Palantir Technologies: Absolute Dominance

Equity research follow-up coverage, rating upgrade

For three quarters in a row now, Palantir has posted what I believe to be the best SaaS earnings the stock market has seen. Q4 in particular blew past all my expectations and has yet again raised fair intrinsic value massively in a mere quarter.

[…]the numbers speak volumes that we are in an N of one category of our own, and we are doing things unlike any other company has done, which has, of course, been confounding to people over the years[…]

Alex Karp, Chief Executive Officer

Palantir Technologies Inc, Q4 2025 Earnings Conference Call

The sentiment for the Q4 earnings results by management is clearly one of confidence. All the pieces of the puzzle are aligning as intended, and the accelerator pedal is firmly pressed down. Corporations and government entities alike are realizing where actual AI value creation is happening, and they all want in. Palantir has gone from trying to get a foot through the door to showcase their capabilities to having inbound volume at a scale where they have to turn down potential customers.

Seemingly every financial metric is growing at a triple-digit pace, and what’s magical about it is that Palantir won’t stop accelerating anytime soon. Given Q4 results and the guidance outlined for 2026, Palantir has truly showcased why their slogan is “Software That Dominates.”

Company profile

February 5, 2026 Follow-up coverage

Direction: Buy

Previous fair intrinsic value: $169.69, as of November 9, 2025

Symbol: PLTR, Exchange: NASDAQ

Sector: Technology, Industry: Software - Infrastructure

Theme: AI Software

Fair intrinsic value: $204.45 (46.52%), as of February 5, 2026

Market capitalization: $359 106 million

Pricing data: P/S 80x, P/E 220x

Previous coverage:

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

The best financial results in the SaaS world

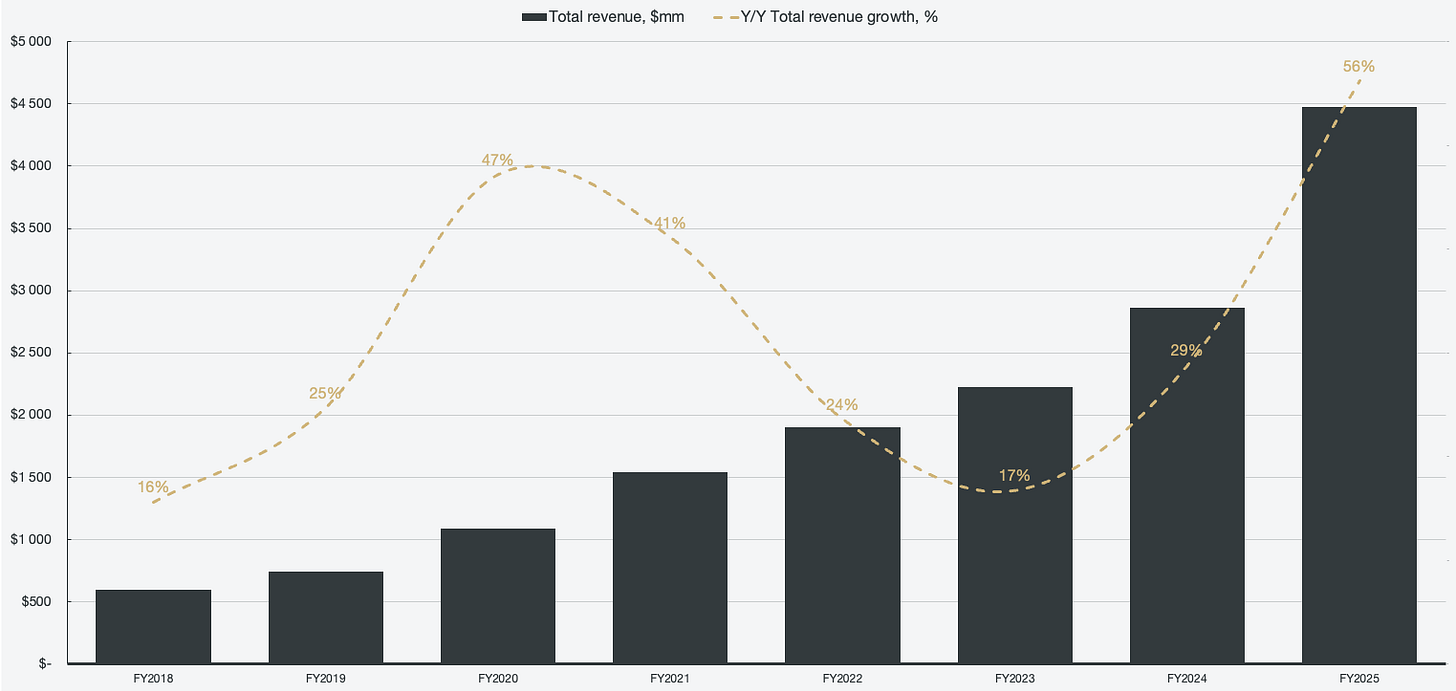

In Q2 2022, Palantir abandoned their 30% CAGR target through 2025 that the company announced during its direct listing. At the time, revenue growth was decelerating for each passing quarter, a trend that would reach a low a year later in Q2 of 2023, when Palantir recorded 13% Y/Y growth. During the earnings call in Q2 2022, a Wall Street analyst noted that the 30% target was not reiterated.

CEO Alex Karp responded in a plain and easy-to-understand tone.

I am driving the company to get to $4.5 billion in 2025.

Alex Karp, Chief Executive Officer

Palantir Technologies Inc, Q2 2022 Earnings Conference Call

Figure 1: Total revenue

Representing a 56% Y/Y growth rate, Palantir hit $4.5 billion in 2025. On a quarterly basis, the company grew 70%, further accelerating Q3’s 63% growth. As always with Palantir, the mere top-line number does not tell the full narrative. The raw number in itself, while impressive, pales in comparison to the manner in which that growth was achieved.

Out of the 70% Y/Y growth, 39% came from existing customers. Ever since AIP started seeing adoption, the value creation being witnessed by enterprises and government entities where it is deployed keeps justifying an ever-increasing cost. AIP is usage-based, which means that deploying it to solve a single use case may not move the needle, but seeing adoption across a whole company may double or triple that company’s spend on Palantir products.

Figure 2: Cohort growth

This makes the products infinitely scalable as long as the value being created exceeds the cost of the product. For instance, Palantir shared two cases during the Q4 earnings call that highlighted this dynamic. One customer grew annual contract value by 343%, while another customer grew ACV by 400%, both within the same year (Q1 to Q4). In addition, Lear shared that they started with 100 users and four use cases, which they then scaled to 16,000 users and 280 use cases. That is the underlying strength of the growth that Palantir is exhibiting, and it is what makes me believe that it is not about to slow down anytime soon.

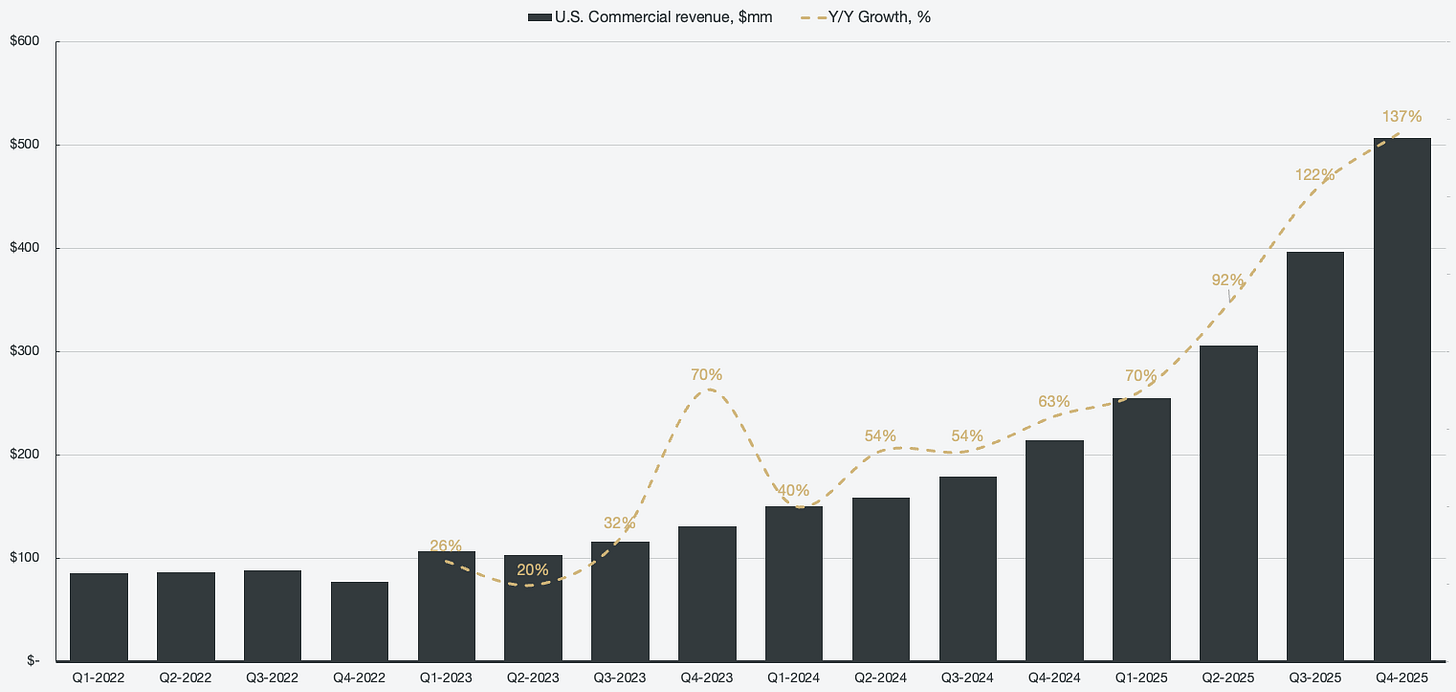

On a segmented basis, U.S. Commercial is the crown jewel in terms of growth and the primary beneficiary of AIP. For 2025, U.S. Commercial grew 109%, and Palantir has guided the segment to grow at least another 115% in 2026. For Q4, U.S. Commercial grew a staggering 137%, eclipsing 122% of the prior quarter.

Figure 3: U.S. Commercial revenue

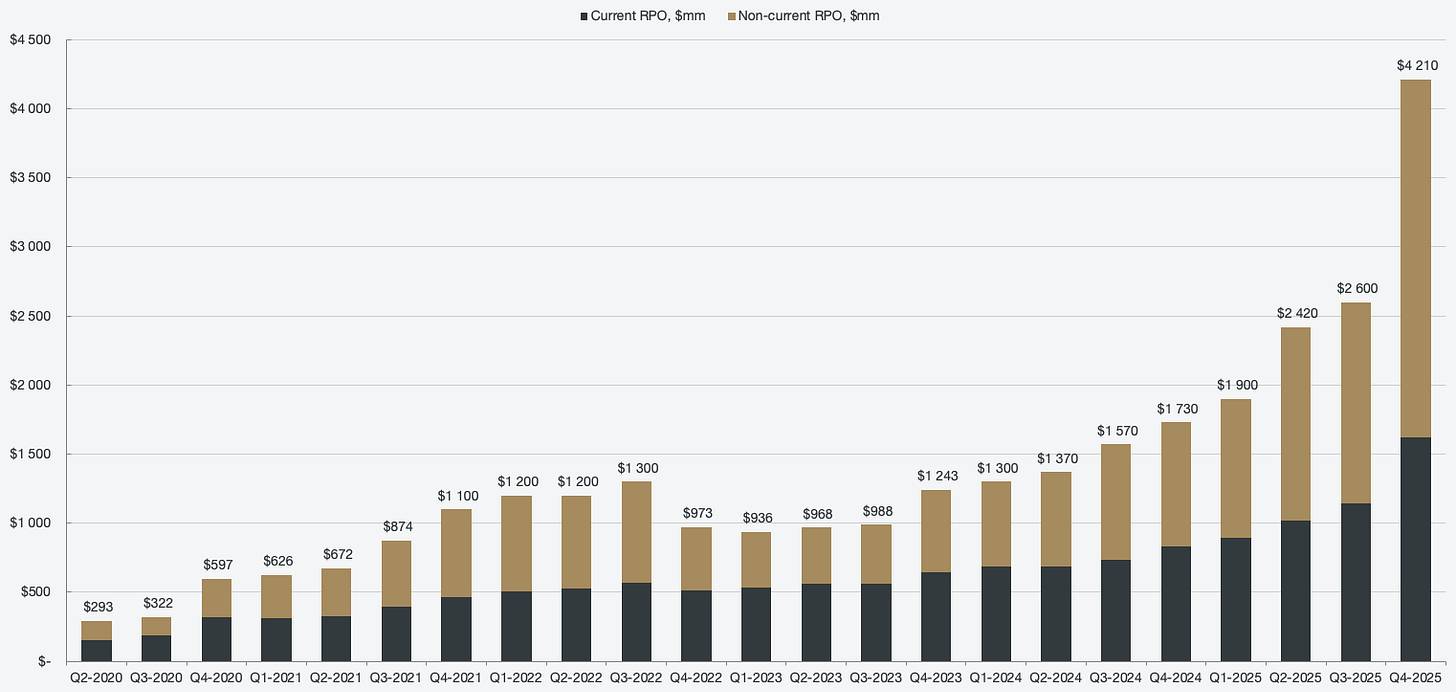

The guidance provided by Palantir for 2026 is strong, but I believe it is on the conservative side. Looking at remaining performance obligations, which essentially are a proxy for guaranteed commercial revenue to be recognized, there is $1.62 billion to be recognized over the next twelve months already. That is guaranteed revenue, with another $2.6 billion to be recognized over the long term. The reason RPO specifically ties to the commercial business is because many government contract types lack fixed terms, and as such, can’t be recorded as RPO. The RPO growth for the quarter is also in the triple digits, growing 143% Y/Y.

Figure 4: Remaining performance obligations

Adjacent to RPO is remaining deal value (RDV), which grew 145% Y/Y for U.S. Commercial specifically. The difference between RDV and RPO is that the full RDV is not guaranteed, as it also includes contractual options that may not be exercised. In any case, U.S. Commercial RDV is $4.4 billion, which further strengthens the narrative that there is a lot more revenue growth recognition waiting to be recorded, without accounting for any new growth. To put it in an easy-to-understand context, even if Palantir simply closes down its business over the next year, the raw RPO would be enough to surpass the full fiscal year 2025 U.S. commercial revenue.

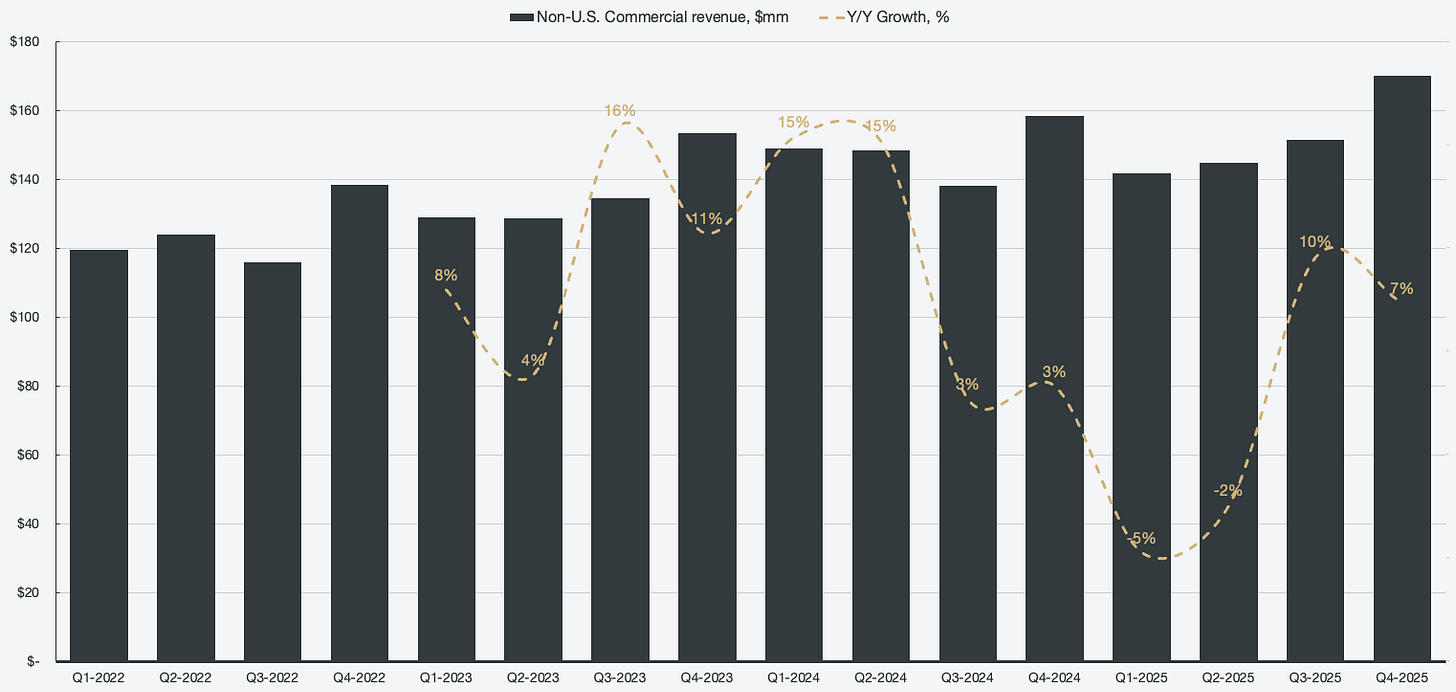

In a surprising turn of events, the non-U.S. commercial segment reached an all-time high in Q4 2025. With a mere 7% Y/Y growth rate and the net outflow of 3 customers, a new record high of $170 million was recorded for the quarter. For the full year, non-U.S. commercial revenue grew 2%. As mentioned in previous reports, and as mentioned by management during a majority of earnings calls since going public, European growth is still absent from the business. Europe has been shooting itself in the foot when it comes to economic growth and the overall tech scene for a long period of time, and it is now a matter of time before they stop over-regulating and hindering their own success. European growth in particular is not a mere Palantir issue but an issue rooted in the fundamental culture within Europe as a whole.

The stagnant European growth can also be seen through a different perspective. Meaning, if Palantir is growing at this rate without Europe, what will it look like when Europe starts to adopt the products as well?

Figure 5: Non-U.S. Commercial growth

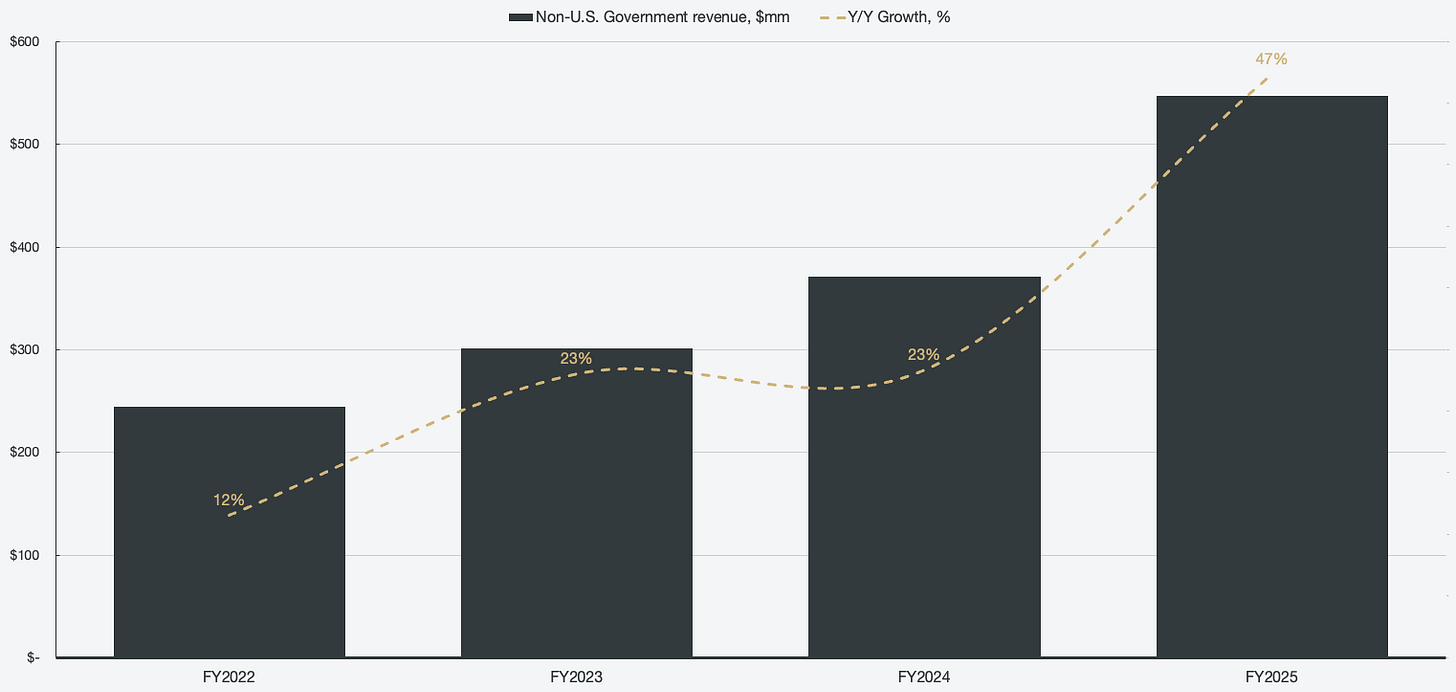

While the commercial end is struggling outside of the U.S. borders, the non-U.S. governments seem to have understood that they need Palantir. Y/Y growth more than doubled in 2025 compared to 2024, and similarly to the rest of Palantir’s business, this segment is also just getting started.

Figure 6: Non-U.S. Government growth

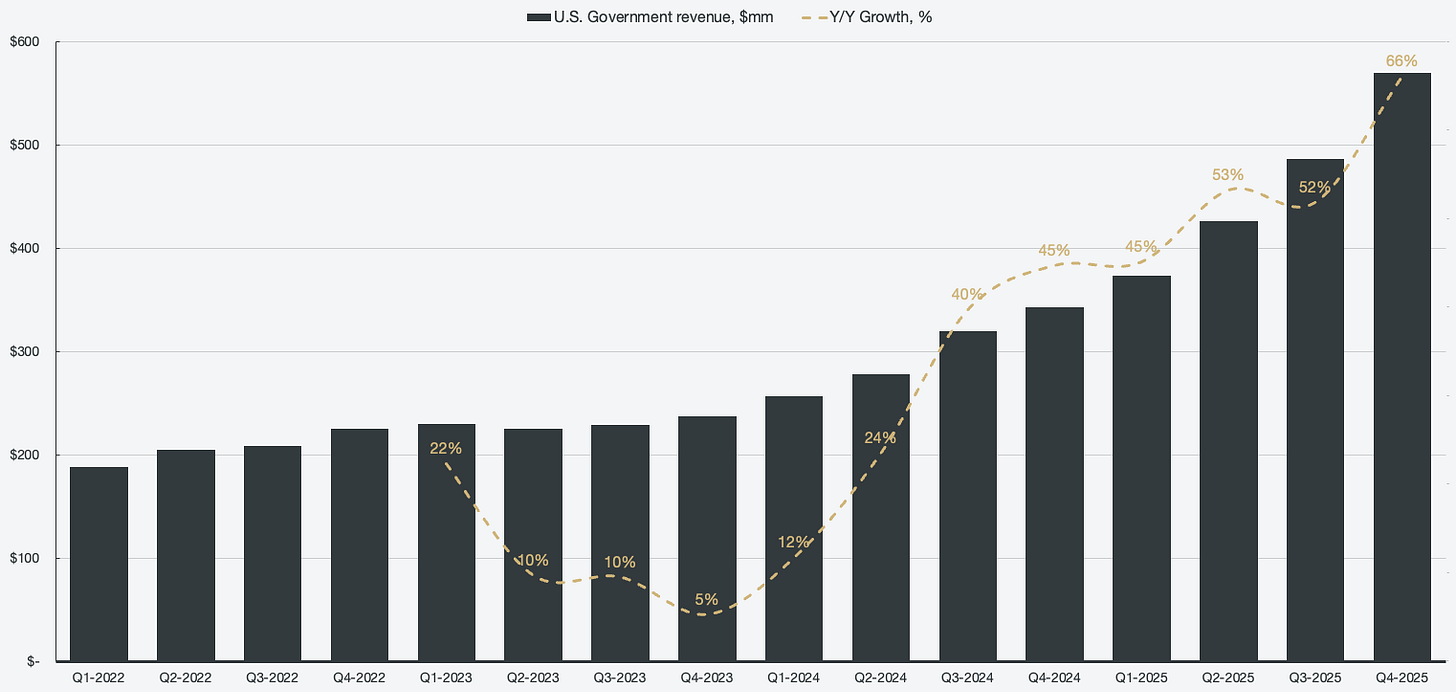

As for the U.S. government, I have been bringing attention to this segment for a long time. I expect the segment to grow at more than 40% CAGR over the next 10 years. While many see Palantir as a company aligned with the current administration, Palantir has operated and performed under both sides of the political spectrum. While Thiel is right-leaning, Karp is famously left-leaning.

Concentration risk is a real threat for a business, but among the best customers to have is the U.S. Government. In particular, when you are aiming to be the operating system of the West, U.S. government agencies will be key customers. Historically, many of the contracts awarded to Palantir are sole-sourced, meaning that the capabilities requested in the tender could only be provided by Palantir. However, it is true that Palantir is experiencing massive acceleration under the Trump administration, with executives stating that the current administration has gotten more done in one year than the previous administration got done in four years (in terms of government contract activity). The segment grew 66% Y/Y for the quarter, and once embedded in USG, it tends to be incredibly sticky by nature.

Figure 7: U.S. Government growth

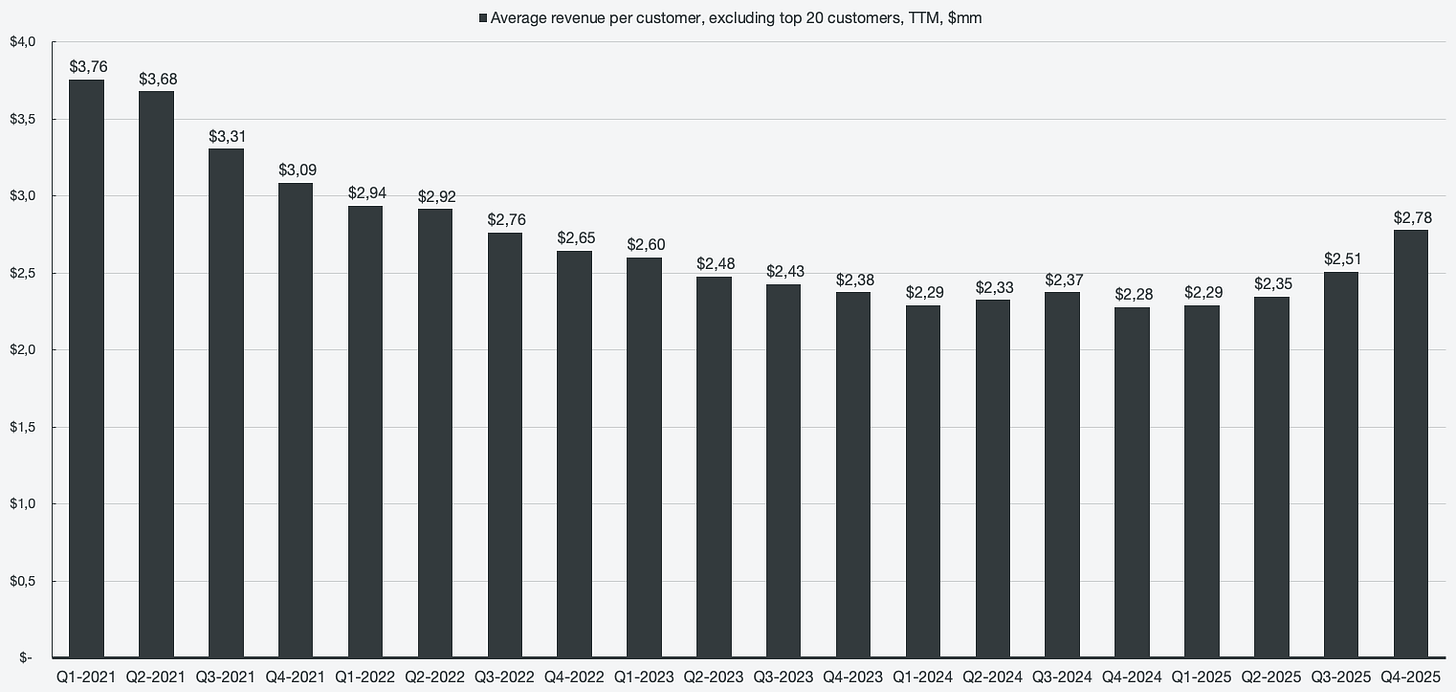

What makes Palantir special is not merely growing at an incredible pace, but the manner of how it is growing. I already covered the cohort growth dynamic, but it goes deeper, and for each stone turned, another positive surprise is discovered. Q4 2025 was a clear inflection point in what kind of customer contracts that Palantir is recognizing. In particular, the downward trend of average revenue per customer has flipped aggressively to the upside. The ARPC is calculated excluding the top 20 largest customers since they alone account for 42% of overall revenues and would heavily skew the calculation.

Figure 8: Average revenue per customer (excl. top 20 customers)

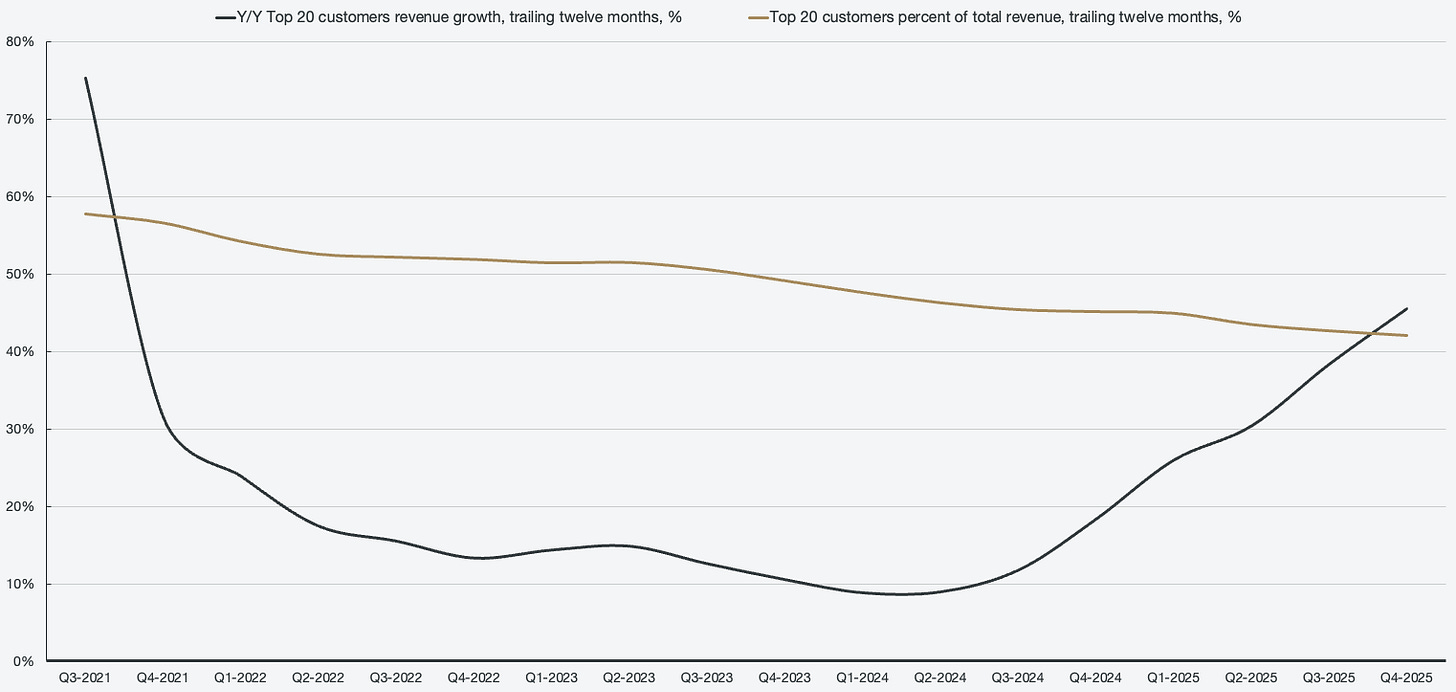

Speaking of the top 20 customers accounting for 42% of revenue and concentration risks, these are safety nets. I have mentioned it in previous coverage of Palantir, but the largest customers of Palantir are also the fastest growing. In essence, it means that the customers who utilize Palantir the most, already pay hefty contracts to use Palantir, and are also those who can’t wait to pay more. Overall existing customer cohort growth was 39%, but the top 20 customers grew 45.5%. Since the top 20 customers are a part of existing customers (most likely), they are bringing up the 39% average significantly, meaning the “whales” are the fastest-growing cohort by a wide margin.

Figure 9: Top 20 customers growth and percent of total revenue, trailing-twelve-months

In summary, the manner in which Palantir is expanding their revenue is exponential in nature and also very scalable. The value proposition is exceptionally strong, as evident by the cohort growth rates. The nature of the land and expanding dynamics will sustain accelerated growth rates over an extended period of time.