Eos Energy: Up 400% in a year, high-risk high-reward

Equity research report

Recently, there has been a surge in primary, secondary, and even tertiary benefactors of the AI revolution. People are out of breath trying to scoop up as many shares as possible in companies adjacent to the exploding AI trend, even if the companies themselves are unproven, pre-revenue, and extremely unprofitable.

The question then becomes, are these stocks investable from an intrinsic valuation point of view? What are investors looking for when there are no historical references? I had the opportunity to research Eos Energy, a speculative name that is up over 400% in the past year. EOSE 0.00%↑.

Price chart 1: Eos Energy Enterprises, Inc., stock quote, $ per share

In this equity research report, I will share my approach to these questions.

Company profile

Theme: Future Energy, Direction: Hold

Symbol: EOSE, Exchange: NASDAQ

Sector: Industrials, Industry: Electrical Equipment

Fair intrinsic value: $11.82 (-35.36%), as of October 15, 2025

Market capitalization: $4 346 million

Pricing data: P/S 129x, P/E N/A

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

Participating in booming markets while still pre-revenue

Investors are always excited to participating in the next big thing, and in today’s landscape, that is artificial intelligence. Data center electricity consumption is expected to double or triple by 2028 due to AI, according to a 2024 U.S. Department of Energy report. At that point, data center consumption would account for up to 12% of total U.S. electricity.

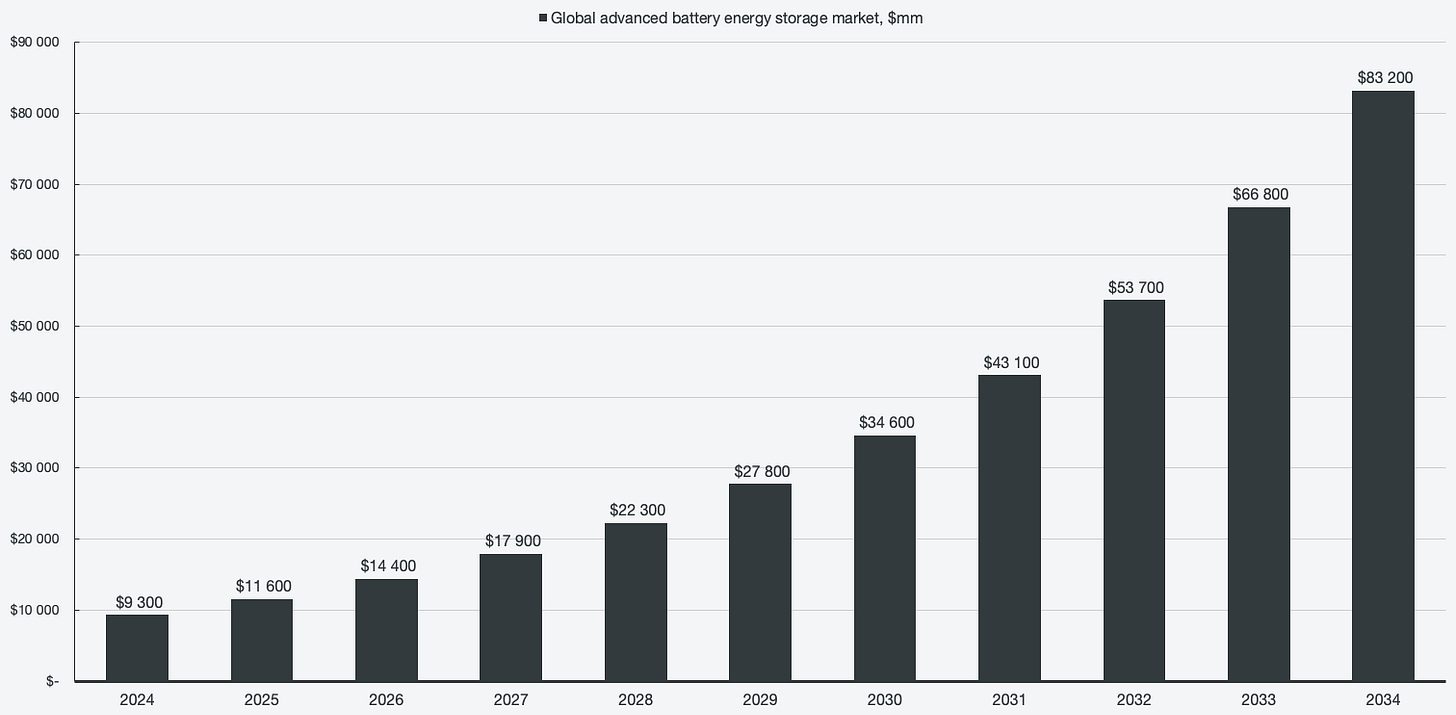

There are many third-party reports projecting future energy demand driven by AI, and what they all have in common is that the grid is nowhere near ready to meet the demand. Adjacent to that, a new, rapidly expanding market has presented itself for businesses like Eos Energy: battery energy storage. Similar to the forecasts of future energy demand, the global advanced battery energy storage market is expected to compound at a very high growth rate. According to one such source, market.us, which is often cited by Eos themselves, that market presents a 25% CAGR opportunity over the next ten years.

Figure 1: Projected global advanced battery energy storage market

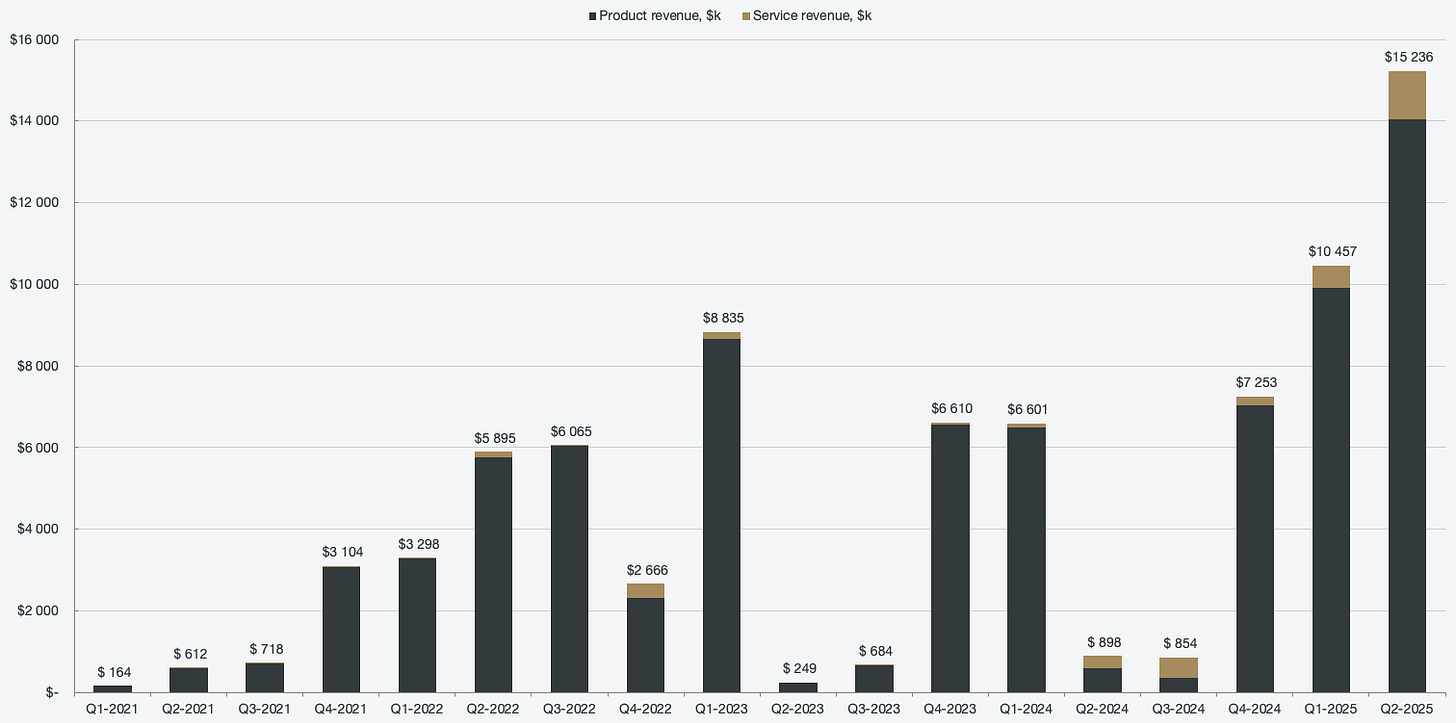

The challenge lies in identifying future winners—finding the businesses that will carve out a significant share of the ever-growing pie. Looking at Eos revenues, it is evident that they are not, and have not been, at scale. The revenues are inconsistent and highly concentrated (87% of Q2 2025 revenue is attributed to a single customer), and most importantly, nowhere near enough to justify where the stock quote is currently trading.

Figure 2: Segmented revenues

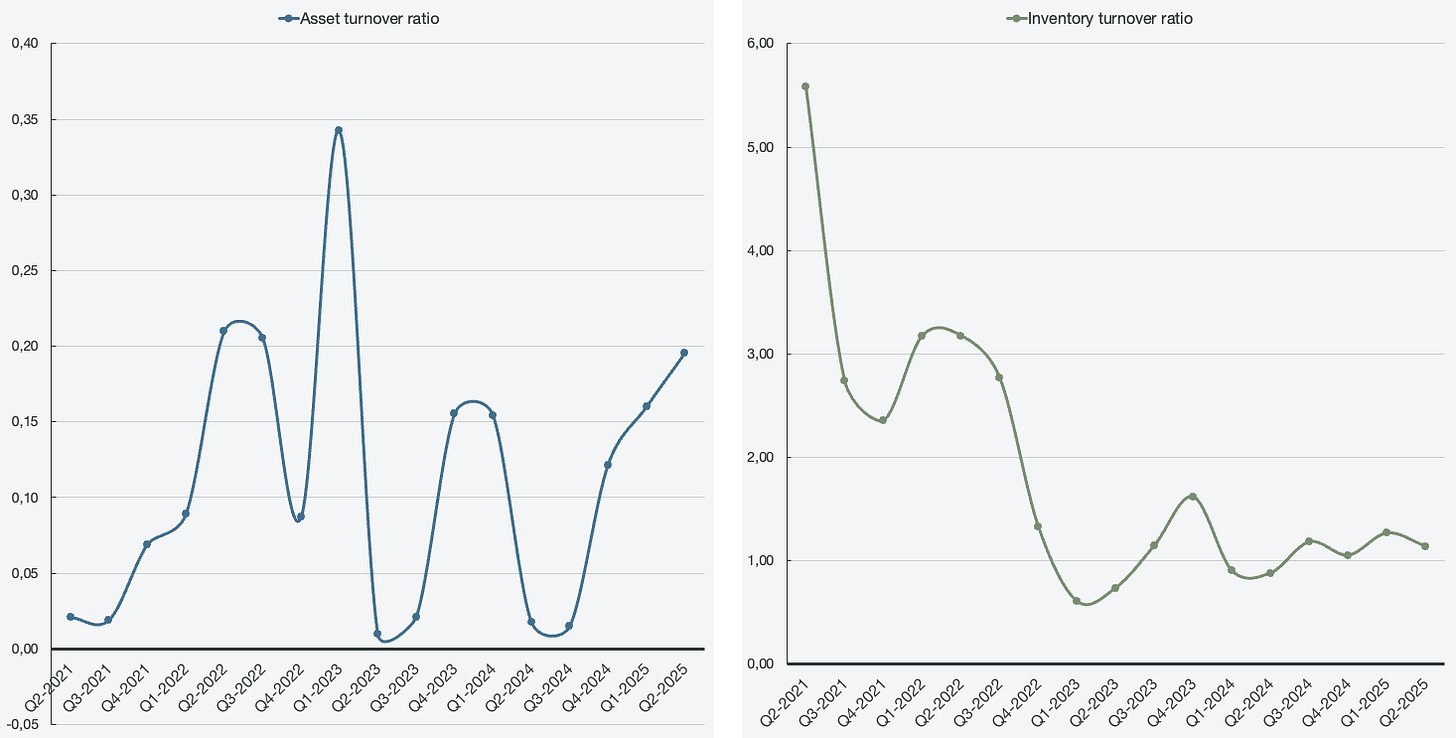

Revenues are not the only financial measure point that can be used to see how far along a business is towards volume and scalability. For a manufacturer in particular, there are various trends that can be measured in relation to its inventories. The inventory information relating to Eos that is of interest when it comes to measuring operational scale and efficiency is the asset turnover ratio and the inventory turnover ratio.

Asset turnover ratio

Shows how efficiently Eos’s assets generate sales.

A rising trend indicates scaling and better capital utilization.

0.8-1.5x is a benchmark for a mature manufacturer.

Inventory turnover ratio

Shows how quickly inventory is being converted into revenue.

An improving inventory turnover ratio indicates operational scale.

4-6x is a benchmark for a mature manufacturer.

Figure 3, 4: Asset turnover ratio, Inventory turnover ratio

The inventory further reinforces the narrative that Eos has still not started proper volume production or scaling. The inventory turnover is decreasing, and while asset turnover is improving slightly, it is still far from a ratio that would be considered mature at volume.

In addition, every margin imaginable for the business is either triple or quadruple digits in the negative. The business is not close to turning gross margin profitable, and as such, it is even further away from operational and net profitability.

However, there are some metrics that tell a different story about the business. Metrics that tell of the future potential of Eos and paint a narrative of explosive growth ahead for the business.