PayPal Holdings: Best risk-reward in the stock market

Initiating equity research coverage

It has been quite a while since PayPal dropped out of favour, from being the hero during the pandemic to scraping along the bottom until present day. However, PayPal is not the same sleepy business it once was. Under new management, PayPal is taking strides to retain its position as the most dominant digital payments service provider, and the market is about to find out.

Company profile

3 August, 2025 Initiated coverage

Direction: Buy

Previous fair intrinsic value: N/A, as of N/A

Symbol: PYPL, Exchange: NASDAQ

Sector: Credit Services, Industry: Financials

Theme: Deep value

Fair intrinsic value: $136.60 (+104%), as of August 3, 2025

Market capitalization: $65 566 million

Pricing data: P/S 2x, P/E 14x

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

Market expectations are delusional

Before delving deeper into the details of PayPal, it is important to understand just what a dire outlook the market has for the business. Once the market expectations are understood, it will become a lot clearer what an asymmetrical opportunity PayPal currently presents for investors.

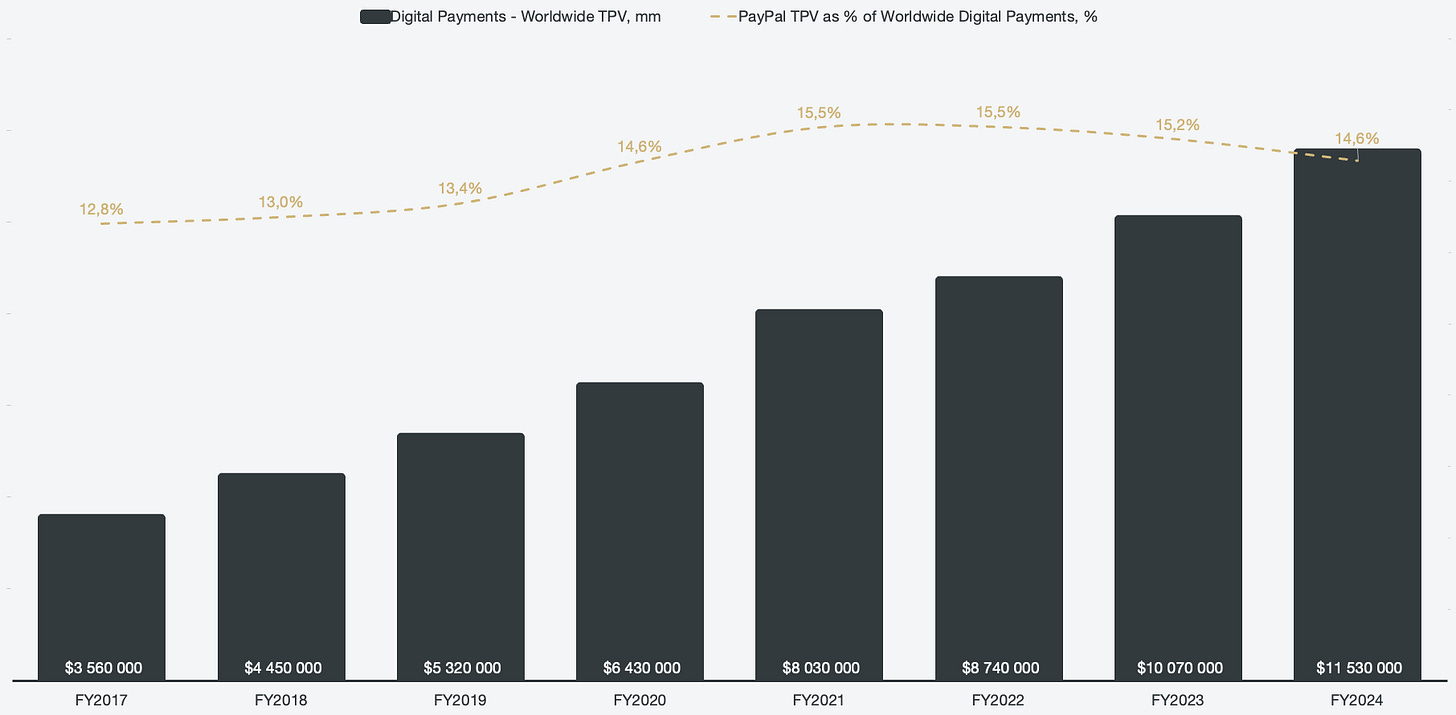

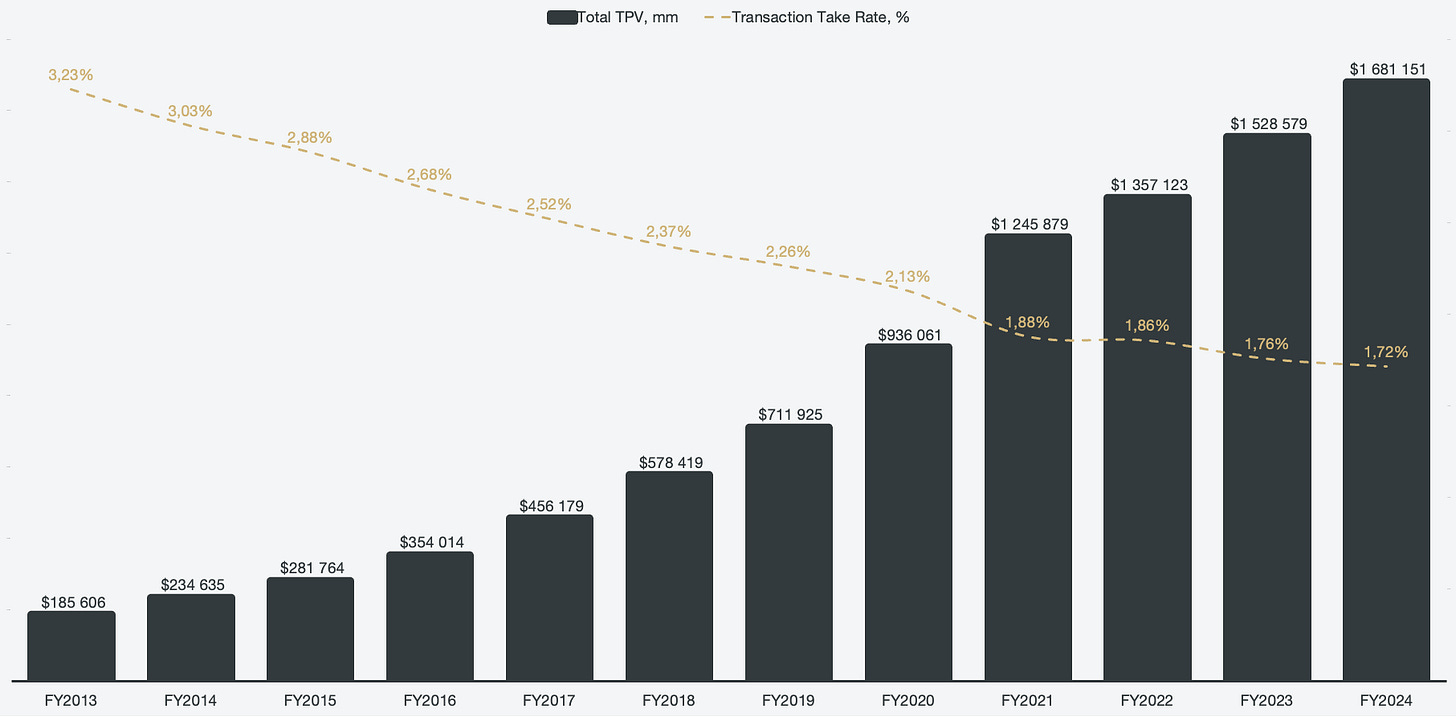

Figure 1: Historical global digital payments market share

PayPal has been the largest and most dominant player in the digital payments space for over a decade, with continuous market share expansion throughout. However, for the past two years, PayPal has contracted its market share slightly, from 15.5% in 2022 to 14.6% in 2024. On face value, that would be quite alarming, but it disregards the sheer scale of PayPal’s business. PayPal’s total payment volume grew 12.6% in 2023 and 10% in 2024, or in simple terms, from $1.36 trillion to $1.69 trillion. This is roughly in line with the digital payments growth of the core markets PayPal operates in; it is only on a global basis that a loss of market share can be observed.

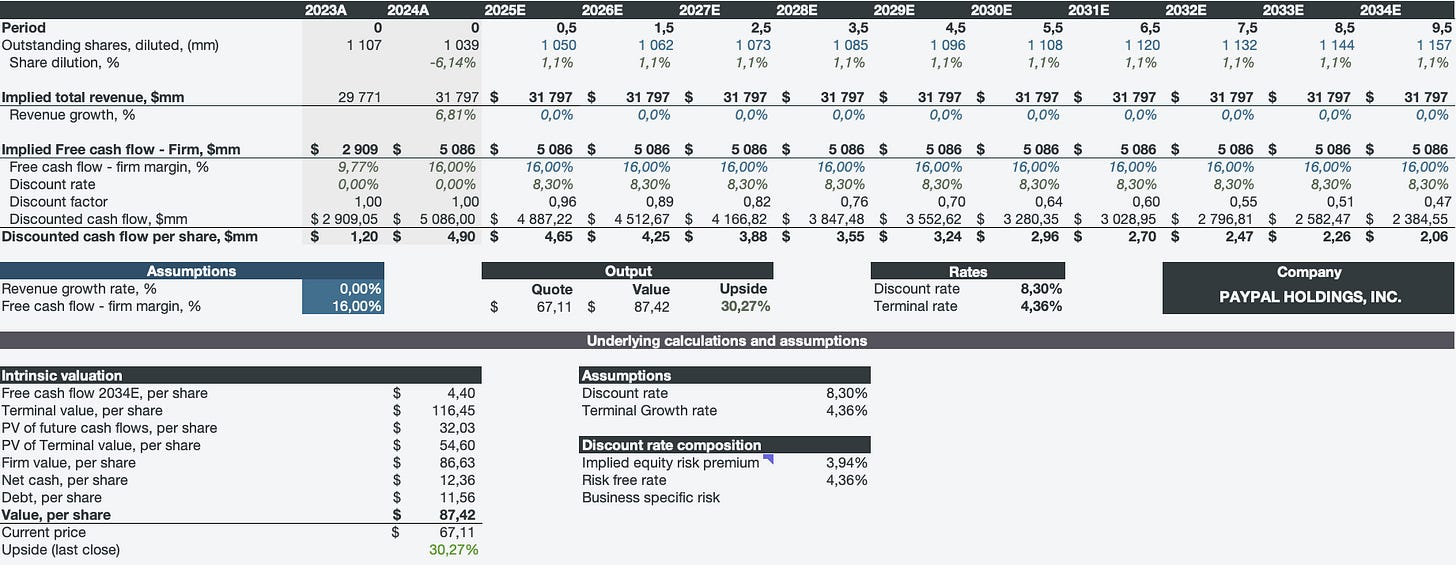

It can be useful to run reverse discounted cash flow models to gauge what kind of expectations are implied in the stock quote. Instead of using forecasting inputs to reach fair intrinsic value, we try to reach the current quote by changing the growth and margin rates.

In the first scenario, I assume 0% revenue and cash flow growth over the 10-year forecasting period. Using the 2024 results and freezing the business in place, the implied intrinsic value still presents about 30% upside to fair value.

Table 1: Reverse DCF model (0% growth assumption)

The reverse DCF model uses market-based assumptions for the discount rate. The discount rate is composed of the implied equity risk premium for the month of July, as well as the 10-year U.S. Treasury yield. To keep the model as unbiased as possible, no subjective business-specific risk is applied.

This implies that the market participants are expecting a decline from 2024, but to what degree? The current quote as of the market close on Friday implies a compounded annual revenue decline of 3.33% per year.

Table 2: Reverse DCF model (-3.33% growth assumption)

The reverse DCF model uses market-based assumptions for the discount rate. The discount rate is composed of the implied equity risk premium for the month of July, as well as the 10-year U.S. Treasury yield. To keep the model as unbiased as possible, no subjective business-specific risk is applied.

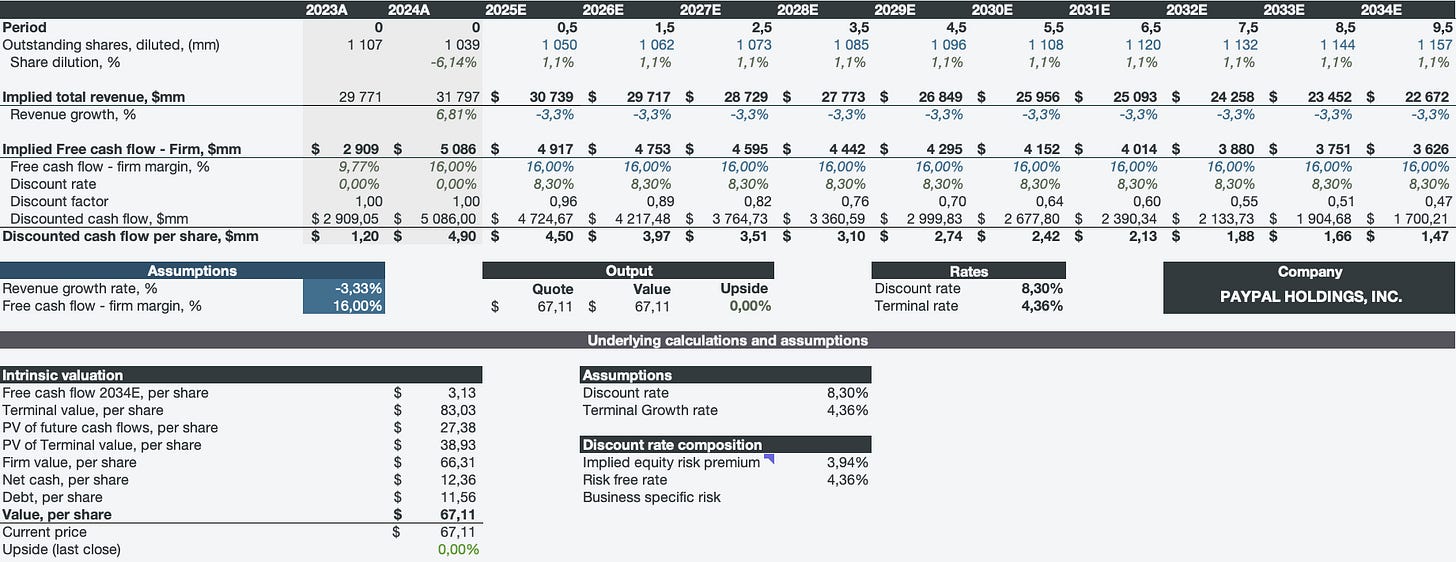

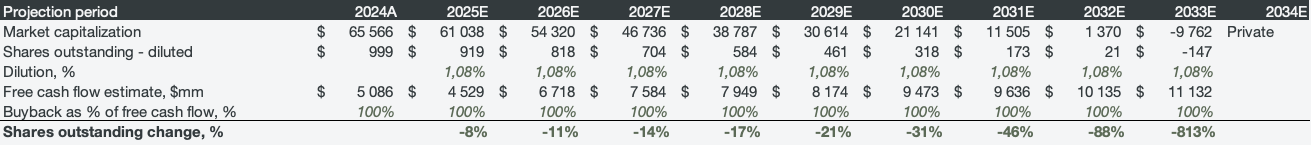

However, PayPal is growing both their revenues and their free cash flow. One key aspect to the quote about being so depressed is that PayPal is buying back their shares aggressively, committing ~100% of their free cash flow towards share repurchases. This makes me believe that there is very limited downside to the stock, barring any catastrophic events to the core business.

Borrowing the free cash flow to the firm (FCFF) projections from my intrinsic valuation model and forecasting its use towards buybacks, PayPal will be taken private in less than a decade. For any decrease in the stock quote, the time to repurchase all outstanding shares gets exponentially lower, which leads me to believe that a bottom may be found in the quote.

Table 3: Share repurchase timeline forecast

This is not to say that I believe the company will be taken private; this is simply to showcase how detached the market is from PayPal’s business. The stock quote implies disastrous events to befall PayPal’s business, something that does not appear when reviewing the actual business and its financial results.

Keep that in mind as you continue reading this report.

Core business and the moat

PayPal currently operates three main segments:

Branded checkout

Pay with PayPal, Pay with Venmo, and eBay checkout options

P2P (peer-to-peer)

PayPal and Venmo transfers and debit

PSP (Payment Service Provider)

Card processing solutions across PayPal and Braintree, as well as other merchant solutions

Most investors may associate PayPal as a business that merely allows you to sign up for an account and use that account for online purchases. However, what most may not be familiar with is that the payment processing part of the business is the largest by volume and powers many of your online purchases.

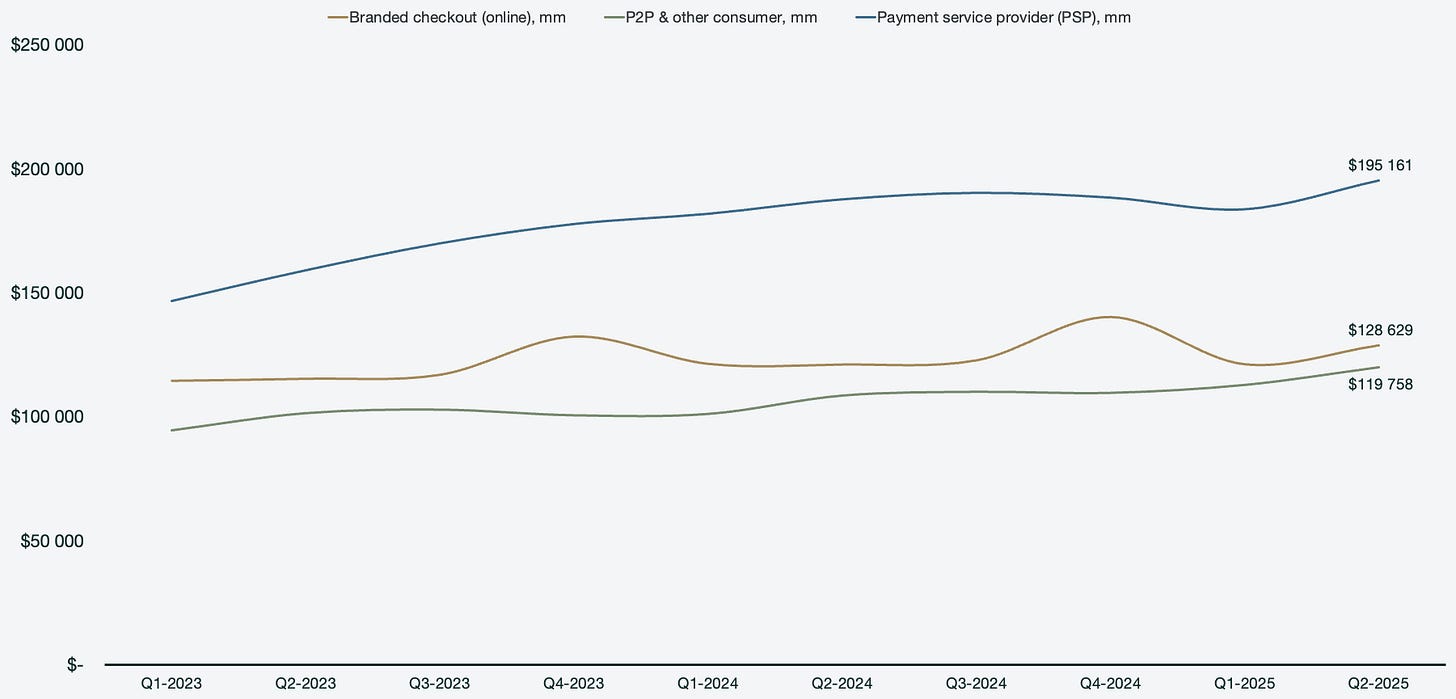

Figure 2: PayPal segmented total payment volume

The problem with the PSP business is that it is highly competitive, which leads to what some refer to as a “race to the bottom” for all participants. This means that all competing payment service providers undercut each other in order to acquire more volume, but the take rate (yield) from the overall volume keeps decreasing. Prominent global competitors in this space include Adyen (AMS:ADYEN), Fiserv (NYSE:FI), Chase (NYSE:JPN), and Stripe (private), while smaller markets are dominated by local companies.

Figure 3: Total payment volumes and transaction take rates

PayPal replaced its CEO with Alex Chriss (formerly from Intuit) and has since then focused on exiting the race to the bottom. Instead, PayPal wants to leverage its moat to enable the next generation of checkout solutions and provide enough value to merchants that they would choose PayPal over a cheaper competitor. Alex Chriss has gradually been replacing the senior management of PayPal and aligning the voices inside the company towards once again being innovative and dominant within digital payments.

PayPal has a moat that has not been properly leveraged until recently, namely the sheer amount of consumer data in PayPal’s Vault. The Vault stores more than 25% of all issued cards in circulation, which makes it the biggest store of financial instruments in the western world. Currently, ~7 billion financial instruments are vaulted, meaning that PayPal’s ability to tailor experiences for consumers is unrivalled.

PayPal has put their efforts towards creating the best guest checkout experience, leveraging their vaulted instruments in order to make guest checkouts frictionless and seamless. Fastlane is the product name and allows users with vaulted data to check out as a guest across millions of merchants without having to enter any data besides an identifier such as an email address; the rest is fetched from the vault.

The next step in leveraging the Vault is by creating an ads platform; PayPal’s ability to know users and their behaviour based on purchase history is very attractive for personalised targeting. Over time, an ads platform might be one of the core revenue drivers, but it is still early. Using ads to create targeted recommendations that users are actually thankful for rather than view as a nuisance is the ultimate goal for any ads business, and PayPal has the prerequisites to create such an experience.

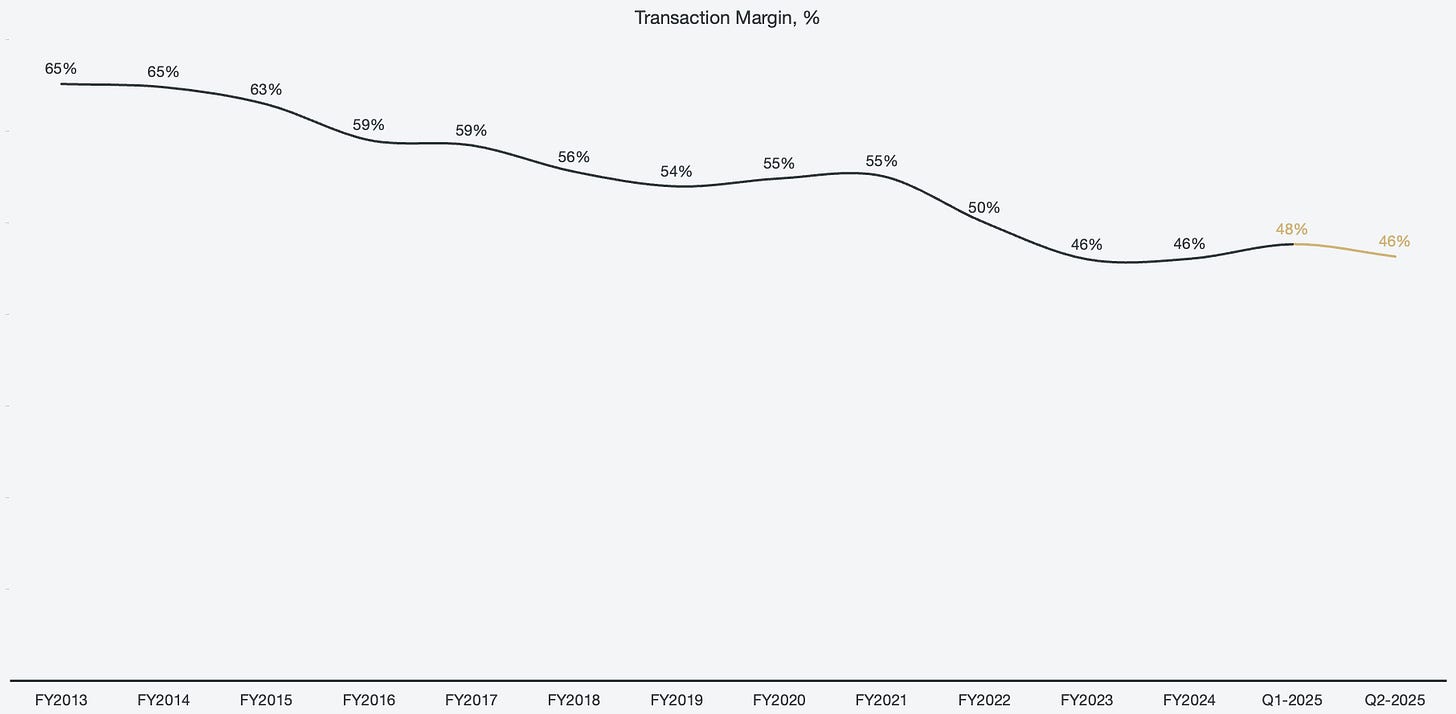

Over time, however, the idea is that execution from the management team will lead to margin expansion rather than contraction, but it has yet to meaningfully materialise in the financials. Profitable growth is the vision, and management has resigned short-term revenue growth in order to align the business for the future.

Figure 4: Historical transaction margin

The business operations are not stagnant

The general notion is that PayPal is somewhat of a legacy dinosaur. As implied by the stock quote and investor sentiment, there is not a lot of excitement surrounding PayPal. As discussed, it will take time to turn around the overall core mission of the business, but what’s already in place is seemingly overlooked.

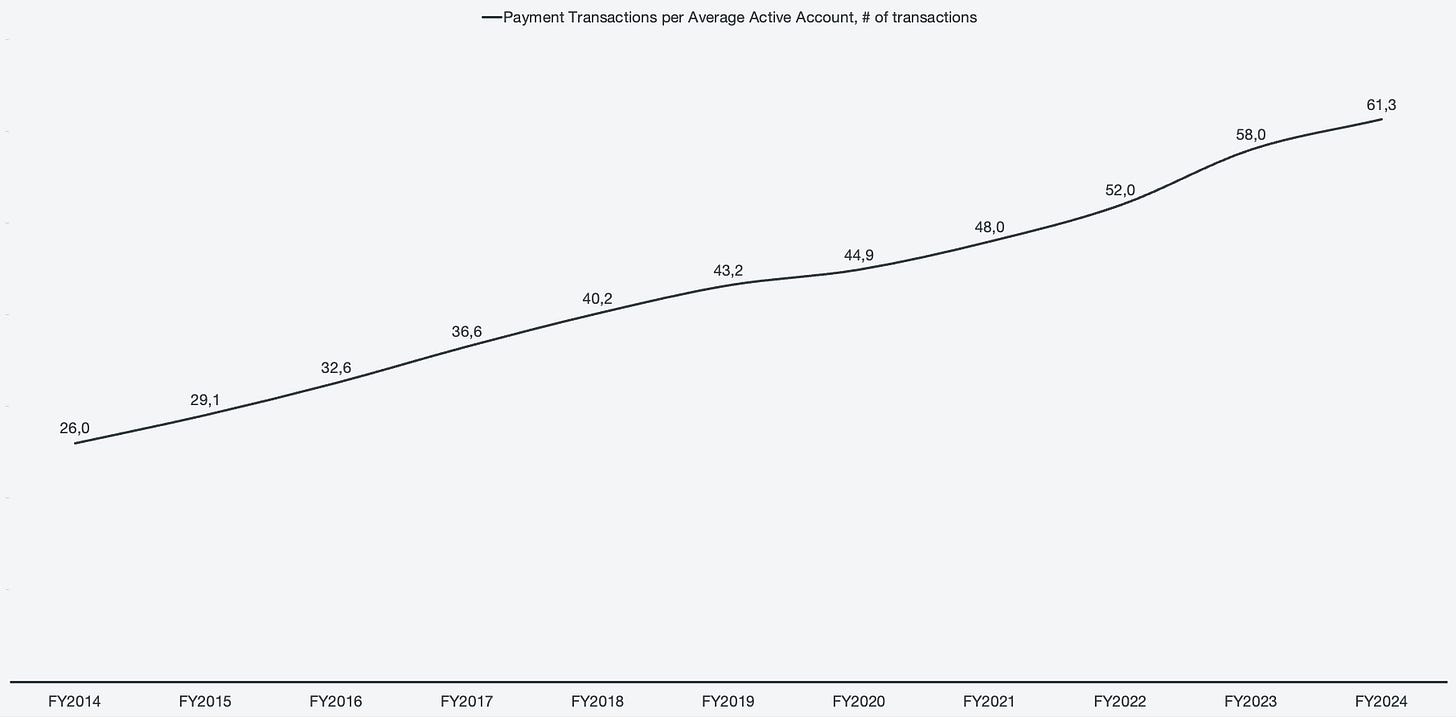

Figure 5: Historical payment transactions per average active account

When looking at the business as a whole, PayPal is not looking fragile at all. The customer base is growing, each customer is increasingly transacting more, and the transaction amount is increasingly higher. This dynamic speaks of a very healthy business, not one expected to decline 3.33% on a compounded basis over the next 10 years.