Tesla: Reacceleration across all segments, but is it enough?

Equity research follow-up coverage, rating unchanged

Tesla is up ~$500 billion in market cap since my last report, and the business has reaccelerated across all segments. All relevant margins improved, and all relevant revenue segments increased their pace of growth. However, perhaps the most positive news of all is that CEO Elon Musk has decided to tone down his political involvement and instead focus his attention on the business.

The intrinsic valuation still requires the inclusion of Optimus in order to justify today’s quote, a segment Q3 did not give more clarity on. The expectation is still that Optimus will be a multi-trillion dollar segment and that it’ll be the most significant product to be introduced in the history of mankind. However, timelines for expected adoption are still absent.

Company profile

October 27, 2025 Follow-up coverage

Direction: Hold

Previous fair intrinsic value: 268.37, as of August 9, 2025

Symbol: TSLA, Exchange: NASDAQ

Sector: Auto Manufacturers, Industry: Consumer Discretionary

Theme: Growth

Fair intrinsic value: $278.3 (-39.34%), as of October 27, 2025

Market capitalization: $1 618 152 million

Pricing data: P/S 17x, P/E 303x

Previous coverage:

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

Reacceleration across all segments

All product segments besides automotive leasing hit new all-time highs, and Tesla appears to have returned to growth. For the first time since Q2 2023, Tesla has managed to hit double-digit revenue growth on a year-over-year basis, hitting $28 billion in revenue for the quarter.

Figure 1: Historical segmented revenue

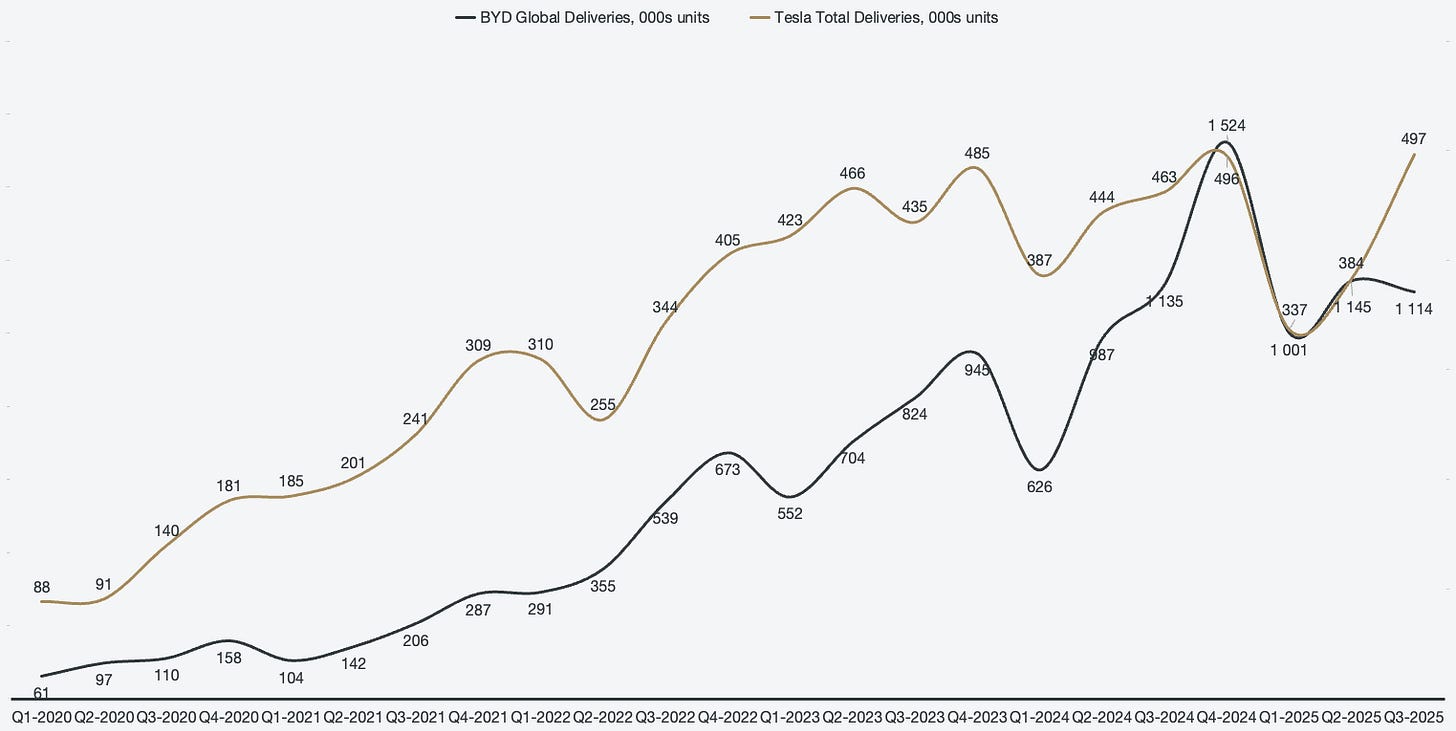

The first point to investigate is to see if this acceleration can be credited to Tesla improving or if they are simply following the overall market. Historically, Tesla deliveries have had a similar trend trajectory to BYD’s deliveries, and thus it serves as a good point of comparison. BYD delivered fewer vehicles than in Q2, while Tesla accelerated massively. This suggests that it is not a mere market trend and that Tesla is reaccelerating rather organically.

Figure 2: Deliveries as a percent of production and capacity utilization

Deliveries outpaced production for the quarter, and the capacity utilization increased to 76%. 82% of Model S and Y capacity was utilized, while only 46.5% of the Model S and X capacity was utilized. Outpacing the capacity also means that Tesla was able to clear out significant amounts of inventory, now down to 10 days of global supply from 24 in the quarter prior. That is the lowest level since Q3 2022.

Figure 3: Global inventory

Tesla was able to clear out significant amounts of its inventory while reaccelerating deliveries. However, in order for that to be a net positive for the business, the implied price per vehicle needs to stay stable. If Tesla lowered the average price per vehicle to dump inventory, it would not necessarily signal strength. The implied price per vehicle was $41,816, which is flat quarter-over-quarter. That is a sign of increased attractiveness in the cars.

Those dynamics converged into a new all-time high for total deliveries, reaching 497k, a 29.4% increase Q/Q, and 74% Y/Y.

Figure 4: Segmented deliveries

The overall automotive revenues did not quite keep pace with the delivery increase despite the implied price per vehicle staying the same. That is due to regulatory credits revenue being down 43% Y/Y, the second quarter in a row where regulatory credits are basically halved on a Y/Y basis. As regulatory credits will decline over time, it is a positive sign that Tesla is growing less and less reliant on them. Regulatory credits accounted for ~2% of automotive sales in Q3 2025.

Figure 5: Automotive regulatory credits as a percentage of automotive sales

Chinese revenue accelerates and once again accounts for ~20% of overall revenues. Both U.S. revenues and international revenues fell slightly. However, it is to be noted that Chinese revenue is flat Y/Y, while U.S. revenue grew 16%.

Figure 6: Geographical revenue mix

Perhaps the more exciting segment that reaccelerated was the energy segment. Storage deployed is up 81.2% Y/Y, reaching 12,500 MWh. In addition, energy generation and storage revenue is up 40.6% Y/Y, reaching a new all-time high after two consecutive quarters of decline.

However, despite the growth, it was eclipsed by the current scale of automotive revenue and actually decreased Q/Q in terms of overall revenue mix.

Figure 7: Energy generation and storage revenue

In addition, the reacceleration in the energy segment occurred while Tesla also improved margins. This implies that the unit economics are improving with scale. After teetering on the 30% level for 3 out of 4 prior quarters, Tesla finally reached >30% gross profit margins in the energy revenue segment, equivalent to a 151 basis point increase Y/Y.

Figure 8: Energy generation and storage gross profit and gross profit margins

Optimus and RoboTaxi uncertainties

Reacceleration aside, the current bid that Tesla is catching is not due to current business performance. I believe that a majority of the current stock quote is due to the promise of future segments, most notably the RoboTaxi network and the Optimus robot. However, we did not learn much new regarding either segment.

RoboTaxi is operational in limited capacity as noted in my previous report, and it is slowly expanding. Regulatory approval was a real concern under the previous U.S. administration, and perhaps also during the period when CEO Elon Musk decided to publicly criticize the sitting President of the United States. However, both hurdles seem to have been crossed, and Tesla estimates that by year-end, RoboTaxi will be operational across 8-10 metro areas. Currently, RoboTaxi is launched in Austin, which has seen an expansion of its geo-fenced area by 3x since launch, as well as most Bay Area cities.

However, the belief remains that the pace of adoption and scalability will be rapid and wide as soon as the technology and regulation are in place.

We’re really just at the beginning of scaling quite massively Full Self-Driving and Robotaxi and fundamentally changing the nature of transport. I think people just don’t quite appreciate the degree to which this will take off. Honestly, it’s going to be like a shock wave. The cars are all out there.

Elon Musk

Tesla Inc., Q3 2025 Earnings Conference Call

Taking RoboTaxi to scale will require FSD to mature further. Version 14 is yet another step up from the team, and the plans are quite grand in terms of the roadmap. Tesla plans to add reasoning to the cars in the future, and Elon even jokingly mentions that the cars might become too smart, to the point where they feel bored.

Figure 9: Cumulative FSD miles driven

This car will feel like it is a living creature. That’s how good the AI will get with the AI4 computer. This is before AI5. AI5, like I said, is by some metrics 40x better. Let’s just say safely it’s a 10x improvement.

Elon Musk

Tesla Inc., Q3 2025 Earnings Conference Call

In essence, future plans are as grandiose as ever, but they are still quite intangible in the present day. FSD is already impressive and can handle a lot of real-world challenges that a driver may face, but it is still a far cry from the promises presented to investors. I do include RoboTaxi in my intrinsic valuation model, as it is operational, but I am quite reserved in the scalability until we see more concrete hints at what the future may bring. More importantly, the timeline as to when that scalability may arrive and become meaningful for Tesla.

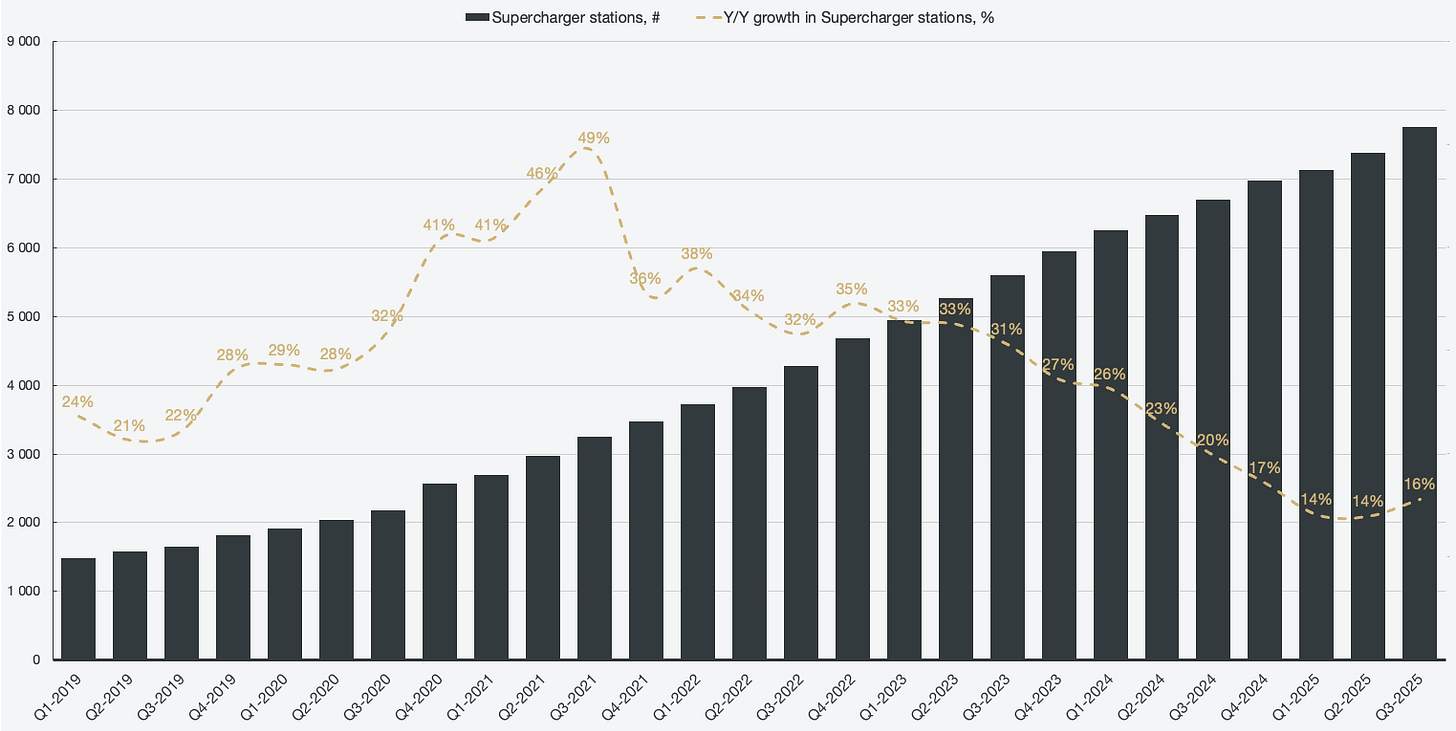

For FSD and RoboTaxi to be operational at scale, the infrastructure has to follow suit. One of the most consistent metrics in terms of growth is the Supercharger network. The future potential for the network is not limited to Tesla’s own ambitions and its own infrastructure but also includes the ability to lease out the stations to third-party OEMs. After decelerating the pace of growth in the supercharger network for close to three years, the growth accelerated on a Y/Y basis in Q3 2025.

Figure 10: Tesla supercharger stations

There are 9.5 supercharger connectors per station, up from 9.3 connectors per station in the year prior.