Palantir: Citron's Short Report Is A ChatGPT Copy/Paste

Palantir trades down -10% on an uninformed, lazy short report from Citron

There have not been any negative catalysts outside of macro events to drive Palantir’s stock quote down for about a year, since the stock traded at $21 in August of 2024. On the 18th of August, Citron Research published a short report on the company, which contributed to driving the quote to drop ~10%. The problem, however, is that the points made in the report can all be dismissed as outright false or misinformed.

It has to be noted that Citron’s short piece appears to be largely (if not fully) LLM generated using OpenAI’s products, as shown in the images and wording featured in their report.

Company profile

Theme: Dominance, Direction: Hold

Symbol: PLTR, Exchange: NASDAQ

Sector: Technology, Industry: Software - Infrastructure

Fair intrinsic value: $128 (-19%), as of August 19, 2025

Market capitalization: $404 299 million

Pricing data: P/S 118x, P/E 523x

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

Trades expensive compared to OpenAI

The very first remark is that Palantir trades expensively in comparison to OpenAI, which recently held a funding round that implied a market capitalization of $500 billion.

OpenAI, the undisputed leader in AI, is achieving revenue and user growth at an unprecedented pace in technology history. Its new $500 billion valuation provides a true benchmark for evaluating Wall Street’s favorite trading stock, Palantir—a company now detached from fundamentals and analysis, ironically the very services it claims to offer.

The report then continues to extrapolate a Price-to-Sales multiple from OpenAI’s new market capitalization and its projected revenue in 2026:

According to Wall Street consensus estimates for Palantir in 2026, the company is expected to generate $5.6 billion in revenue. Using OpenAI’s multiple of 16.89, that would imply a share price of $36.9 (quoted as $40 in the report):

Citron Research argues that Palantir does not deserve the same multiple as OpenAI, as OpenAI is the superior AI company. The rest of the report argues which company “truly leads the pack,” which is what my report will focus on.

In regard to pricing multiples (P/E, P/S, etc.), it is to be noted that pricing is not valuation. Pricing is a reference to price, not value. It is a snapshot in time of either current financial results or near-term financial results compared to the quote. By comparing pricing multiples, investors can assess if the company appears expensive or cheap relative to its peers. However, it does not tell the investor if the company is overvalued or undervalued. In essence, a company at the beginning of its narrative, which is rapidly expanding margins and is expected to have explosive growth, will rarely appeal attractive on a pricing basis.

Valuation centers around growth, cash flows, and the associated risks, the way businesses have been intrinsically valued for centuries. On an intrinsic valuation basis while using market-implied risk (the equity risk premium and the risk-free rate), a $37 quote implies that Palantir is only expected to have a ~23.5% revenue CAGR using 30% free cash flow to the firm margins. For anyone who has studied and analyzed Palantir, those assumptions are extremely pessimistic.

Revenue growth falls short of OpenAI’s transformative pace

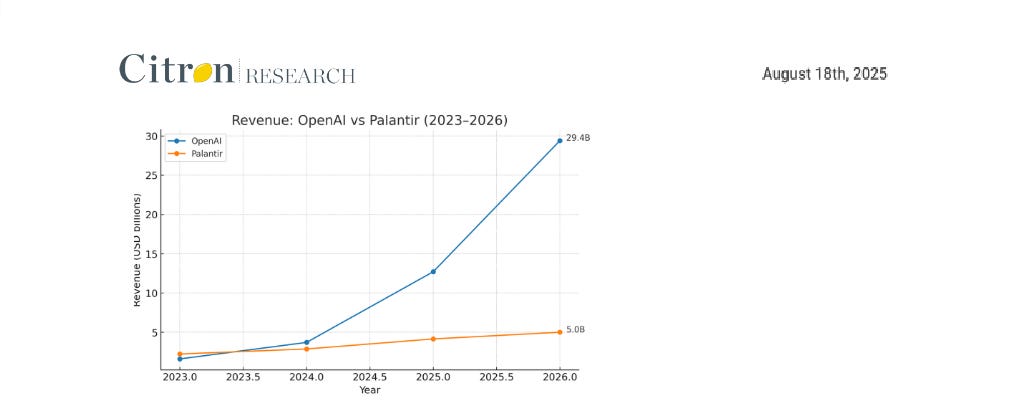

Citron’s report features a chart that captures what they perceive to be the expected revenue for Palantir and OpenAI into 2026. OpenAI reaches $29.4 billion in 2026, while Palantir reaches $5 billion.

The implied ~100% year-over-year revenue growth from OpenAI is quoted to be unique in tech history, while Palantir is expected to grow what seems to be implied as ~4% (~$4.8 billion to $5 billion) in their chart.

Figure 1: Projected revenue growth for Palantir and OpenAI

The two businesses operate different go-to-market strategies and feature incomparable growth profiles. Defining a leader of the pack on projected year-over-year growth for a single period is not telling of the quality or sustainability of the growth.

OpenAI is in a stage of growth where it is unprofitable and is burning up large amounts of capital in reinvestment to fuel the growth under fierce competition. Palantir has a capital-light, scaling model, where it’s expanding margins and accelerating growth each period.

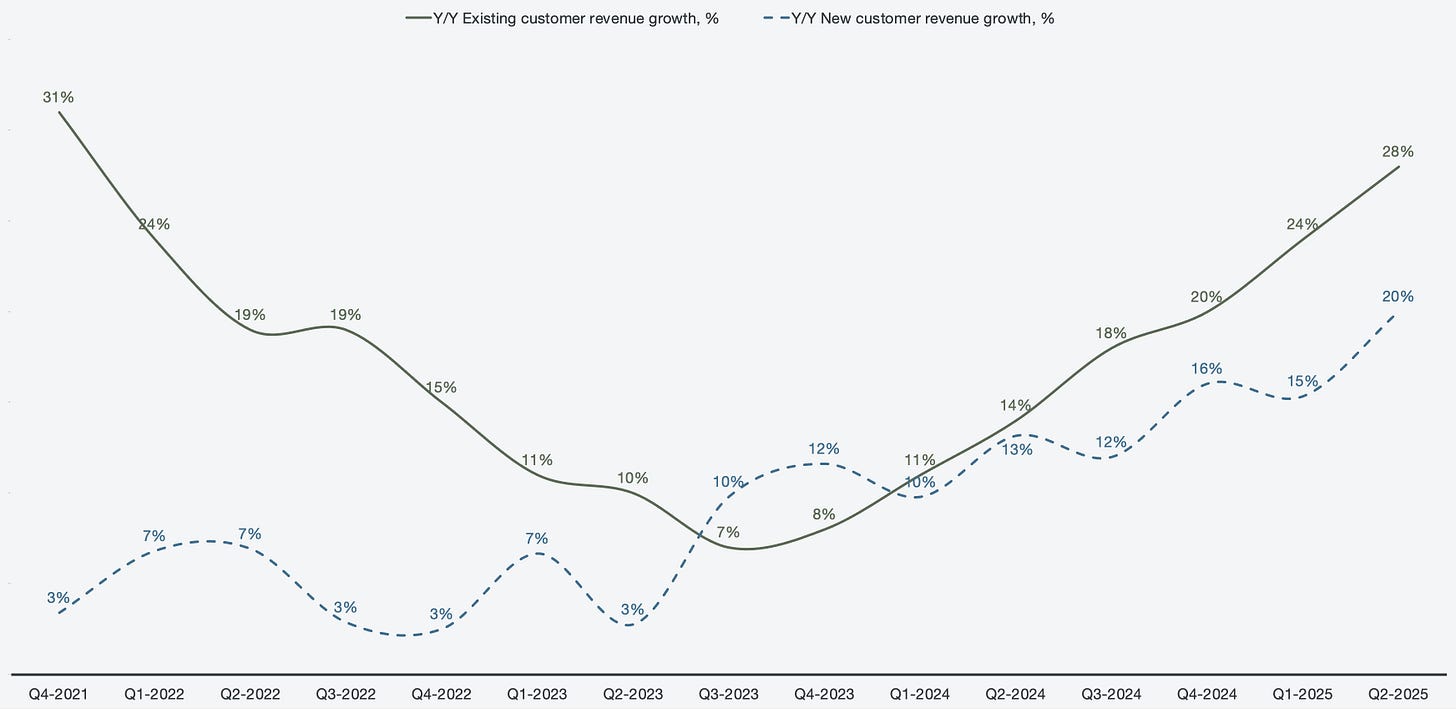

I argue that Palantir’s growth model is a lot more sustainable, both in terms of reinvestment needs and also in the ability to retain exceptionally high growth rates over a long period of time. This stems from the fact that Palantir’s growth primarily comes from existing customers expanding their use and not from an inflow of new customers. As the customer base continues to grow, new cohorts of scaling customers are created.

Figure 2: Historical cohort revenue growth

OpenAI primarily grows through subscriptions to its ChatGPT product, a product that is under immense pressure from many competitors. These competitors are also better capitalized than OpenAI, and all participants run the risk of unpredictable rates of improvement. Competition spawns a natural race to the bottom for all parties involved, where over time, Large Language Models (LLMs) will be commoditized, and each service will undercut the other in order to gain market share. While growth may appear to be impressive in the near term, sustainability of the growth is at severe risk.

Because OpenAI is not public, we do not have audited financial records for the business. However, it is assumed that the company is incurring massive losses in order to compete in the LLM space.

Business models

Citron claims that OpenAI operates a SaaS-like subscription model spanning massive global segments. It also paints a picture of Palantir primarily relying on large contracts in its government segment and lumpy, less scalable revenue in the commercial space.

This is plain and simply wrong, and it appears that Citron let a hallucinated response from their ChatGPT session make its way to their report.

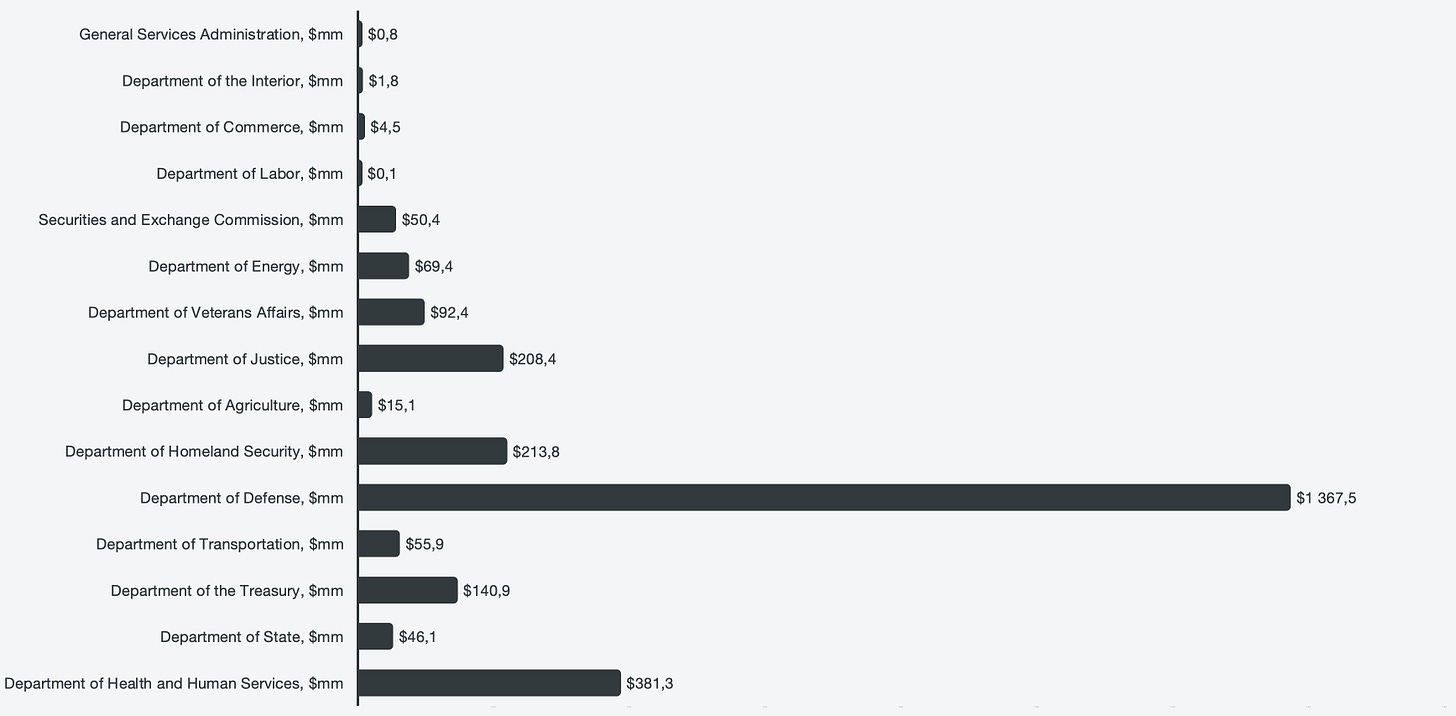

While it is true that the government has signed extraordinarily large deals with Palantir, it’s not true that they’re all structured this way. Palantir is active across more than 15 different agencies, with contracts of all sizes. For example, in Q1 2025, Palantir recognized a $50,000 contract from the Department of Justice.

On a cumulative basis from 2009, strictly looking at U.S. government contract awards of type A, B, C, and D, only one agency has awarded more than $1 billion. The average is $176.5 million across all agencies over a 16-year span.

Figure 3: Cumulative U.S. Government Contract awards of types A, B, C, and D

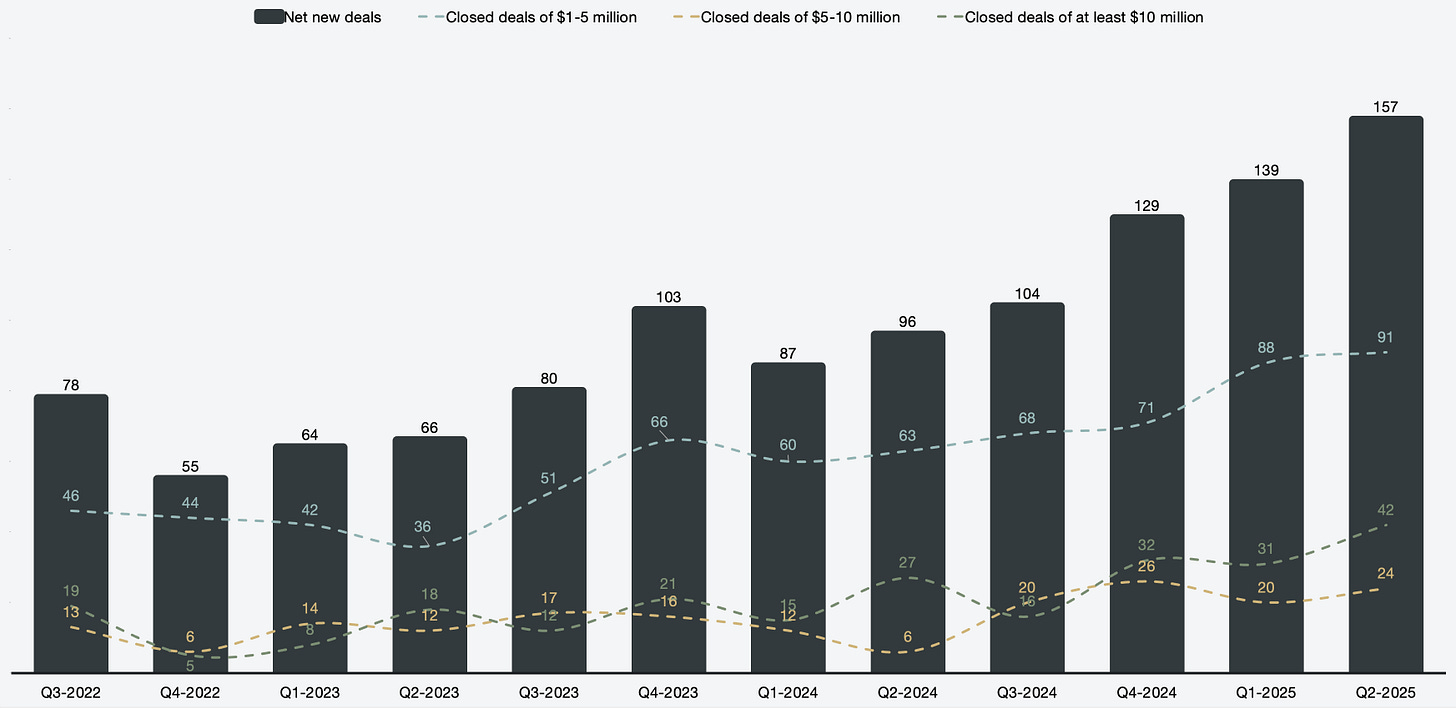

On the commercial side, there is no evidence of the revenue being lumpy or less scalable. Instead, the whole commercial segment is driven primarily by scalability, as noted in Figure 2. By looking at the deal distribution, there is an upward trend across all segments, and no lumpiness is observed besides specific quarters that are outperforming.

Figure 4: Closed new deals of $1 million and above

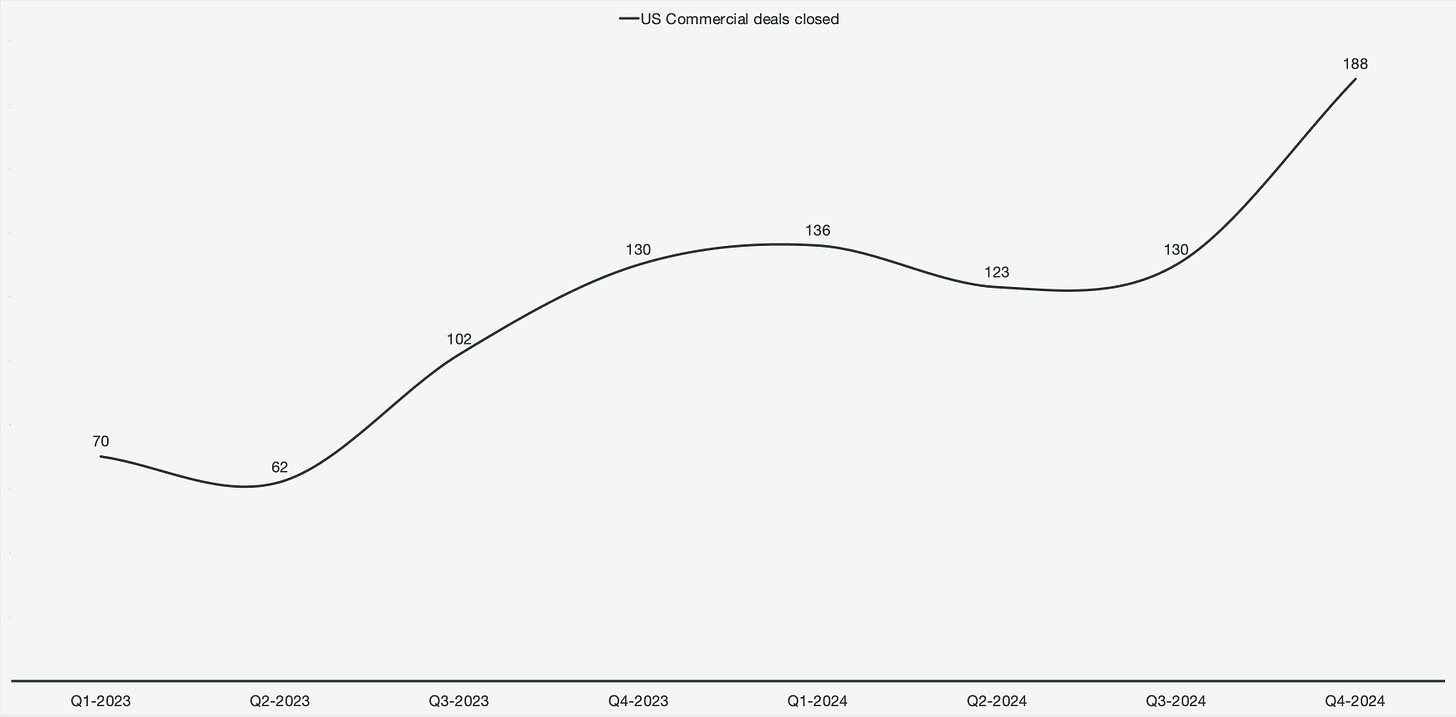

Similarly, while Palantir reported it, there was no lumpiness observed in the U.S. commercial deals closed (reported from 2023 through 2024).

Figure 5: U.S. Commercial deals closed

In the same segment, Citron claims that OpenAI’s total addressable market (TAM) is measured in trillions, spanning every consumer, enterprise, and developer use case. Palantir’s TAM is portrayed to be defense and enterprise contracts that scale slowly and compete head-on with giants like Microsoft (NASDAQ:MSFT) and Databricks.

As discussed, Palantir is contracted by more than 15 different agencies, not only the Department of Defense. In addition, scalability was also discussed above. However, the noted competitors, Microsoft and Databricks, are not directly competing with Palantir. Palantir offers a platform where both Microsoft and Databricks services can be leveraged, and both are partnered with Palantir.

Instead, it could be said that both companies are competing directly with OpenAI. Microsoft develops its own AI capabilities in addition to being an OpenAI investor, and Databricks has acquired an LLM business.

As for the TAM, Palantir’s TAM is virtually endless. The solutions and use cases are applicable across any given industry and sector. As of present day, Palantir is already deployed in a long list of vastly different businesses.

Competitive threats

Citron’s ChatGPT screenshot lists Microsoft, Amazon, Google, Databricks, and Snowflake as competitors to Palantir, while none of them are competing directly with Palantir. All of the listed businesses are partners and have products that can be leveraged within Palantir’s platforms. Instead, the listed businesses are actually competitors to OpenAI:

Microsoft: Develops LLMs

Amazon: Develops LLMs

Google: Develops LLMs

Databricks: Develops LLMs

Snowflake: Develops LLMs

Palantir has no comparable competitor at the time of writing. LLMs are quickly becoming commoditized, and as mentioned above, there is a very unprofitable race to the bottom ongoing for the competing companies.

Flywheel effect

In the next section, Citron Research claims that Palantir lacks a flywheel.

One customer doesn’t improve the platform for the next. That’s the key difference: OpenAI is a self-reinforcing growth engine, while Palantir is essentially locked-in consulting wrapped in software.

Palantir, on the contrary, may have one of the most powerful flywheel effects in the business world. Palantir has developed a whole ecosystem for powering enterprises using Palantir products.

When a customer adopts Palantir and extracts value in the form of improved efficiency, cost savings, growth, and improved KPIs, it puts pressure on industry peers to adopt or be left behind. Given that Palantir can be operational across any sector and industry, it creates a powerful compounding growth effect.

Every potential customer may not be able to relate to use cases across other industries, but every potential customer understands the language of time. When Palantir’s customers claim that something used to take them 12 months with a team of 20, and Palantir’s AIP allows them to do it in seconds in an automated manner, everyone can relate to that.

Palantir does not need to highlight success stories themselves. During recent quarterly earnings calls, customers are out of breath trying to highlight their partnerships with Palantir and how Palantir has helped them drive value across their businesses. Similarly, during Palantir’s AIPcons, customers are happy to present how they utilize Palantir products within their businesses, and they are not paid to do it.

Contrary to what Citron’s LLM-generated report states, Palantir’s platform is self-improving as more and more use cases are deployed. Solved use cases can be redeployed across other customers within the same industry. For example, it is likely that an oil & gas business faces similar challenges as another oil & gas business. In addition, solutions built by the customers themselves can be sold on the marketplace. This dynamic supports an ever-growing developer community centered around Palantir products.

Adoption drives ecosystem expansion, which in turn drives further adoption.

The Palantir Dilemma

The next segment highlights that Palantir does not provide any value to its customers:

Palantir faces a familiar squeeze. If it wants to keep growing, it will have to come up with new products that actually solve real business problems—or risk getting sidelined as clients realize the upside isn’t what it used to be. The days of selling “data fairy dust” are fading; it’s time for Palantir to prove it can deliver something new and tangible, not just bigger numbers.

Palantir are quite vocal about other enterprise software solutions being sold over a steak dinner or at the golf course, without providing value to customers. Palantir prides themselves in delivering outcomes, so I am not sure why the GPT model was led to believe that Palantir does not provide anything tangible. In fact, as mentioned in the segment above, customers are widely sharing their success stories from using Palantir.

Conclusion

Ironically, Citron concludes by writing, “Leave it to ChatGPT to hand us the answer,” before announcing OpenAI’s superiority. I don’t know if Citron tried to prove a point that OpenAI is superior to Palantir by generating a short report using ChatGPT; if so, it has backfired since the arguments are completely misinformed and inaccurate. The only real argument that a portion of investors may care about is the multiple comparison, but the actual analysis of Palantir’s business is full of hallucinations.

I would advise Citron’s team to start studying Palantir sincerely before putting out such a ridiculous report. Here is recent coverage I published completely for free prior to Q2 2025 earnings, a good place to start:

I am very open to criticism of Palantir and well-grounded bear arguments. I find it interesting to discover new things about businesses that I research that I may have missed or overlooked. However, Citron’s blatant ChatGPT-generated report simply served to diminish Citron’s credibility in my eyes.