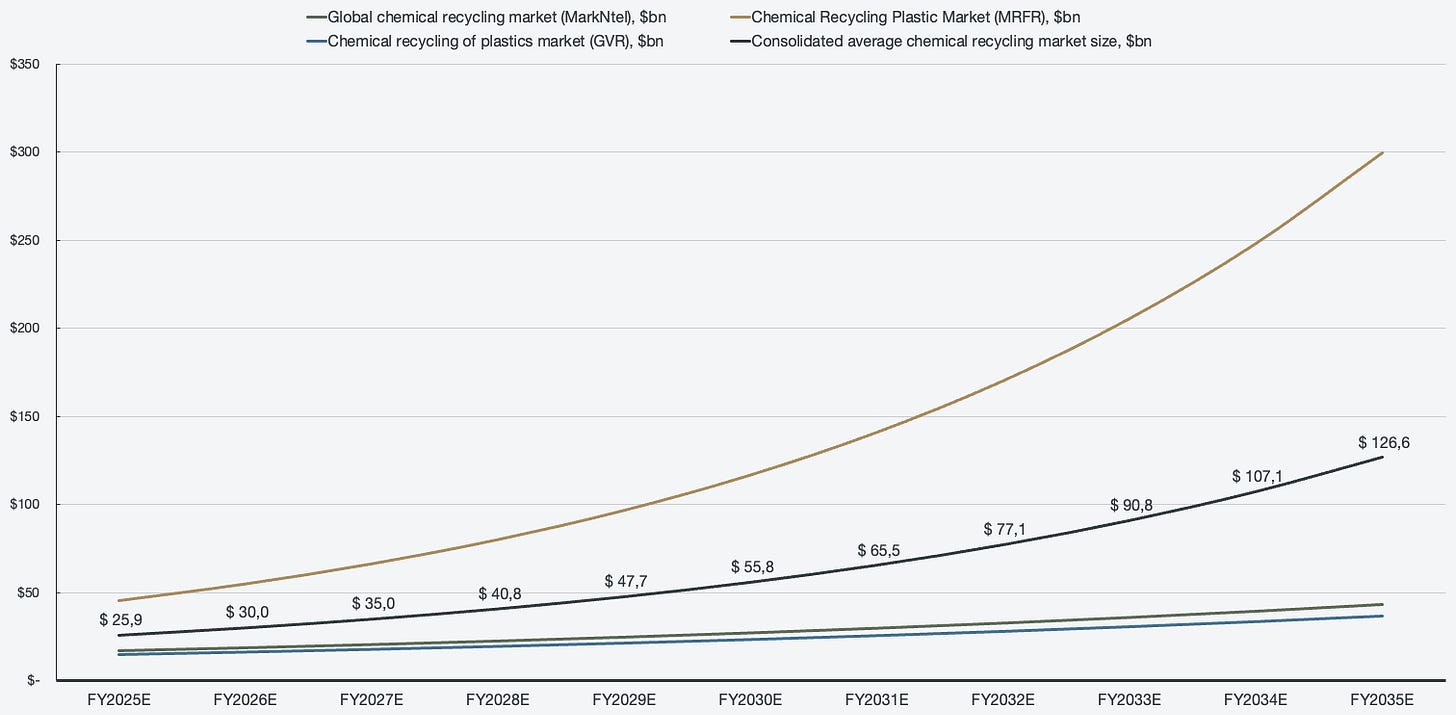

Looking at the overall market projections in which Aduro operates can show some insight in regard to the market being static or expanding. The overall recycled plastics market growth is forecasted to grow at ~8%, not bad, but not exciting either. However, the chemical recycling of plastics market is expected to grow at double that, which is the space that Aduro operates in.

Figure 2: Chemical recycling market size forecast

There are limitations in what traditional mechanical recycling can address, which is the basis for the rapid expansion of emerging technologies, such as the one from Aduro. Currently, the recycled plastics market is estimated to be worth ~$61 billion, with around 70% being held by mechanical recycling processes. There are several tailwinds for the chemical recycling market size to grow, including:

Global government support and investments

Incentives and infrastructure for recycling technology, including over $10 billion in circular economy investments (U.S. EPA initiatives).

Environmental concerns and increasing plastic waste

Global pollution, ocean waste, and carbon emissions cause concerns. By reducing landfills and incineration, better technology supports sustainable waste management.

More stringent policies and regulations

Bans on single-use plastics and mandates for recycled content (The EU Circular Economy Action Plan aims for 50% recycling by 2030).

ESG goals and recycling targets drive corporate sustainability commitments

Fortune 500 companies need efficient solutions to meet targets.

The question investors need to be asking themselves is if the core technology is significantly better than peers, and ultimately how much of the market Aduro will be able to capture. The core innovation is Aduro’s Hydrochemolytic Technology (HCT), a water-based chemical platform that facilitates the transformation of low-value feedstock, such as waste plastics, oils, and bitumen, into higher-value resources. This is differentiated from current methods that rely on gasification or pyrolysis.

HCT uses water to chemically deconstruct complex hydrocarbons, acting as a solvent, heat-transfer medium, and reaction facilitator. The chemical engineering is complex, and writing it out could be done over several pages. Instead, I’ll focus on the key areas of application and how HCT has a competitive advantage. The core application areas are:

Plastics upcycling (HPU), targeting PE, PP, and PS, which comprise over 70% of waste plastics.

Bitumen upgrading (HBU), deconstructing heavy asphaltenes and reducing viscosity and density to eliminate diluent needs.

Renewables upgrading (HRU), which removes oxygen from renewable oils to produce high-purity hydrocarbons for aviation fuel, chemicals, and diesel.

Aduro expects the HCT process to cut capital and operating expenditures by around 50% compared to pyrolysis, the current dominant recycling process. HCT also boasts significantly higher yields at around 90-99%, compared to 50-70% of pyrolysis. In addition, the energy requirements are significantly lower, as HCT operates at around 325-350°C compared to 400-800°C of pyrolysis. The produced waste is only 2% char, compared to 30% in pyrolysis. HCT also targets 6 of 7 main plastic types, which is a lot broader compared to other emerging processes by competitors that typically focus on a limited amount of types.

Overall, the differentiation is through efficiency, cost, and environmental benefits compared to pyrolysis. Pyrolysis and gasification are typically limited to high-quality materials, while Aduro can utilize lower-value materials and access a far broader range of waste plastics, including those found in landfills. While mechanical recycling focuses on minimal processing of relatively clean and sorted plastics, HCT can handle dirty and complex plastic waste. Essentially, Aduro faces little to no competition in that aspect of the market, as the concentration of competition is in the parts of the market with less contamination.

Another core differentiation is the scale and nimbleness. Aduro plans to offer modular HCT plants, with units designed with a scale of 25,000 tons per year, while competitors typically only offer ~100,000 tons per year. The flexibility allows for a more efficient and less capital-intensive deployment and go-to-market strategy. Increasing scale over time can also be done since the plants are modular.

Evidence of the technology working

The technology sounds great in theory, and it seems to offer clear competitive advantages over peers. But, since HCT has not reached commercialization, there is no reinforcement of these claims at scale. That will always be the struggle with emerging tech for investors: being able to identify winners and, more importantly, what to pay for it (stock price). While the business model itself is designed to rapidly penetrate the market and generate revenue with its nimble, modular plants, they are not there yet.

At the time of writing, Aduro operates a small 10 kg/hour pilot plant, which is currently under commissioning with the aim to turn into a 1-ton per hour plant this year. Aside from that, there are two major customer engagement programs that drive progress towards commercialization.

Shell

Aduro joined Shell’s GameChanger accelerator in order to develop HCT. It involves a six-phase program, where phases 1-3 were completed in 2023. In alignment with Shell’s net-zero goals, the goal of the partnership is to test HCT on PE and PP plastics in order to produce high-quality naphtha for petrochemical crackers. During the partnership, Shell offers technical expertise and non-dilutive funding.

The partnership has built some levels of credibility, and the overall goal is to accelerate commercialization. The collaboration allows Aduro to demonstrate HCT’s efficiency in continuous operations, and the remaining phases focus on reactor demonstrations and advanced validation.

TotalEnergies

What started as a research collaboration for advancing chemical recycling has evolved into an increased scope. A recent announcement has indicated that Aduro completed pilot-scale steam-cracking of its HCT oil from mixed waste plastics under stable operations. The olefin yield is comparable to fossil feedstocks without dilution or pretreatment, which is a major milestone for the company.

The pilot trials focused on feedstocks from a diverse mix of plastic feedstock, including PE, PP, PS, and PET. The trial was monitored by an independent organization with expertise in steam-cracking design and operations, and the oil was processed without any dilution, hydrotreatment, or additional pretreatment and managed to maintain stable furnace conditions.

This is a clear step towards scale for Aduro and confirms much of what was theorized about the technology.

In addition, the overall management team has a lot of expertise and credibility in engineering. The CRO is a chemical engineer with over 30 years of experience in cleantech commercialization, the chief scientist has a Ph.D. in chemical and biochemical engineering with reactor specialization, and the CTO and principal scientist is the principal author of over 15 patents with a background in chemical engineering and hydrothermal upgrading.

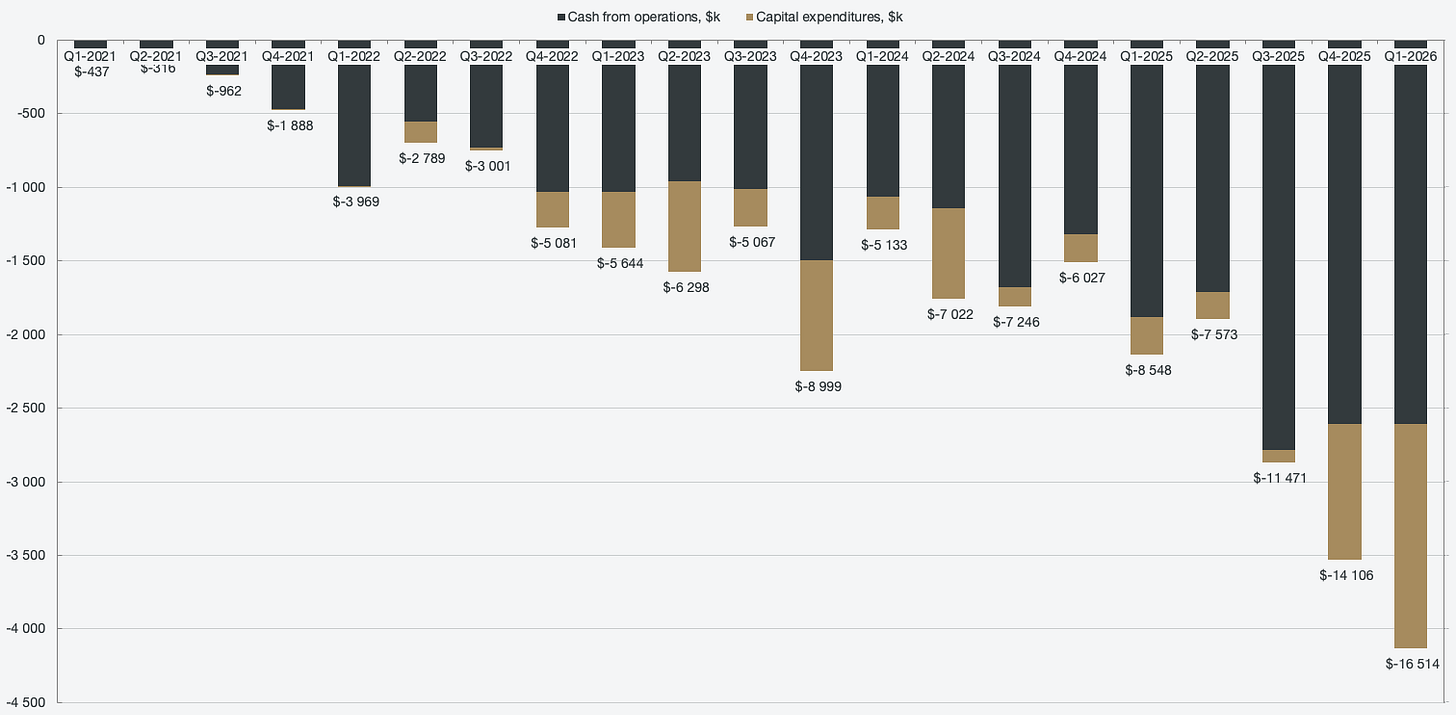

Survival: funding and cash burn

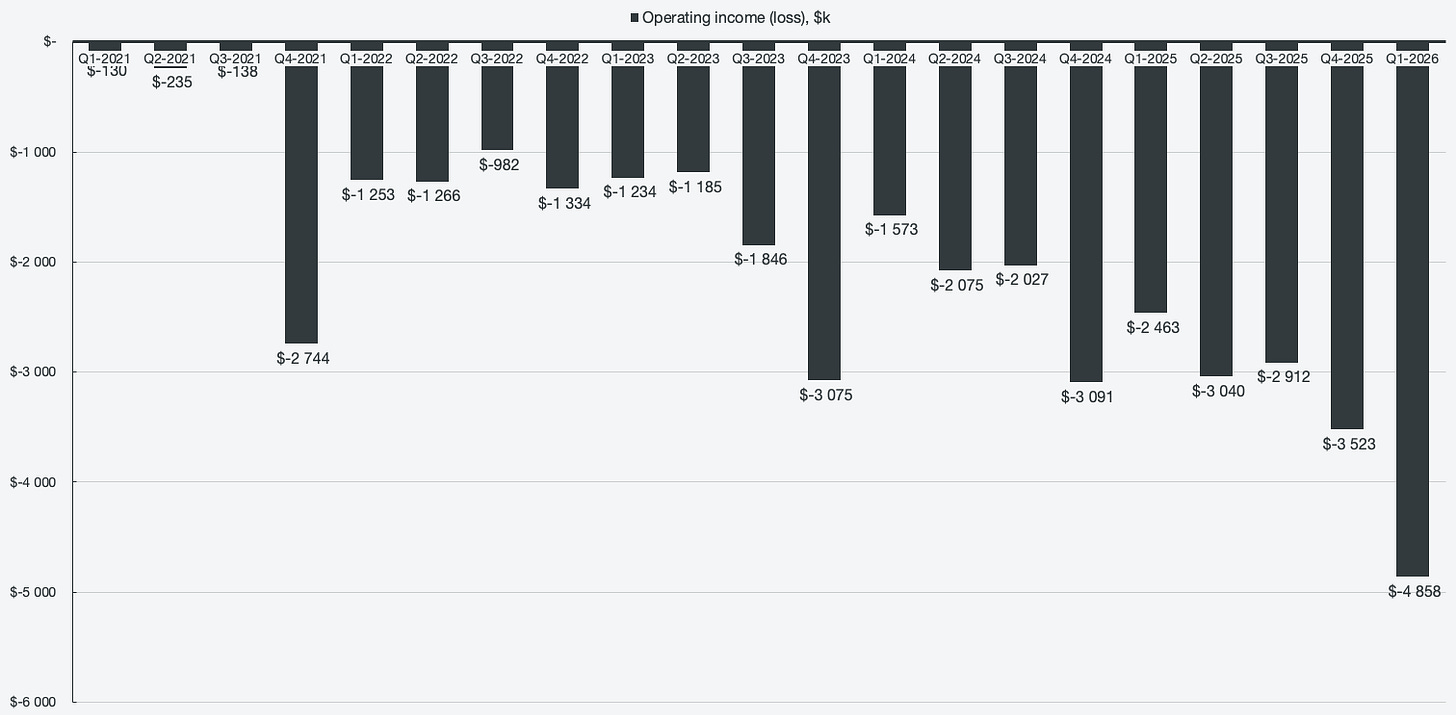

None of the above really matters unless Aduro can survive as a company. As pilots and scale start to materialize, so do the operating costs for the company. Without any revenue, let alone profits, the company needs to be able to survive until there are material financial results.

Figure 3: Operating loss

The majority of the increase in operating costs can be credited to G&A, which increased 137% Y/Y. Office and general expenses increased by 402% Y/Y; professional fees by 358% Y/Y; salary and related costs by 98% Y/Y; and transfer agent and filing costs by 114% Y/Y.

R&D saw an overall increase of 70% Y/Y, where salary costs accounted for a 92% Y/Y increase. As a whole, SBC increased 318% Y/Y and is the single largest expense increase at 51% of all operating costs, from $0.59 million to $2.46 million. But to assess cash burn, we have to look further than operating costs, as SBC is not a cash expense.