FICO: Pricing Power Through Total Domination

Equity research follow-up coverage, rating unchanged

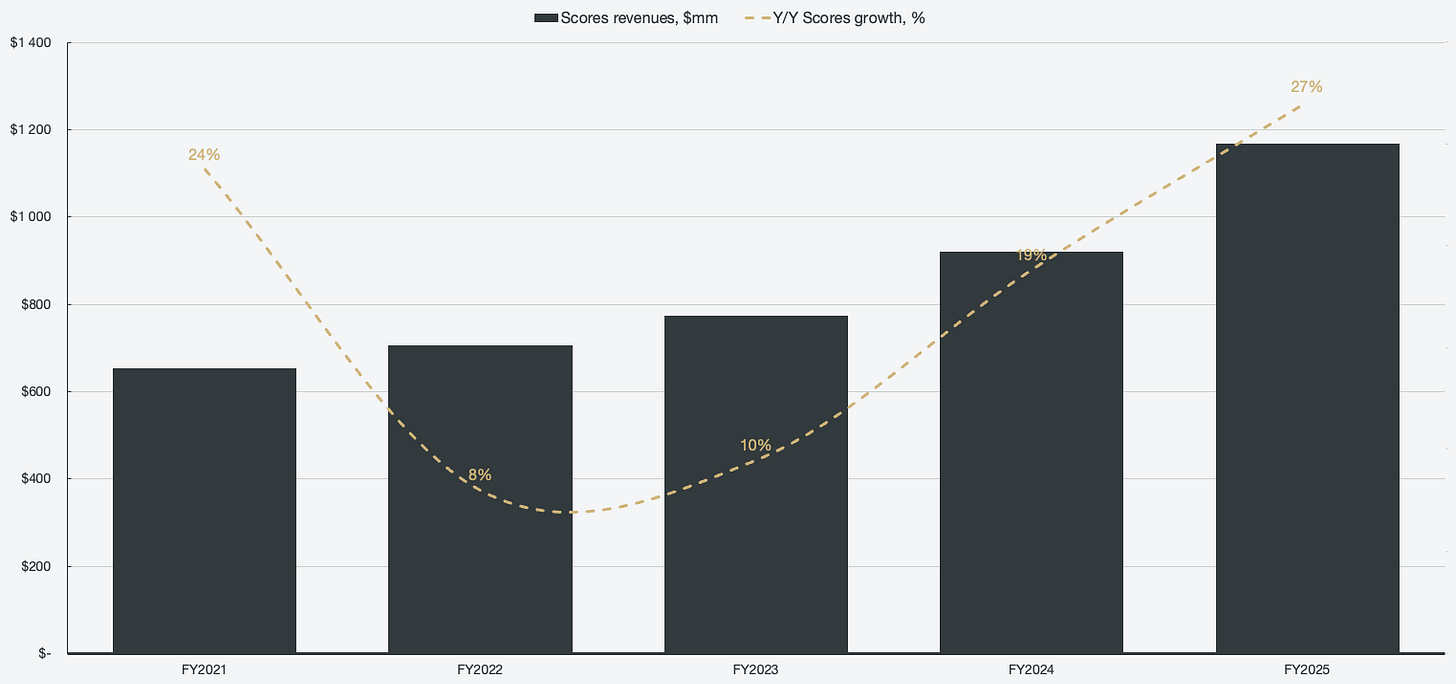

The behemoth FICO concluded 2025 with 16% year-over-year top-line growth and simultaneously expanded its operating margins to 46% and FCFF margins to 45%. The highly profitable scores segment grew 27% Y/Y, while the software segment lagged with only 3% growth. The scores segment remains the crown jewel of the business and, in my opinion, the most unfair business in the world. The systemic moat surrounding the scores segment is insurmountable, and 2026 could see revenues absolutely explode given recent announcements.

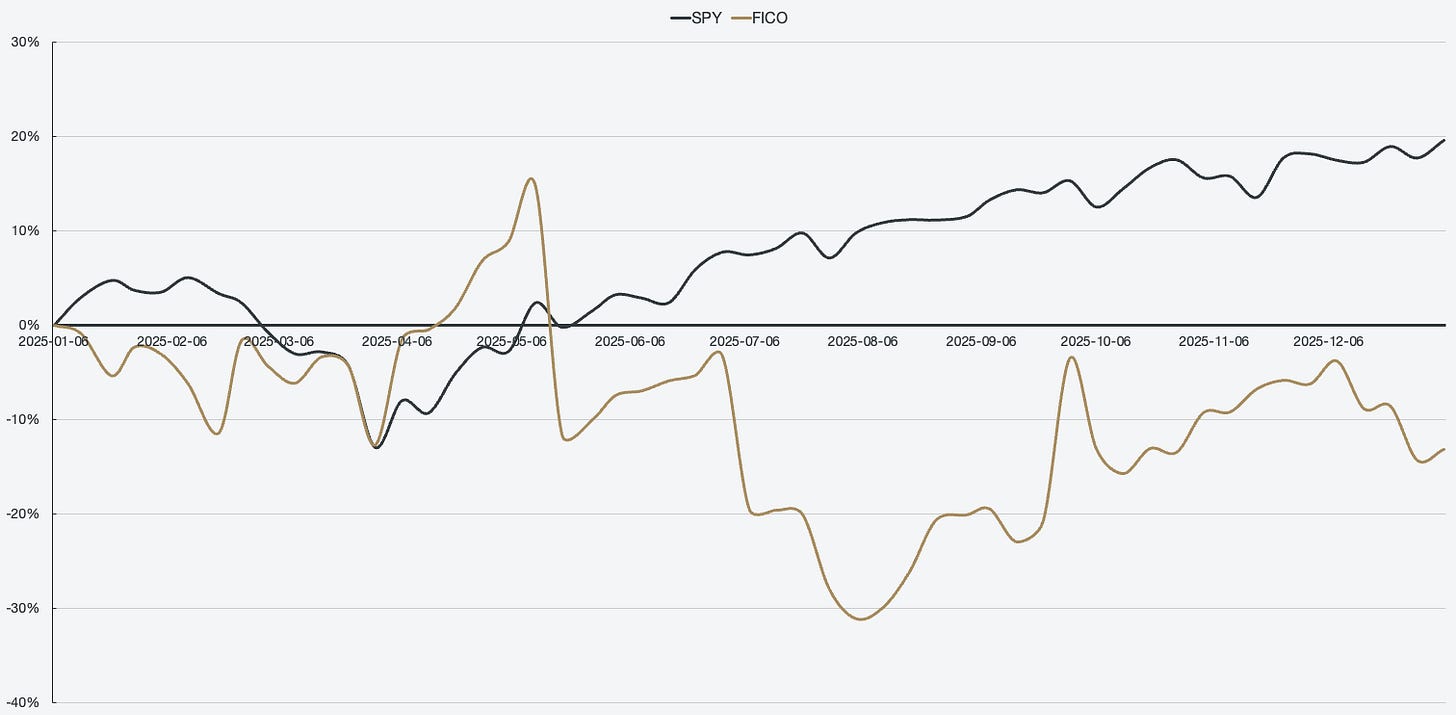

2025 was a year where FICO’s stock quote tumbled against the S&P 500 index, after outperforming massively over prior years. The quote peaked in December of 2024, at ~$2400 per share, and has since normalized in the ~$1500-1600 range. This has allowed fair intrinsic value to catch up, allowing more prudent investors a chance to purchase FICO under fair intrinsic value.

Price chart 1: FICO and SPY, 1-year stock return

Company profile

January 12, 2026 Follow-up coverage

Direction: Buy

Previous fair intrinsic value: 1595.16, as of August 17, 2025

Symbol: FICO, Exchange: NYSE

Sector: Technology, Industry: Software - Application

Theme: High quality

Fair intrinsic value: $2081.66 (27.60%), as of January 12, 2026

Market capitalization: $40 126 million

Pricing data: P/S 20x, P/E 61x

Previous coverage:

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

Scores pricing power is now unlocked

If I could only own one business segment in the stock market, it would be FICO’s scores segment. It remains the golden standard for credit risk assessment, just like it has for the past century. With estimates of >95-99% market share, this segment has immense pricing power, which the company has exercised over the past years. The FICO score royalty per score pull has seen a 725% price increase since 2018. However, another 700% increase is around the corner.

Figure 1: Scores revenue and scores revenue growth

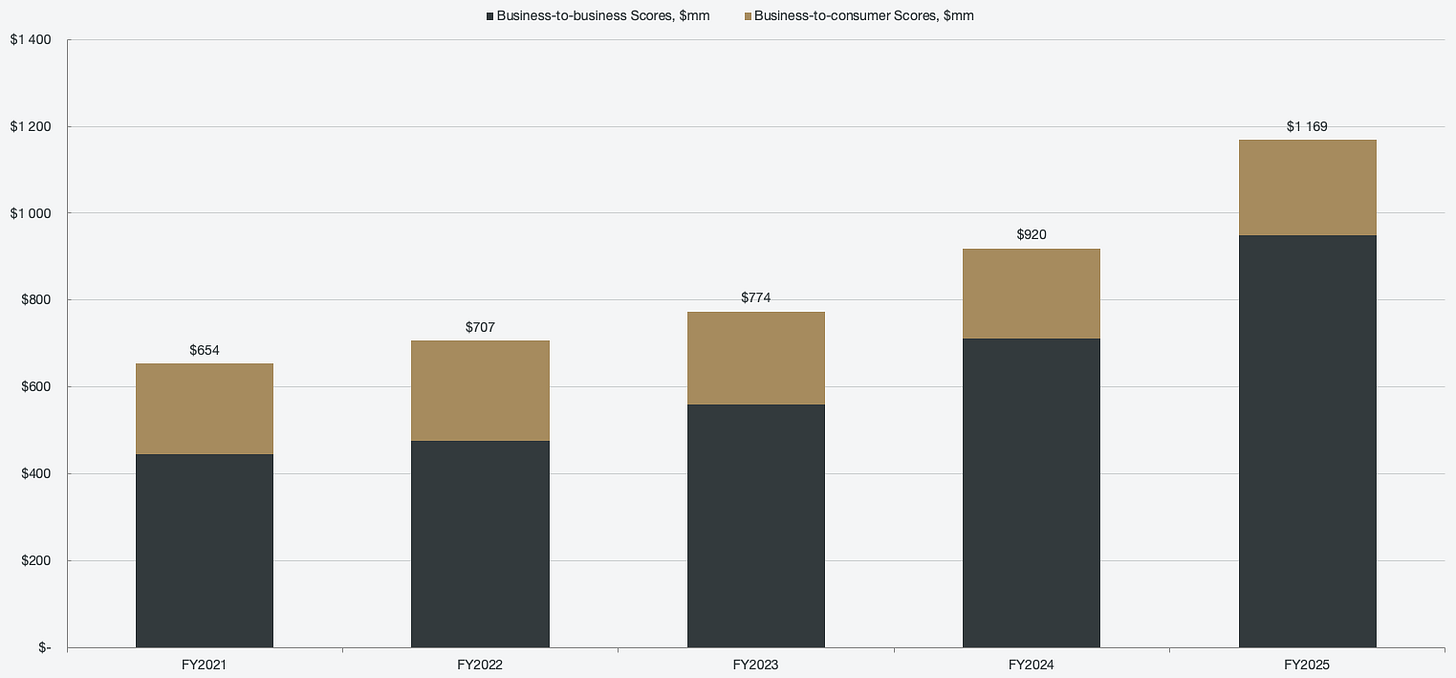

The primary driver of the scores revenue growth is the B2B segment, which has increased its part of the mix from a low of 68% in 2021 to now accounting for 81% of overall scores revenue in 2025. B2B, which serves banks, credit card issuers, insurers, retailers, and other various lenders and reporting agencies, grew 33% Y/Y. The B2C segment, which is primarily comprised of myFICO.com offerings, grew 6% Y/Y after declining in 2023 and 2024.

Figure 2: Segmented scores revenue

The scores segment could start to see major acceleration given FICO’s new direct license program. In short, FICO sells its scoring model to the three credit bureaus (Equifax, Experian, and TransUnion) for a royalty each time a lender pulls a score. These bureaus would mark up the price significantly and then sell the bundle back to the lenders—a tri-merge. The lenders pay a single price to the bureaus and often don’t know how much they paid for the score itself and how much they paid the bureaus for the data.

The direct license model allows FICO to offer its scores via resellers with two distinct pricing models:

A flat upfront fee of $4.95, with a $33 funded loan fee, which only gets paid when the mortgage closes.

A flat $10 per score, with no additional fees.

FICO’s royalties are already fixed at $4.95 as of 2025 (up from ~$0.60 in 2018), so the first option with a funded loan fee would mean a 667% increase of revenue on a tri-merge basis compared to FICO’s historical flat fee (from $14.85 to $113.85). The flat rate option also straight up doubles FICO’s score revenue per mortgage. Both direct licensing models are massive revenue accelerators, all while being transparent towards lenders.

This undermines the three bureaus’ role in the lending process, making it clear to lenders how much markup they are paying. Instead of bureaus hiking the overall price of a score pull with markup, they would instead only get a data report fee. This was announced in October of 2025, more or less as a response to the FHFA director blaming FICO for rising mortgage costs. With simple math, it is clear that FICO was never the problem (a tiny fraction of overall closing costs), but with a transparent licensing model, it diverts pressure from FICO towards the credit bureaus instead.

As a response, Equifax announced that they would sell VantageScore 4.0 for $4.50, which is less than half of FICO’s price. The only issue is that lenders don’t switch to VantageScore even when it is free, as it’s already being bundled with FICO score pulls with no one using it.

When free is not cheap enough, that’s when you know you have a systemic monopoly.

For example, a bank’s internal risk engine is hardcoded with FICO bands. A 700 FICO score is not the same as a 700 VantageScore, so a bank would have to re-underwrite millions of past loans to figure out what the VantageScore equivalent is, at a great risk. If they get the risk profile wrong, it could mean billions in unexpected defaults. In addition, banks often repackage and sell mortgages in bundles based on average FICO scores. Trying to approach securitization buyers with a VantageScore credit profile would make investors demand a heavy risk premium, further disincentivizing lenders to switch. This is a perfect example of a systemic moat.

Figure 3: Scores chain (pre-direct licensing model)

The initial reception, as detailed in the Q4 2025 earnings conference call, has been overwhelmingly positive. Lenders appreciate a direct approach, and the optionality allows for lenders to optimize their score consumption based on specific business needs. FICO anticipates that resellers will evaluate throughput rates to determine the most advantageous pricing model for their customers. FICO has taken a conservative stance in regard to its 2026 guidance, as performance-based payments have a lag and the adoption mix will take time to develop.

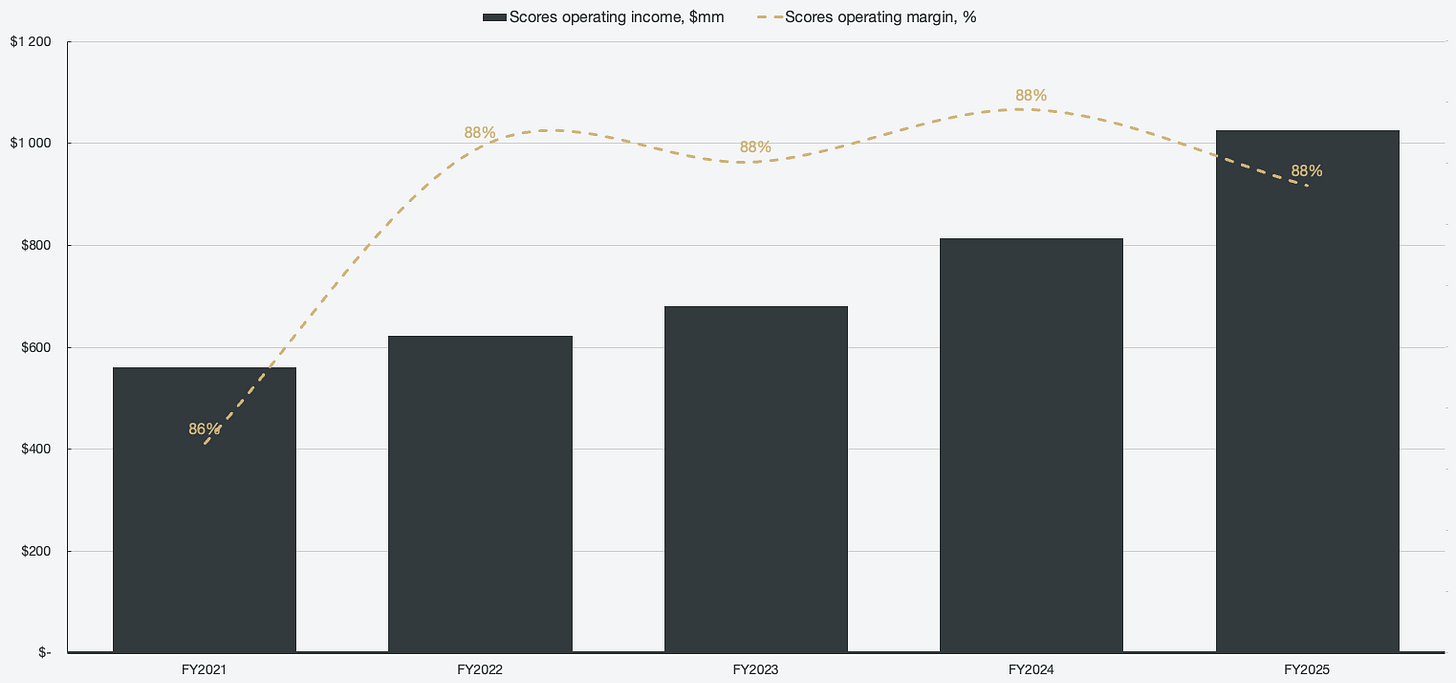

In the meantime, the current scores business model is still performing in a way that is expected of a compounding machine. The segment already has an outstanding margin profile of 88%, and the operating income is accelerating.

Figure 4: Scores operating income and operating margin

Software sees innovation

The scores segment, albeit tremendously impressive, has the downside of being cyclical. The consumer credit markets largely dictate the earnings potential of the segment, and as such, there is not much room for organic growth outside of the pricing power that FICO has. That’s where the software segment becomes increasingly important for driving FICO’s long-term intrinsic value higher.

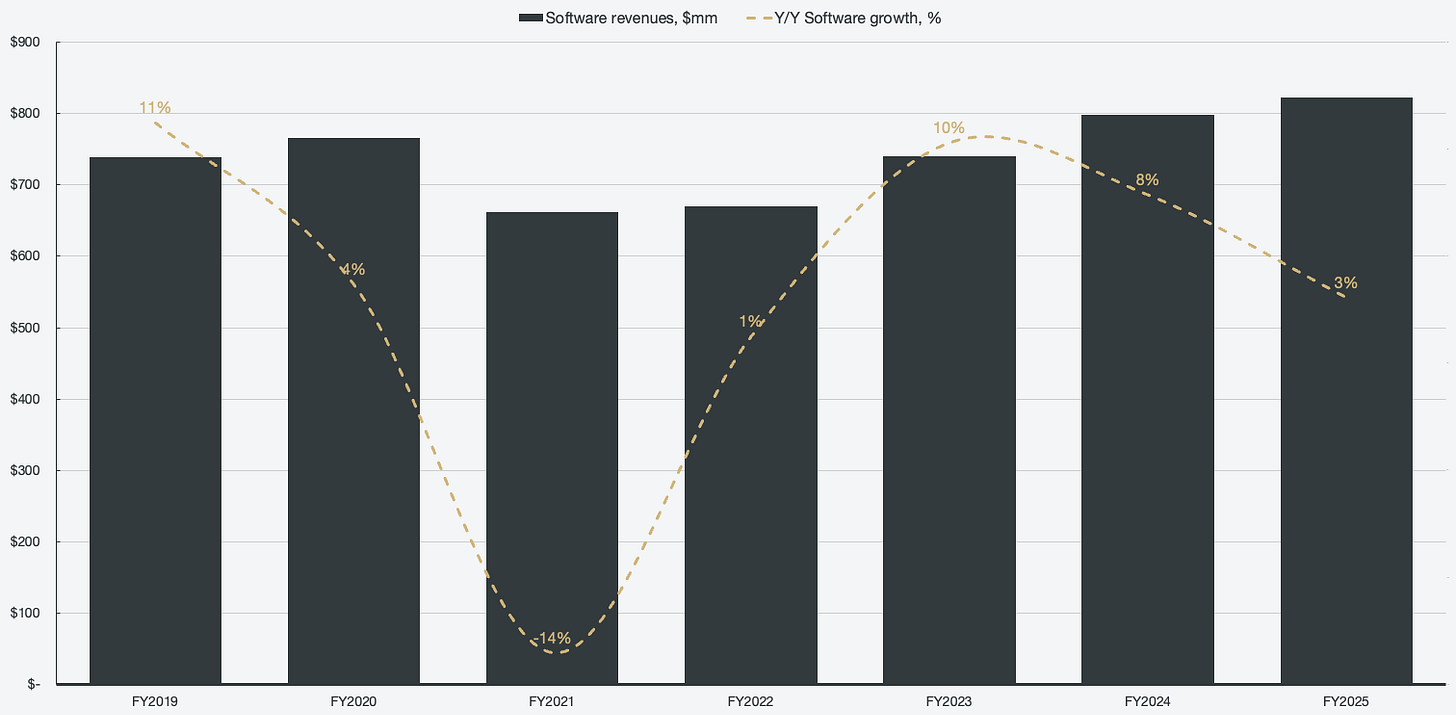

Figure 5: Software revenue and software revenue growth

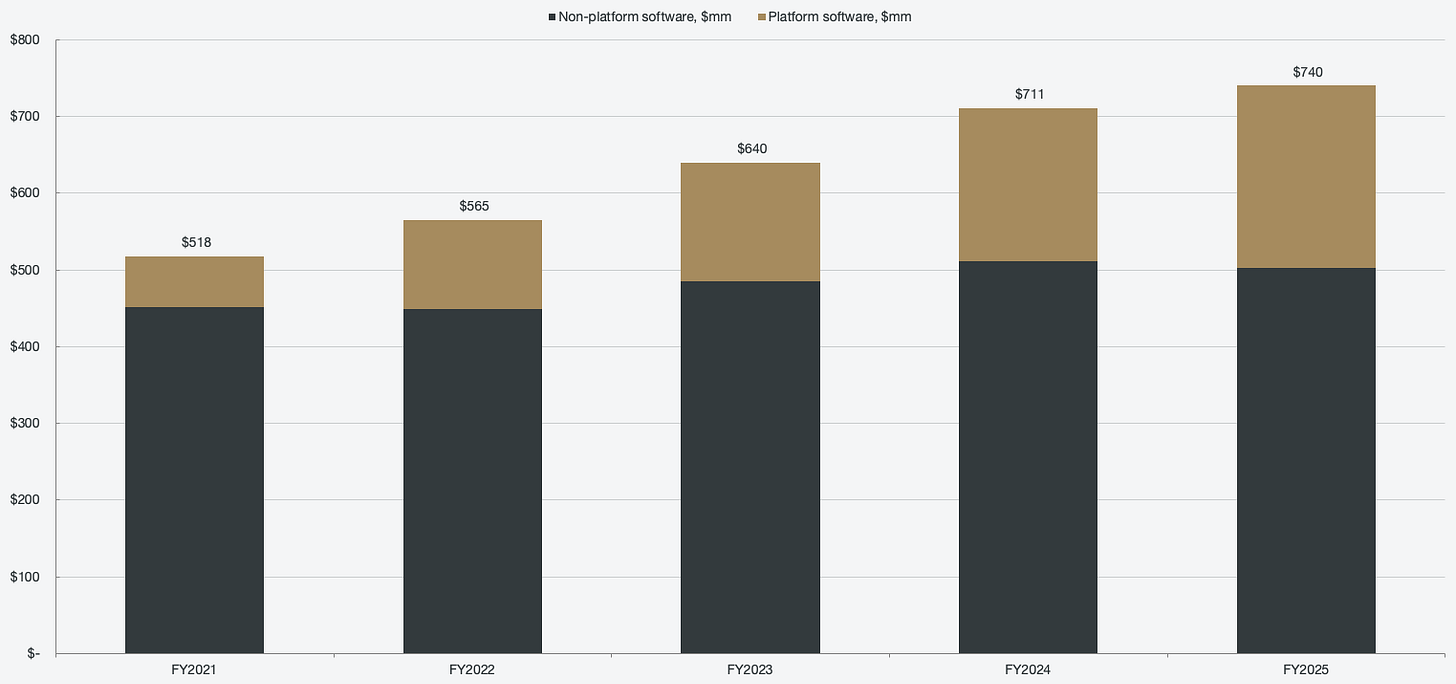

The software segment is divided into platform and non-platform. Non-platform is the legacy solution, which is being phased out for a modern cloud-based decisioning and analytics platform (platform). The FICO Platform is used for assessing credit risk, fraud detection, marketing, and compliance for decision-making. The interesting part is that the FICO Platform can apply advanced analytics and AI to execute real-time rule-based decisions and workflows (creating simulations and feedback loops). This part of the business in particular saw a major announcement a few days ago at the time of writing.

Figure 6: Segmented software revenue

FICO Xpress is used by large institutions to solve complex computational problems. It is a suite of mathematical modeling and optimization tools, such as solvers. It is used by various industries, such as banking, energy, healthcare, insurance, and manufacturing, for supply chain planning, scheduling, logistics, and pricing. It’s also widely used in academia for operations research and analytics programs.

A few days ago, FICO announced Xpress 9.8, which integrates Nvidia CUDA-X libraries to accelerate its hybrid gradient algorithm. This is expected to deliver up to 50x speedups for very large optimization problems. It will also reduce memory overhead and target dense problems.

Competitors in the solver market include Gurobi and IBM ILOG CPLEX. Some readers of this report may wonder if Palantir is a competitor, but they are not. FICO Xpress natively solves mathematical optimization problems, specializing in solvers for linear, mixed-integer, and non-linear programming. Palantir may integrate such a solver into environments on customer platforms, but it is not a direct competitor to the tech itself. Instead, it can rather be seen as a complement to existing Palantir environments where Xpress plugs in for specific solver needs.

Optimization software is currently niche in a broader sense, but the market is shifting from predictive analytics to prescriptive analytics. Xpress is in the prescriptive analytics segment, and as the name implies, a solver tells you what to do about problems, while predictive analytics predict what will or what is likely to happen.

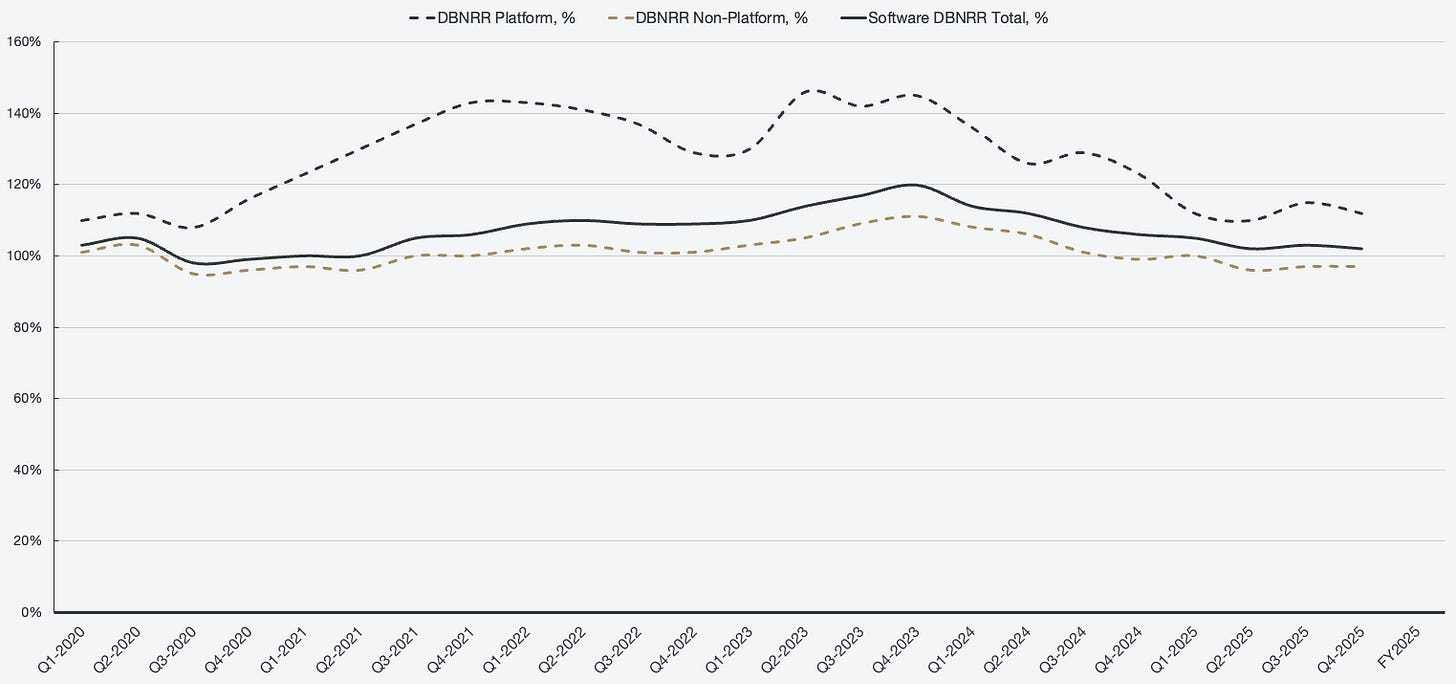

Since FICO uses a land-and-expand strategy (similar to Palantir), it is important to track net dollar retention. Dollar-based net retention rate (DBNRR) is the metric used to see how much ARR growth is attributed to existing customers. The goal is to get through the door and have companies deploy FICO software and then increase their spending and usage of the platform over time.