Tesla has been a volatile stock ever since it was publicly listed, but the core investment thesis and vision remained intact for a long time. The electric vehicles are subjectively the best in the world, but the metrics associated with the EV business are deteriorating while CEO Elon Musk appears to be distracted with side quests.

The intrinsic valuation could be justified with a prosperous outlook for the EV business alone, coupled with full self-driving subscriptions and a rapidly growing energy business. However, the intrinsic value on a segmented basis has dropped significantly with recent quarterly performances, making it hard to justify a bright forecasting period. To justify today’s price, significant value has to be given to intangible business segments that do not yet exist, which is a scary proposition.

Company profile

9 August, 2025 Initiated coverage

Direction: Hold

Previous fair intrinsic value: N/A, as of N/A

Symbol: TSLA, Exchange: NASDAQ

Sector: Auto Manufacturers, Industry: Consumer Discretionary

Theme: Growth

Fair intrinsic value: $268.37 (-18.59%), as of August 9, 2025

Market capitalization: $1 160 038 million

Pricing data: P/S 13x, P/E 189x

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

The automotive segment is deteriorating at a glance

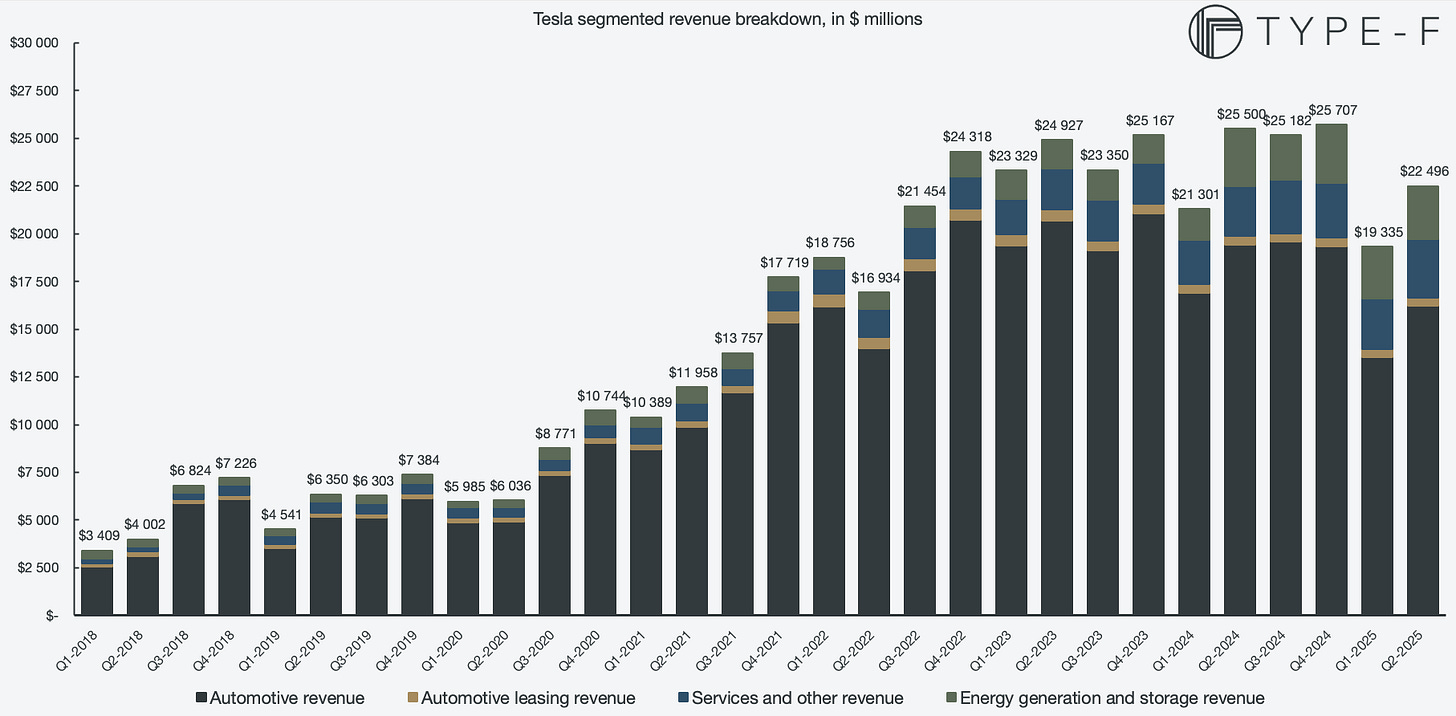

Tesla’s segmented revenues show that the automotive segment is still dominant, and there is no reason to disregard it in future forecasting. Many investors are excited about what future revenue segments might bring for Tesla, but it’s important to keep in mind that Tesla is an automotive manufacturer at its core. The energy and services segments have grown to a meaningful degree, but before diving deeper into other segments, it is important to analyze the core business.

Figure 1: Historical segmented revenue

Automotive revenue is down as a result of decreased deliveries after a stagnant period from H2 2022 to H2 2024. During 2021 and early 2022, Tesla was clearing its inventories fast and was close to having no inventory of finished cars. For several periods in a row, Tesla delivered more cars than they produced. During these quarters, used Teslas were being sold at a higher price on secondhandmarkets than the retail price due to many configurations being backlogged.

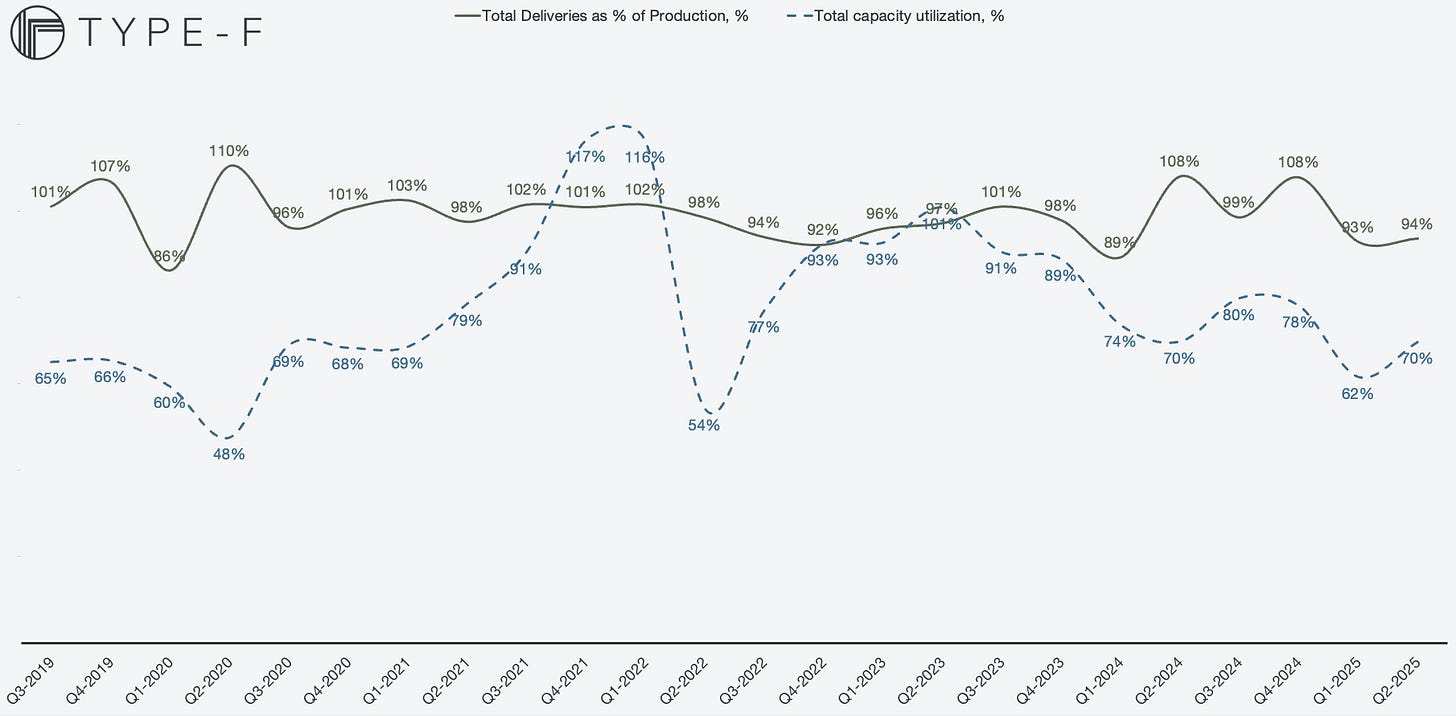

Figure 2: Deliveries as a percent of production and capacity utilization

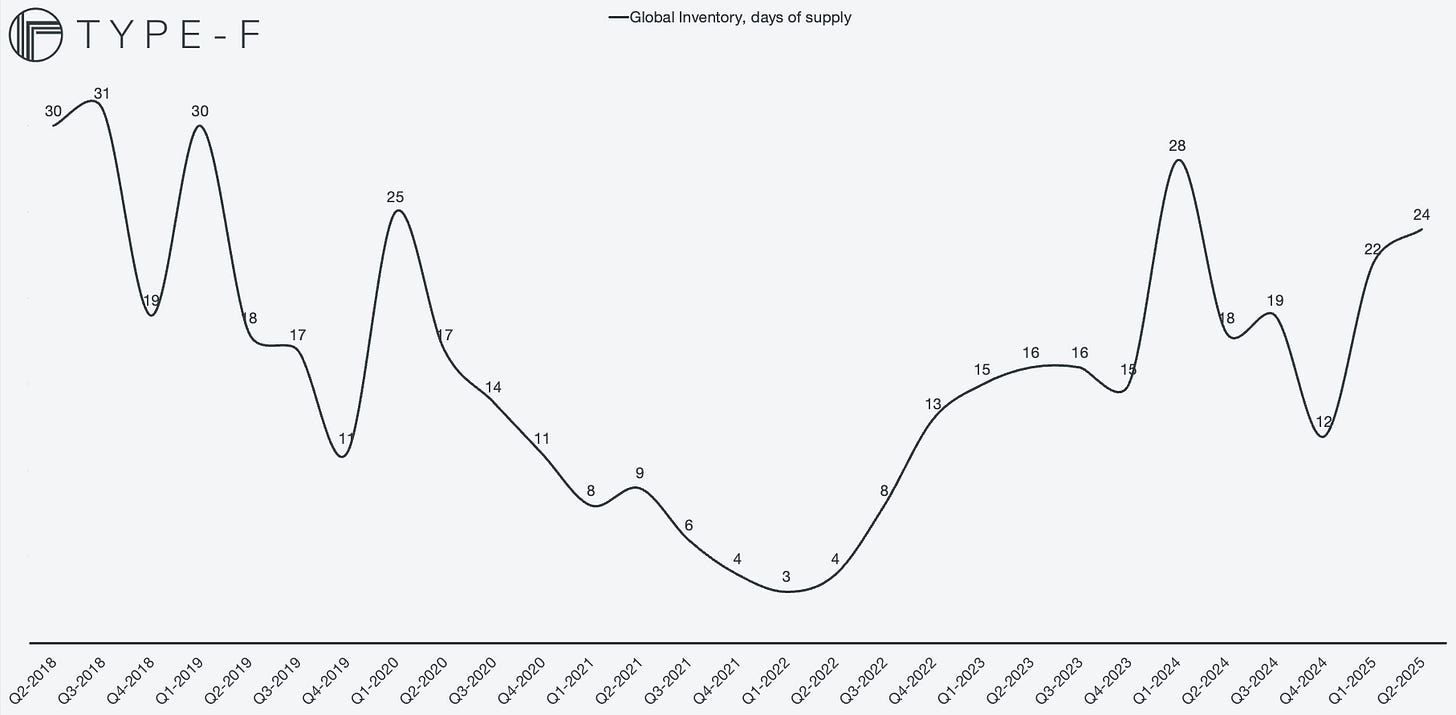

Figure 3: Global inventory supply

Since Q2 2023, Tesla has not been manufacturing at full capacity, going as low as 62% utilization in Q1 2025. This can be explained by transitioning to newer models and having model refreshes. However, it becomes a red flag when Tesla does not manufacture at full capacity and still does not manage to clear deliveries of what it produces.

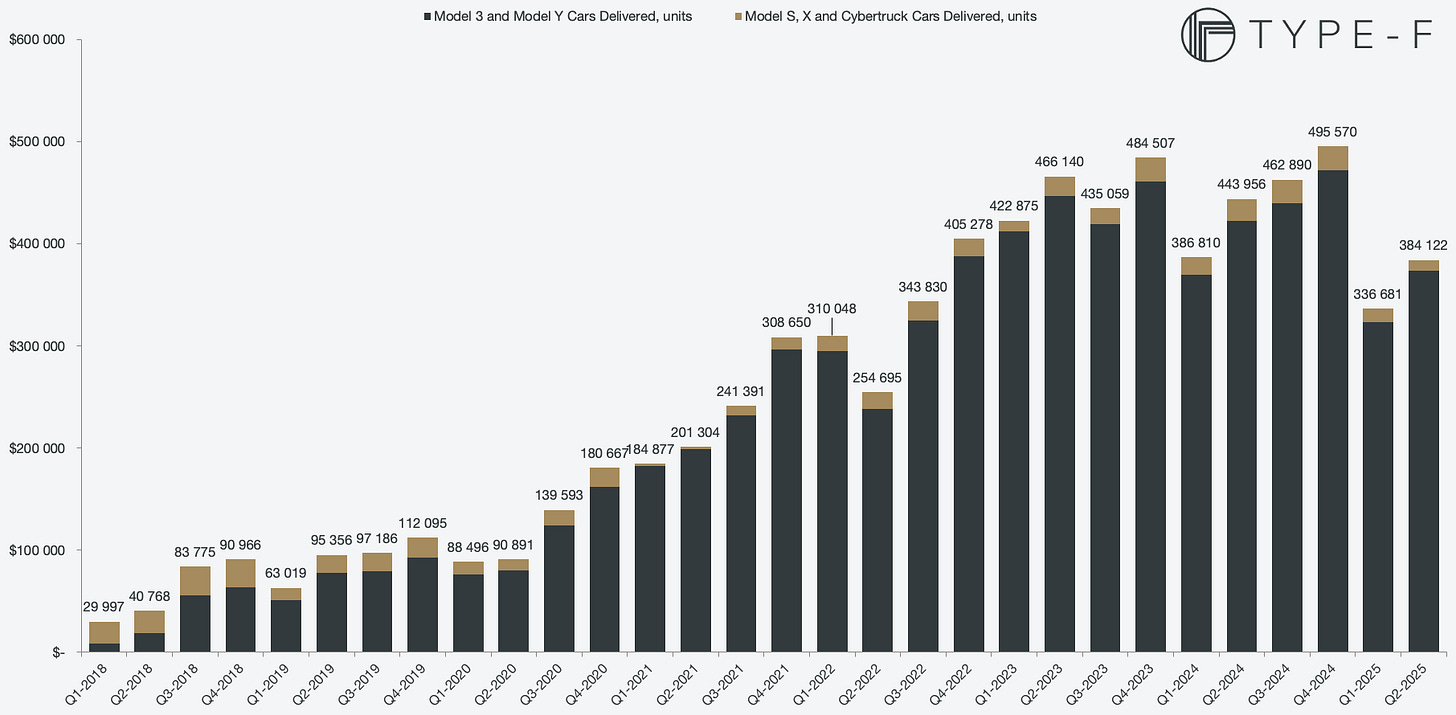

Figure 4: Segmented vehicle deliveries

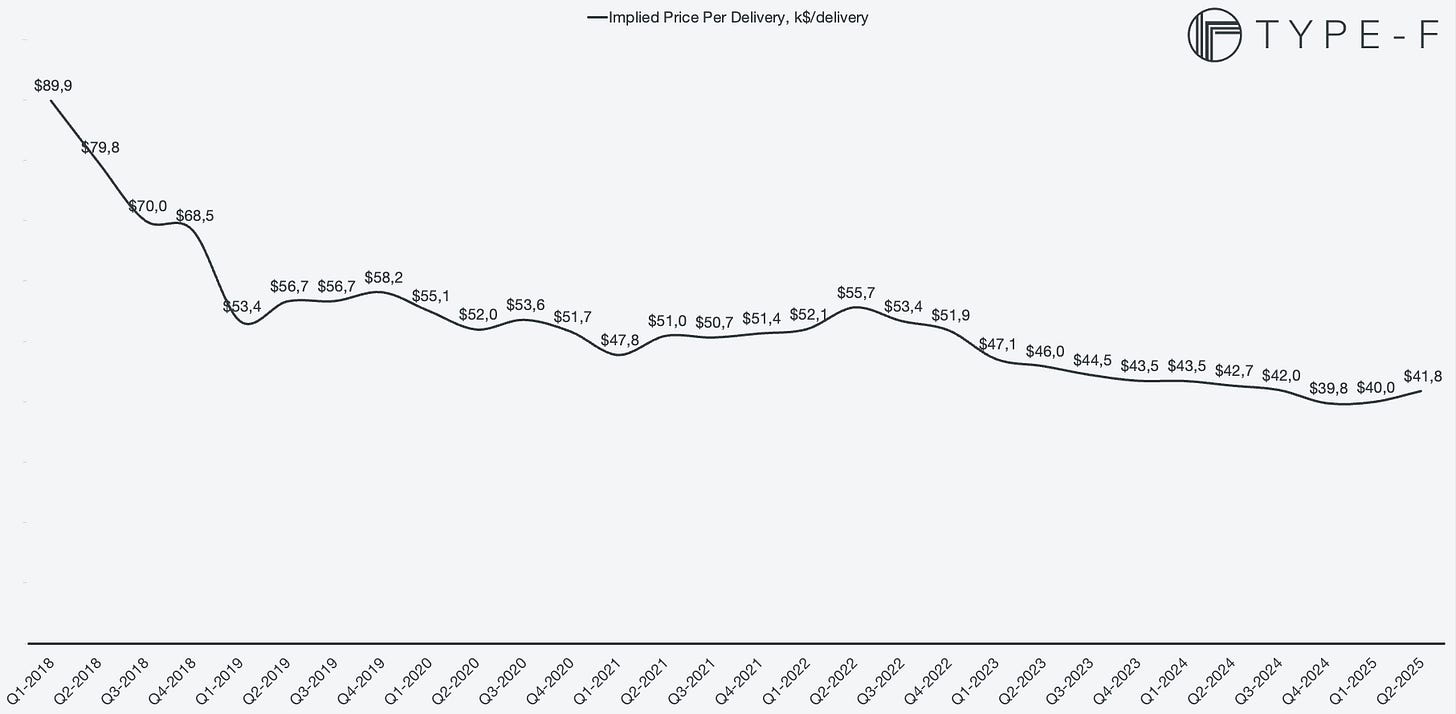

In addition, the decline in deliveries occurs despite Tesla cars being ~$15000 cheaper on average since the peak of 2022, when Tesla had a lot of pricing power due to its backlog.

Figure 5: Average price per delivery

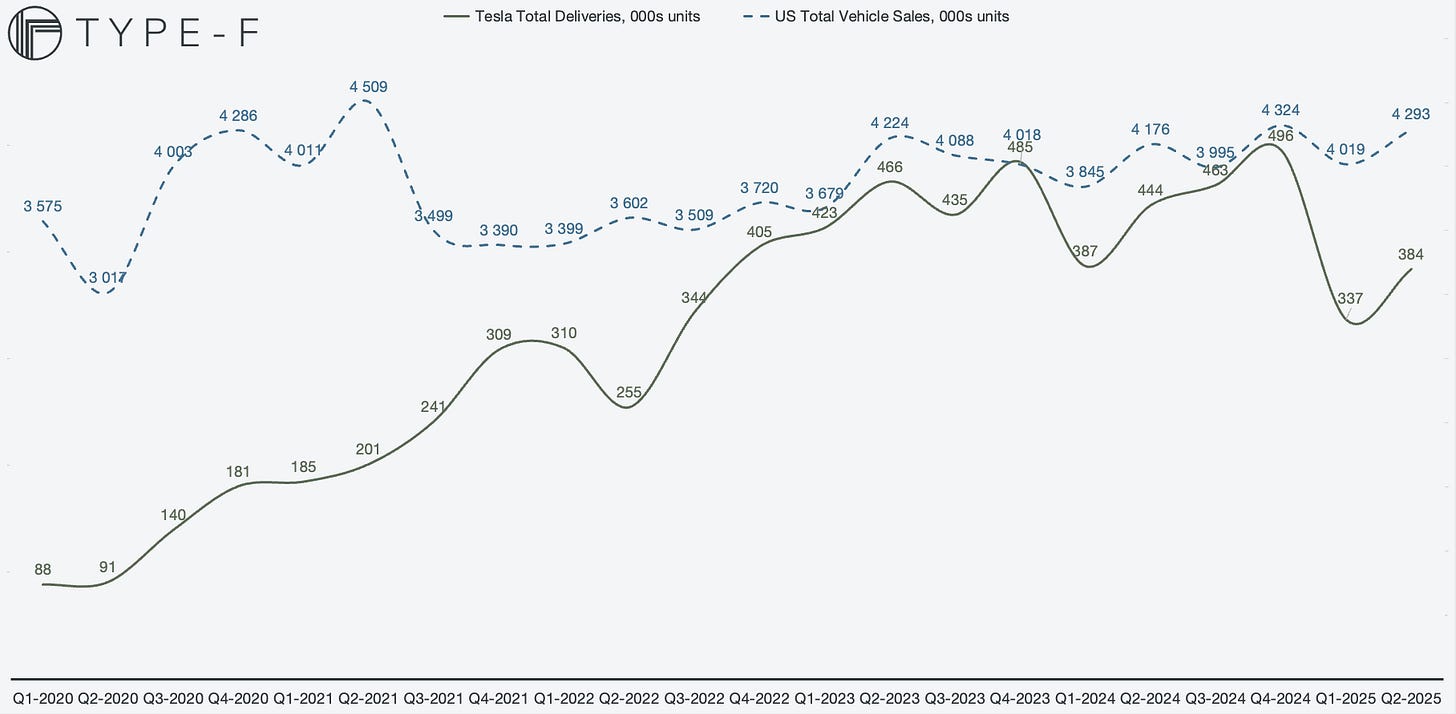

It can be observed that Tesla’s automotive segment is in a decline post its early 2022 peak, but is it simply due to Tesla cars suddenly becoming less attractive? When charting Tesla’s automotive deliveries against the overall U.S. vehicle deliveries, it appears that both are stagnating during the same periods.

Figure 6: Tesla deliveries and U.S. total vehicle sales (opposite axis)

It is easy to draw the conclusion that during the stagnating periods post 2022, it is simply due to the overall U.S. vehicle sales staying stagnant overall, and as such, there is no inherent problem with Tesla’s sales. That argument makes sense assuming the growth rates are equal; however, since 2010, the overall U.S. total vehicle sales have compounded at only 1.62% (Source: U.S. Bureau of Economic Analysis via FRED®). Tesla should never be compared against the overall U.S. vehicle market for this reason. Tesla should, and has, far outpaced the overall vehicle industry in the U.S., even though Tesla’s delivery numbers in this scenario are not U.S. specific.

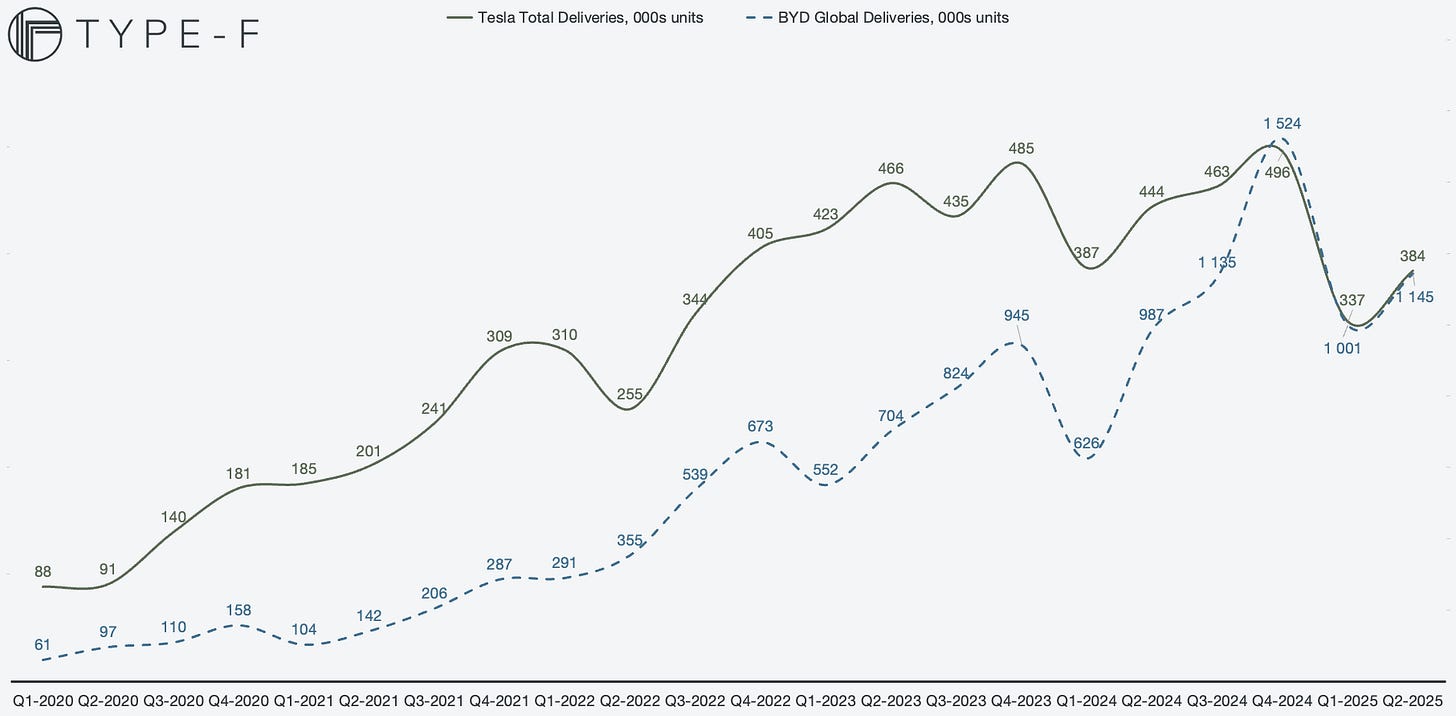

There is no real comparable benchmark for Tesla, as its offerings are quite unique when looking at market availability and price range, but overall trends can be observed in competitors that really show that Tesla seems to be struggling. In particular, BYD is a more compatible comparison, despite the difference in fleet offerings and market availability. BYD has outpaced Tesla’s growth, but by looking at an overall trend, BYD is experiencing the same drop-offs in deliveries in recent periods.

Figure 7: Tesla deliveries and BYD global deliveries (opposite axis)

This leads me to believe that the overall pressures that Tesla’s automotive business is experiencing are not completely specific to Tesla but to the overall electric vehicle market.

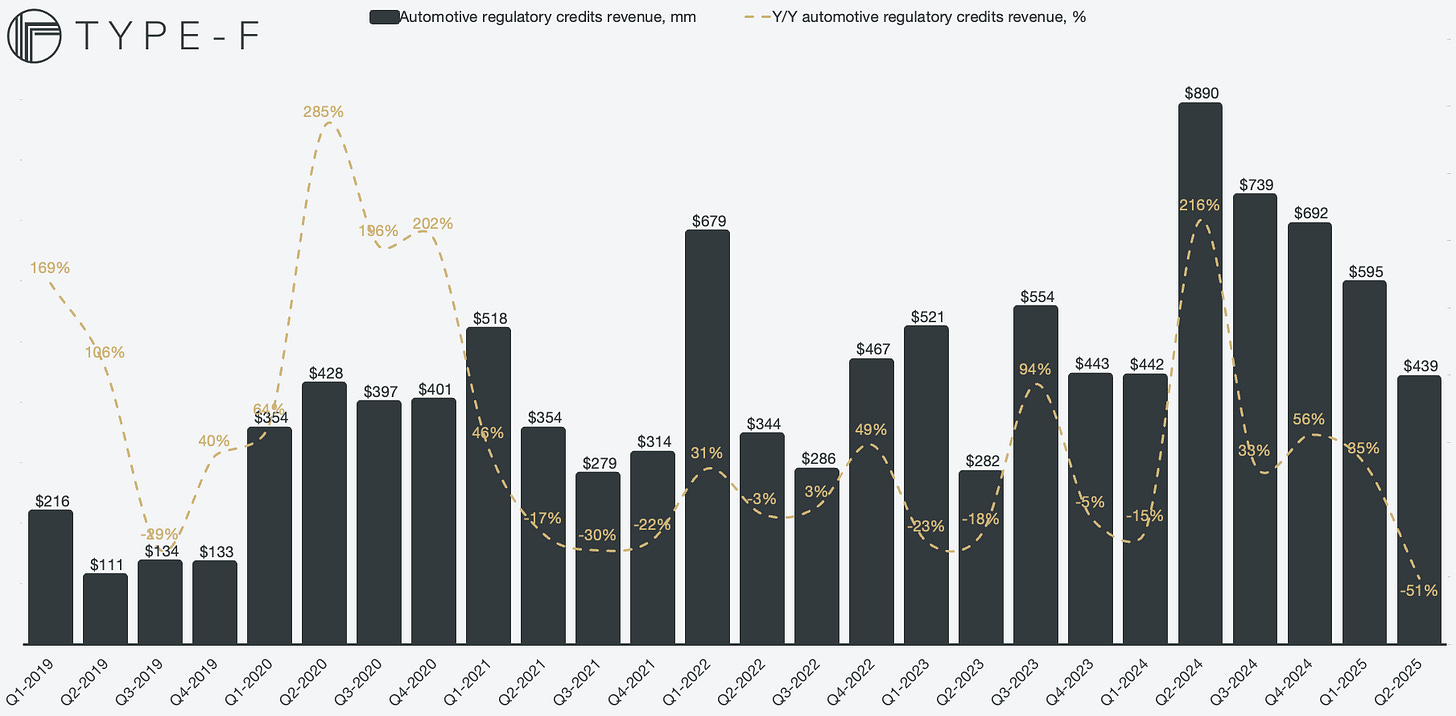

However, Tesla experiences headwinds stemming from regulatory changes as well. Tesla has been earning a significant revenue stream by selling emissions credits to automakers who failed to meet fuel efficiency and zero-emission vehicle requirements. The recently passed “Big Beautiful Bill,” which was signed into law, effectively eliminates the fines tied to these regulations, removing automakers’ incentive to buy Tesla’s credits.

In addition, the federal EV purchase tax credits introduced under the Inflation Reduction Act allowed buyers to be eligible for up to a $7500 credit on new EVs. The tax credit is being phased out effective September 30, 2025, which is likely to dampen sales in the short term.

Figure 8: Automotive regulatory credits revenue

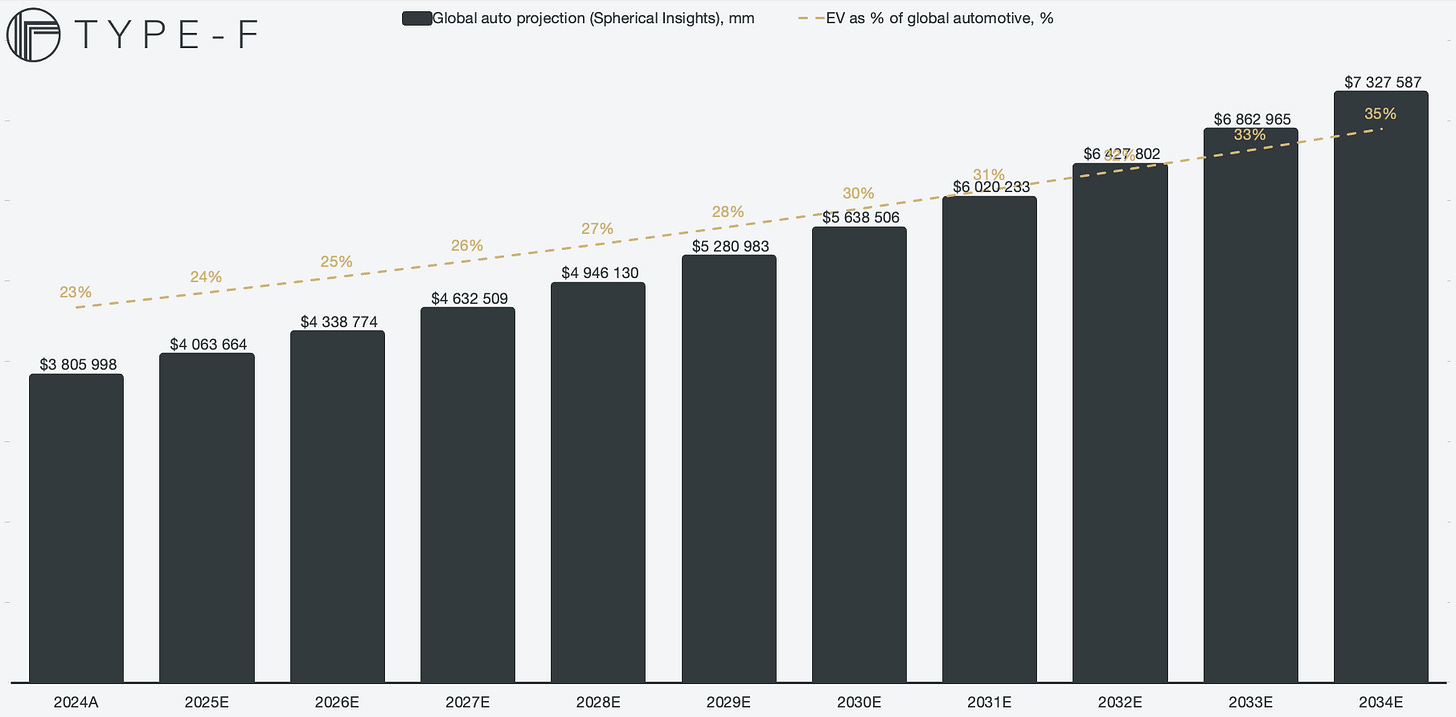

The overall global automotive market is projected to grow at a 7.14% CAGR (Source: Spherical Insights), while the electric vehicle market is projected to grow at an 11.61% CAGR (Source: Precedence Research). Tesla currently has an ~8.6% market share of the overall EV market, and I expect Tesla to outgrow the overall EV market to reach a ~15% market share by 2034. In essence, while current automotive sales are disappointing for investors who had high expectations from Tesla’s automotive segment, they are not alone in their struggles. Auto sales suffer from cyclicality depending on external macro factors, and despite Musk’s political side-tracking, I believe Tesla’s auto segment is not as dire as the numbers currently portray.

Figure 9: Global auto and global EV forecasts

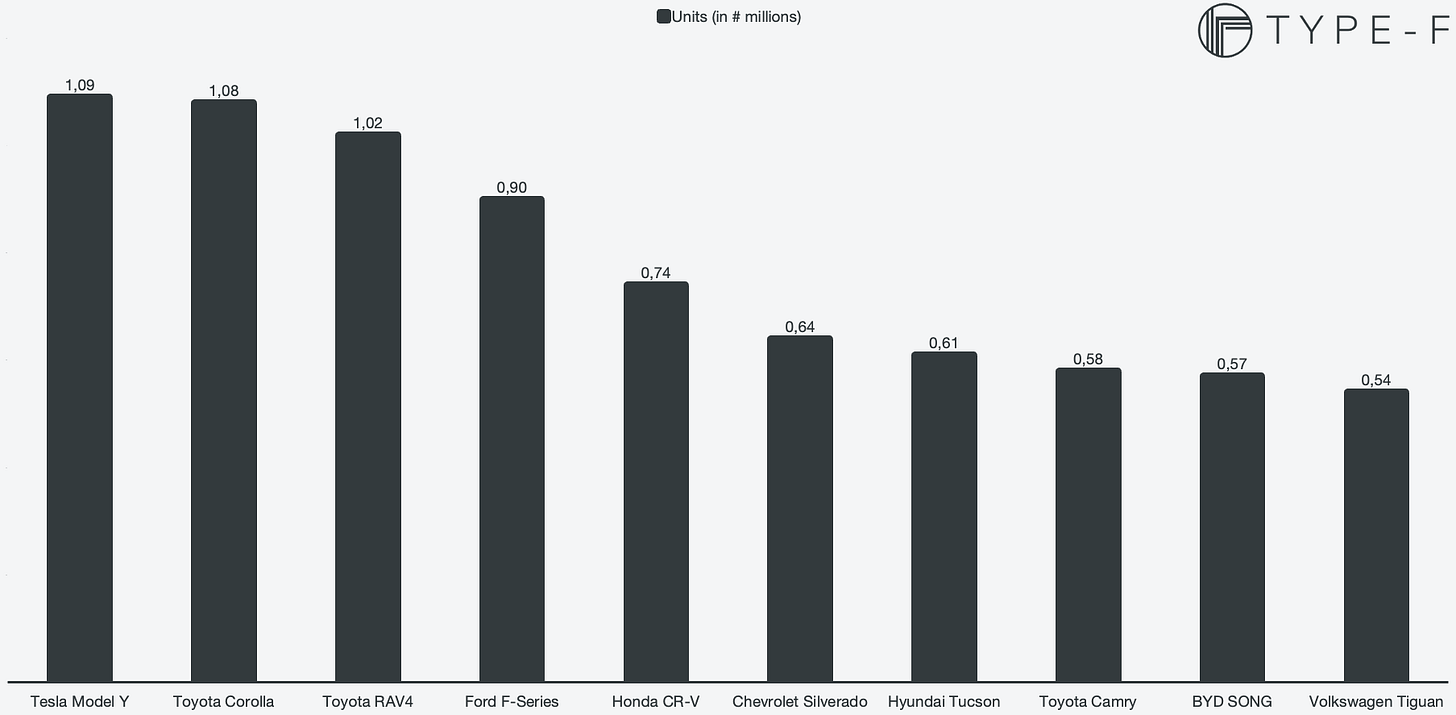

Tesla’s Model Y was the best-selling car globally in 2024, and recent Q2 earnings call commentary from Elon Musk reiterates that the Model Y is currently the best-selling car as of Q2 2025 as well.

Model Y in June became the best-selling car in Turkey, Netherlands, Switzerland and Austria. It is, I believe, the best-selling car of any kind in the world still. And autonomy is a big factor there. So even with just supervised self-driving, it's a huge selling point. And it's worth noting that we do not actually yet have approval for supervised FSD in Europe. So our sales in Europe, we think, will improve significantly once we are able to give customers the same experience that they have in the U.S.

Elon Musk

Tesla Inc., Q2 2025 Earnings Conference Call

Figure 10: 2024 Global automotive sales per model

There are several factors to consider when trying to understand the overall global decrease in sales. Management of Tesla cites several reasons during the Q2 2025 earnings, including:

Automotive sales are down due to the repeal of the IRA EV credit, which limits the supply of vehicles in the U.S. and affects lead times for parts to build cars.

The change in emission standards from the bill has resulted in a reduction of sales of regulatory credits to other OEMs.

Lack of regulatory approval for supervised FSD in international markets is hindering sales growth.

Lower-cost model production will take longer to ramp up than anticipated, affecting overall sales.

The loss of incentives and complex regulatory environments could lead to a further slowdown in automotive sales.

The overall economic climate globally is affecting consumer spending power and influencing demand for vehicles.

Overall, Tesla’s focus on autonomy and the introduction of more affordable models are expected to improve sales. However, this is not expected to materialize until next year. Over a longer forecasting period, I still believe that Tesla will grow faster than the overall EV market, as mentioned earlier.

Tesla is more than a simple auto business

While the current business is largely driven by the automotive segment, management sees Tesla as an AI company. While there is some tangible evidence of this in Tesla’s current state (most notably on Tesla’s balance sheet), it is largely commentary meant for future business segments.

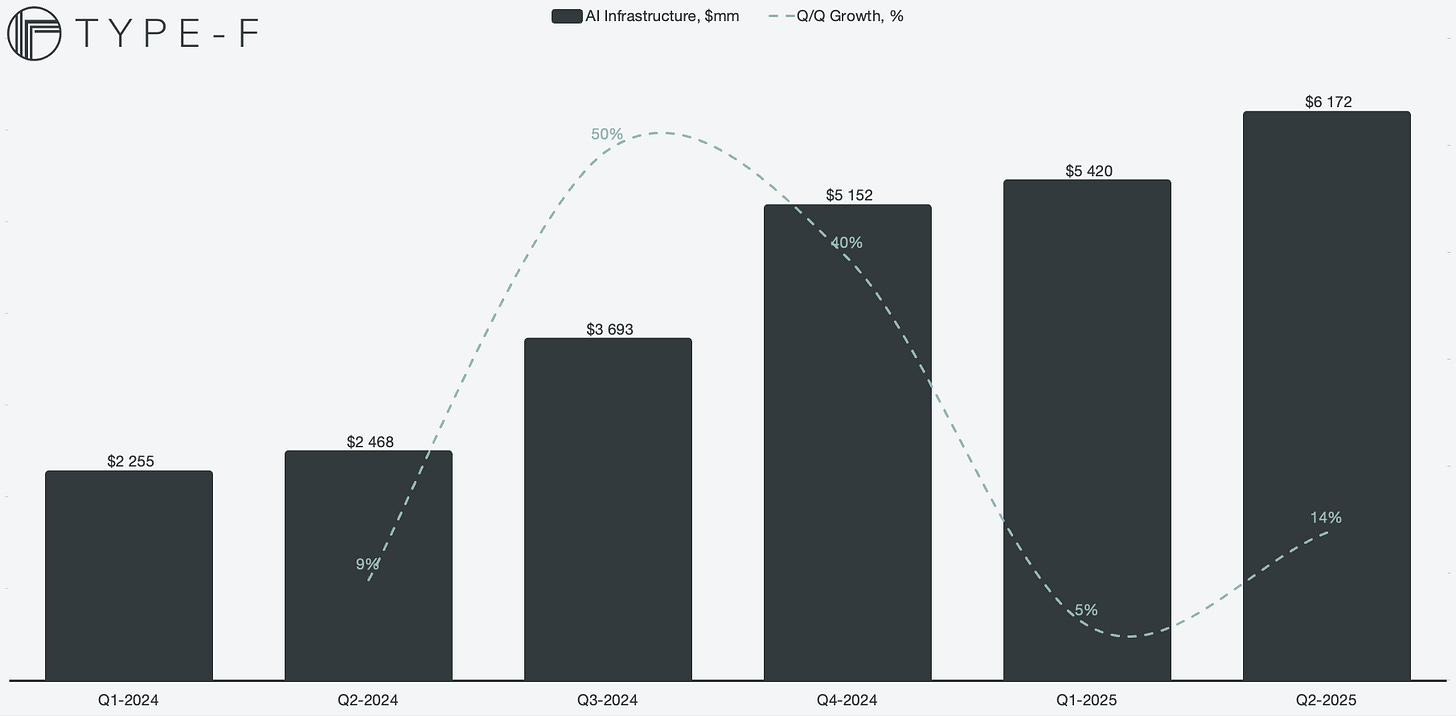

Figure 11: AI Infrastructure on the Balance Sheet

There is no clear description of what the AI Infrastructure line item is comprised of, but it has more than doubled Y/Y, now standing at $6.2 billion. While not filed in detail, there is commentary surrounding the expansion of Cortex in the earnings presentation, now totaling around 67,000 Nvidia H100 equivalent GPUs. AI infrastructure is likely the facilities relating to Cortex.

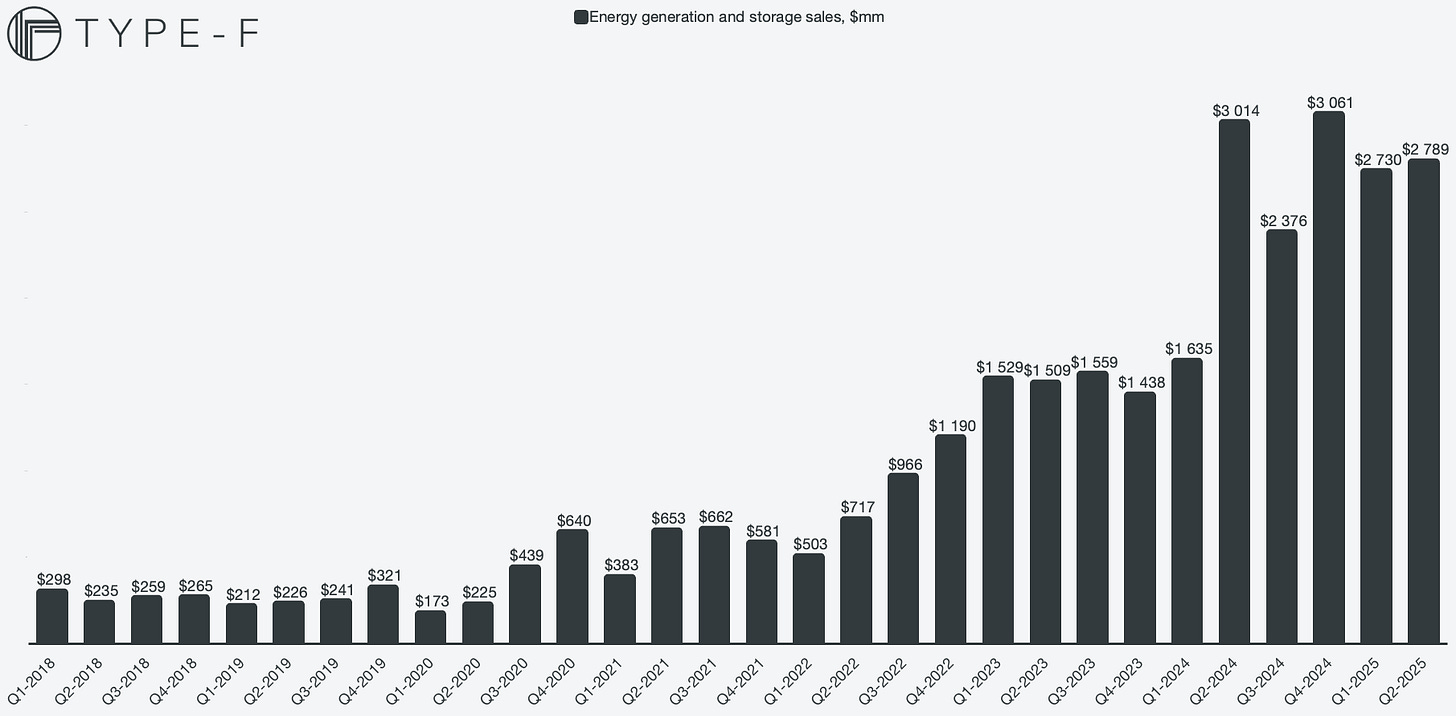

What is reported on, and what is growing quite quickly, is the energy generation and storage business. The segment has grown quite meaningful and is now providing ~$2.5 billion in sales every quarter consistently. However, the sales seem to have somewhat stagnated for a year’s time now.

We know that logistics and project milestones introduce some cyclicality in this business, and we also know that Tesla is actively ramping up megafactories in Shanghai and California and also building a new megafactory in Texas.