Robinhood Markets: Next Era Of Finance Is Here

Initiating equity research coverage

Robinhood has become a high-quality business in the current financial markets and has also positioned itself to be a dominant leader in the next era of finance. The company exhibits relentless execution, constantly pushing the envelope in terms of bringing new features and services to the wide retail investor base.

The risks to the business are diminishing, all while Robinhood grows into becoming a compounding marvel.

Company profile

26 July, 2025 Initiated coverage

Direction: Buy

Previous fair intrinsic value: N/A, as of N/A

Symbol: HOOD, Exchange: NASDAQ

Sector: Financial Services, Industry: Capital Markets

Theme: Growth

Fair intrinsic value: $108.21 (+3%), as of July 26, 2025

Market capitalization: $95 334 million

Pricing data: P/S 29x, P/E 60x

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

The core business is ever-expanding

Robinhood’s core business is cyclical in nature, and results are largely driven by conditions outside of Robinhood’s control. The largest operating segment is trading, where more overall volume and volatility drive increased revenue. Robinhood offers commission-free trading; instead, market makers pay for order flow from Robinhood, which is how trading revenue is generated. Market makers are interested in paying more for order flow when there is a spread opportunity, which in general is derived from volume and volatility.

Figure 1: Historical transaction-based revenue growth

The three main tradable instruments are equities, cryptocurrencies, and options, where the latter 2 account for ~84% of overall trading revenue. Despite having far more overall trading volume, the equity markets are simply too mature for big spread opportunities to present themselves. The take-rate for equities is down to 0.01% and is in a steady decline. On the other hand, cryptocurrencies are a relatively new market with a lot of inefficiencies, which in turn present a lot of attractive spreads for market makers. The take-rate for cryptocurrencies is currently 0.52%, which effectively means that given the same trade size, one cryptocurrency trade equals 52 equity trades.

Similarly to increased cryptocurrency adoption, the options market is still relatively new and subject to big spreads worth paying for in the eyes of market makers.

Figure 2: Cryptocurrency yield

In 4 years, Robinhood has managed to grow the take-rate of cryptocurrencies by more than 400%, showcasing immense pricing power. As a reference, Coinbase (NASDAQ:COIN) has a 1.4% take rate on its consumer-facing cryptocurrency trading segment. This means that Robinhood is a cheaper alternative for users by far and has a long way left to scale its yield before competitive pressures appear. As of Q1 2025 earnings results, Coinbase recorded $78 billion in consumer trading volume, compared to $46 billion for Robinhood. Coinbase focuses solely on cryptocurrencies and offers a far wider range of currencies compared to Robinhood, which makes the volume comparison impressive for Robinhood.

Similarly to cryptocurrencies, the options markets are also relatively new and inefficient. With the exception of 2 quarters, options have accounted for a majority of trading revenue for every trackable quarter. In addition, the options segment is less volatile compared to equities and cryptocurrencies, which helps smoothen out overall transaction-based revenues.

Figure 3: Segmented transaction-based revenues

Most average investors still avoid derivatives and alternative instruments like options and cryptocurrencies, but they are increasing in popularity. For example, the current administration in the U.S. is very open towards cryptocurrency adoption, and the general knowledge for options trading is ever-increasing. This leads me to believe that these two segments are still very far from reaching saturation.

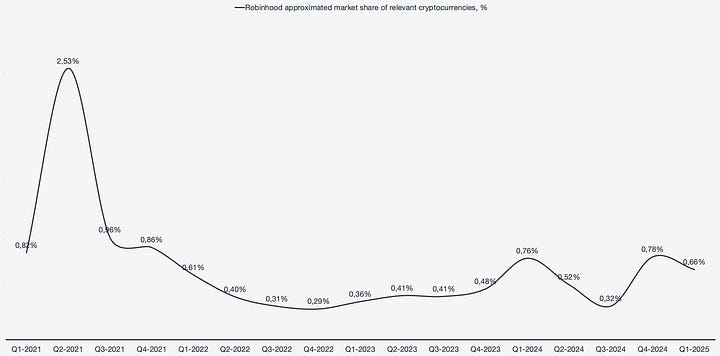

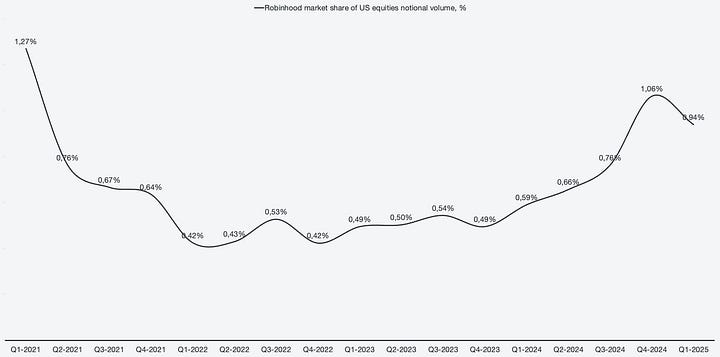

While it is not possible to track for options, Robinhood still has a massive TAM to capture in both equities and cryptocurrencies across multiple geographies. In terms of the U.S. equities market, Robinhood currently only holds a 0.94% market share, with a clear upward trend. In terms of cryptocurrencies, the market share is even lower, currently at 0.66% as of Q1 2025.

Figure 4, 5: Market share of U.S. equity and cryptocurrency markets

The question then becomes, what of equities? As a brokerage, Robinhood is mainly associated with stock trading, but the revenues associated with equities are stagnating as the markets become more efficient. Management seems to have a plan for that, as they recently launched stock tokens in Europe. Stock tokens instantly increased the take-rate of equity trading by 10x, as well as positioned Robinhood for the future of trading across a wide variety of assets and geographies.

Tokenization and expanding across geographies

Given Robinhood’s commission-free trading structure, launching equity trading in Europe presents a big problem since payment for order flow is banned in the region. Robinhood has historically offered cryptocurrency trading in Europe and the U.K., but gaining traction as a brokerage has been halted due to regulation. However, Robinhood held an event on the 30th of June where they unveiled a new financial instrument: stock tokens. This is an important milestone for Robinhood, both in terms of preparing for the future of trading and also solving the immediate problem of expanding into Europe.

Stock tokens are a blockchain-based digital representation of real company shares. The shares are backed 1:1 by Robinhood, and they can be fractionally owned and traded by users. Some of the benefits include:

Operate 24 hours per day, 5 days per week (with plans for 24/7 trading)

Seamless user experience; the complexity of blockchain technology never reaches the user

Global access, allowing geographic expansion despite regulatory hurdles

Commission-free trading is retained

Investors can buy fractional shares, making stocks more accessible

Robinhood made it clear during the event that stocks are just the beginning, with plans to tokenize other assets such as private company shares, real estate, and art.

While payment for order flow is banned in Europe, Robinhood still generates an attractive yield from tokenized trading since they take an FX conversion fee of 0.10%. This fee makes equities 10 times more attractive in tokenized form compared to the native Robinhood app in the U.S., which only has a 0.01% yield for equities.

There is also the added benefit of generating application engagement, which is how Robinhood generates the other portion of its revenue. We have yet to await financial details to know both short- and long-term impacts of tokenization, but I believe that Robinhood is an early mover and has positioned itself well for the future of trading with this move.

The flywheel effect of Robinhood

I recently likened Robinhood’s business to a compounding marvel in a short and concise investment pitch, and there is a good reason for that. While transaction-based revenues remain highly cyclical in nature, there is another growing side to Robinhood’s business, which is increasingly finding more ways to scale and expand.

While transaction-based revenues are highly cyclical in nature, there are two other business segments that can serve as more consistent growth drivers. Subscription revenue refers to Robinhood’s Gold membership offering, which unlocks more features on the platform as well as new service offerings. Interest revenue is tied to Robinhood finding ways to earn interest and fees on the assets that the users keep on the platform.

Figure 6: Segmented revenues

So, what is the flywheel effect, and what compounding am I referring to? At the heart of Robinhood are its users, and finding ways to grow the user base is the foundation for the compounding effect. Growing and retaining users, as well as incentivizing them to use the platform as much as possible, is the key to sustainable high growth for Robinhood.

The user base grew exponentially during the 2021 stimulus-fuelled market and has since then struggled to find meaningful growth beyond the period. In recent quarters, in line with many new feature announcements by the management team, user growth is starting to pick up again.

Figure 7: Historical funded customer count

The flywheel effect is as follows:

User deposits funds into Robinhood

Transfer from a different brokerage, fiat or crypto deposit

Robinhood earns yield on assets under management

Interest income via sweep programs, securities lending, crypto- and margin balances

Assets on the platform incentivize users to use the assets for trading

Drives transaction-based revenue

Users upgrade to Robinhood Gold to make better use of their assets on the platform

Higher yield on cash, margin investing, advanced research and trading tools, priority customer service

Increased engagement and services deepen loyalty and use of the platform

More trading, more deposits, more long-term asset growth

Users increasingly move more of their financial needs to Robinhood

As the user’s portfolio grows, so does Robinhood’s earnings potential

More interest income

More trading volume

Higher subscription conversion

The loop restarts with more deposits and deeper platform engagement

A good measure of ensuring that the flywheel effect is performing is by looking at the customer retention rate, which has stayed consistently high at ~95%. It is a strong retention rate considering how cold markets were in recent years.

Figure 8: Average customer retention rate

Reducing volatility in the financial results

If Robinhood only had its trading segment, the stock would have severe volatility issues. However, Robinhood has managed to find increasingly more ways to monetize its customer base, which is core to reducing the cyclical nature of the business.

The first key part to understanding the dynamic of earning interest is to look at the asset composition.

Figure 9: Segmented assets under custody

The main categories of earning interest are currently cash sweep programs, securities lending, cash yield, margin books, and credit cards. In the future, Robinhood may break out and start reporting on cryptocurrency interest through staking and blockchain rewards, for example.