Palantir: I read Burry's 10,000 word short thesis, and he's wrong

Michael Burry adopts a narrative that does not reflect reality and places puts on Palantir

I want to preface my response to Michael Burry’s short thesis by mentioning that I am a fan of Dr. Burry and his work. However, in the case of Palantir, the narrative presented is one that disregards core drivers of the business and ultimately is not rooted in reality.

Burry’s original research piece can be found here:

Company profile

Theme: Dominance, Direction: Buy

Symbol: PLTR, Exchange: NASDAQ

Sector: Technology, Industry: Software - Infrastructure

Fair intrinsic value: $206 (+56.48%), as of February 13, 2026

Market capitalization: $404 299 million

Pricing data: P/S 76x, P/E 208x

TYPEFCAPITAL.COM

Consider following me on X and YouTube.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities.

Narratives matter in investing

Just like when Citron published an LLM-written short report on Palantir, my interest was immediately piqued when I learned that Michael Burry wrote a lengthy piece on one of the most dominant companies in the world. I am always interested in alternative approaches to my own, as it allows for self-reflection and widens one’s scope of a business. However, I was thoroughly disappointed to find that large parts of the report do not discuss the current business and its outlook. Instead, the report primarily paints a narrative told through a former FDE and Glassdoor reviews, in combination with tidbits of Palantir’s 20+ year history. In general, the report is grounded and thorough, but in aspects with little to no importance to the actual business.

I will be tackling key points from Burry’s report and presenting a counterargument to each. Those familiar with Palantir’s business may find these points non-material, but please keep in mind that these are presented as major bear arguments against the business.

SPACs lost money and were an unforgivable mistake, done to artificially boost Palantir’s revenues

This topic has historically been a recurring bear argument against the business, but I believe that it is misunderstood. On the surface, as Burry points out, Palantir invested in SPACs during a general market-wide SPAC bubble. Palantir calls these “strategic investments,” and it entails Palantir purchasing equity in a business, which in return agrees to purchase and leverage Palantir’s software. Most of the SPACs have either collapsed in price or have gone bankrupt since, which is why some investors see the SPAC investments as “lost money.”

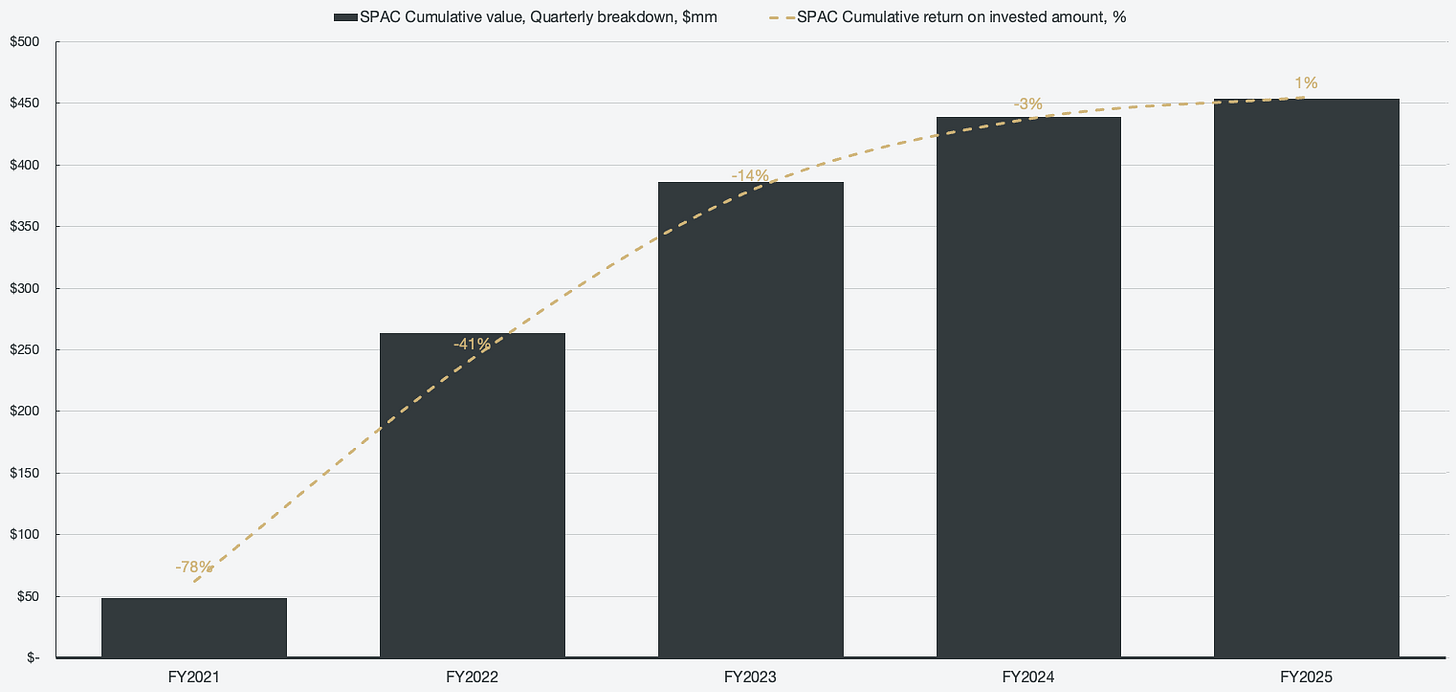

This is rightfully called out as artificially boosting revenue, but that narrative is merely surface level. In general, the contracts that the SPACs signed were 2-5x more favorable than the average contract rate for the time, which Palantir still recognizes revenue from. In total, Palantir invested $450 million in a wide range of SPACs, and I estimate that the cumulative value returned to Palantir is $454 million as of Q4 2025. The cumulative value is defined as SPAC revenue recognition as well as estimated sale proceeds (per 13F filings). To date, Palantir has recognized a mere 1% return, but it was not a complete capital destroyer as it has been framed. Adjusted for time and inflation, it is still at a small loss.

However, the capital itself is not the core of the SPAC investments, nor is the contract value. Instead, I believe R&D and domain expertise were the true purpose behind these SPAC investments. The companies varied across a wide range of industries, which allowed Palantir to quickly gain domain expertise across many emerging technologies. All while having favorable contract deals in return for equity investments, which they were free to sell at their own leisure. I estimate $132.27 million in estimated sale proceeds, and many companies were sold shortly after acquiring equity.

Figure 1: Cumulative SPAC value and return on invested amount

The margins that Palantir has do not reflect a SaaS company. Palantir is a consultancy

Burry compares Palantir’s margin profile to that of a consultancy. Given Palantir’s forward-deployed engineer strategy for onboarding companies, Burry deems Palantir a consultancy. Consultancies like Deloitte and Accenture include consultant expenses in their cost of revenue. Palantir records the FDE expense primarily in R&D, which, according to Burry, is incorrect, and by accounting the same way a consultancy would, Palantir’s gross margin would not be >80%.

Burry implies if Palantir changes their accounting for the FDE expense, it would collapse the pricing multiple that Palantir is fetching on the market. While I do not know how the equity markets would react to Palantir having below 80% gross margins, I do know that no investor or analyst that I have seen covering Palantir ever puts any weight on the gross margins of Palantir. The intrinsic value driver is the operating margin line, which does not change depending on the FDE expenses being recorded in line with a consultancy or a SaaS.

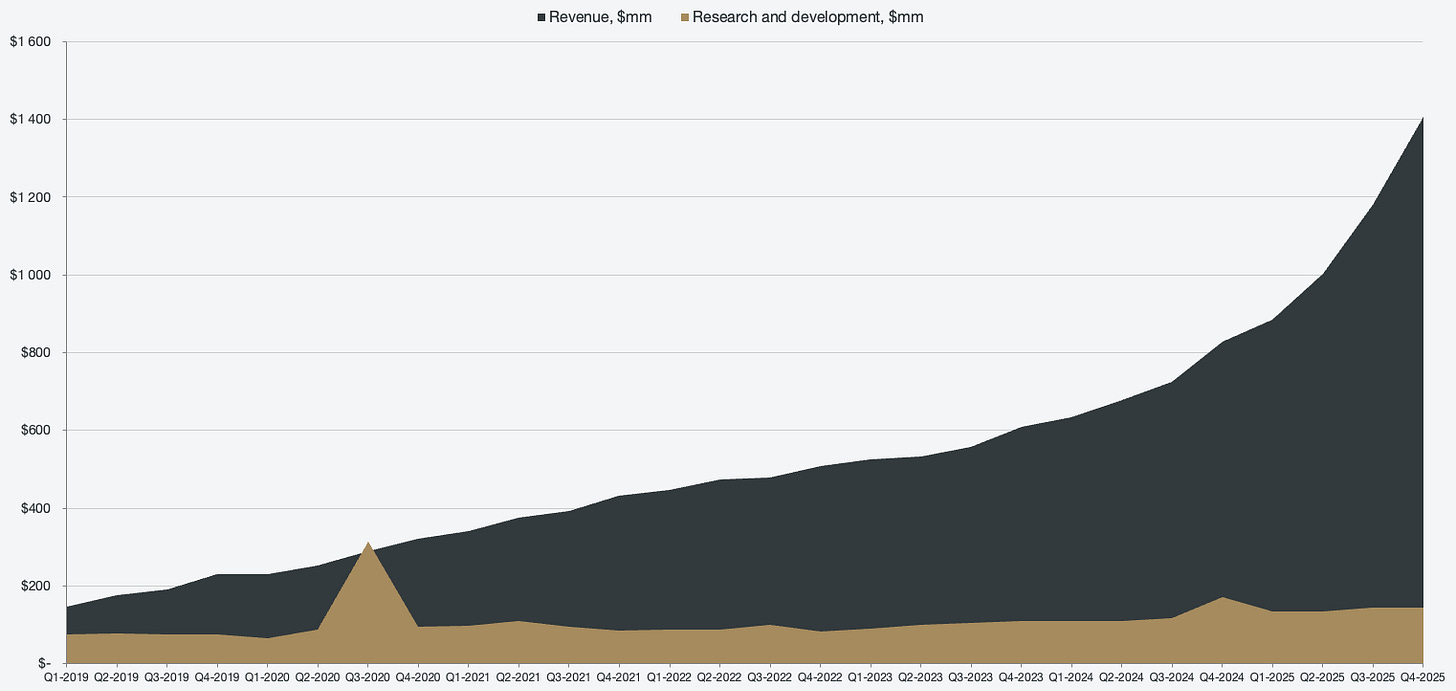

He also points out that Palantir only has 27% operating margins as of Q3 but does not mention the dynamic of how Palantir is able to rapidly expand its margin profile. He also does not mention that the current margin is at 41%, with no signs of slowing down. This is the result of Palantir’s operating leverage.

Figure 2: Operating leverage

AIP is a mere wrapper of LLMs and relies on other companies

The main argument presented in the report is that Palantir products are inherently non-sticky, since both AIP and Foundry merely act as wrappers and integration layers of third-party software solutions. He also mentions that AIP was the result of a panic as OpenAI’s ChatGPT dropped and that it was built in mere weeks by repurposing a previously defunct Palantir solution.

Burry argues that Palantir lacked any AI capabilities prior to ChatGPT and operated using mere machine learning (ML). Since AIP, Palantir is now a wrapper of others’ technologies, which causes a massive risk to Palantir’s business as AIP’s success relies on the proficiency of LLMs.

He then cites various research papers on the low reliability of LLM responses and how they are prone to hallucinations. Burry argues that due to the risks of LLM accuracy, it warrants an extremely high risk adjustment to the company’s discount rate.

It is true that Palantir does not develop its own LLM, and that is by choice. LLMs are a commodity, and capital-intensive commodities at that. Since Palantir’s solutions are LLM agnostic, they do not need to participate in an extremely expensive CapEx race to train models. Whoever ends up winning that race, Palantir still benefits, as it serves as the orchestration layer.

The whole value proposition of AIP is that it mitigates hallucinations in order to be used for even the most mission-critical use cases. By providing context of the whole business using ontologies, guardrails are inherent so that LLMs can be integrated across a business and start extracting value without the fear of hallucinations from LLMs.

I also understand that Burry is wrong regarding AIP and Foundry not providing actual functionality by acting as integration layers and LLM wrappers. This is a false narrative that completely disregards the extensive list of AIPCon customers who have presented tailored solutions to their business, where AIP acts as an operating system. Customers build on top of the operating system, and solutions are used to solve specific use cases within each business.

I agree that a mere LLM wrapper and an integration layer are prone to competition and that the approach is not sticky. However, that is not the case with AIP; the actual dynamic is sticky by nature, since the solutions are deeply integrated and built to solve use cases specific to the company.

Palantir’s net dollar retention is fake and artificially boosted

By scaling small AIP customers, for example, from $500 thousand to $2 million, Palantir gets a high retention on a low base, which inflates the blended figure.

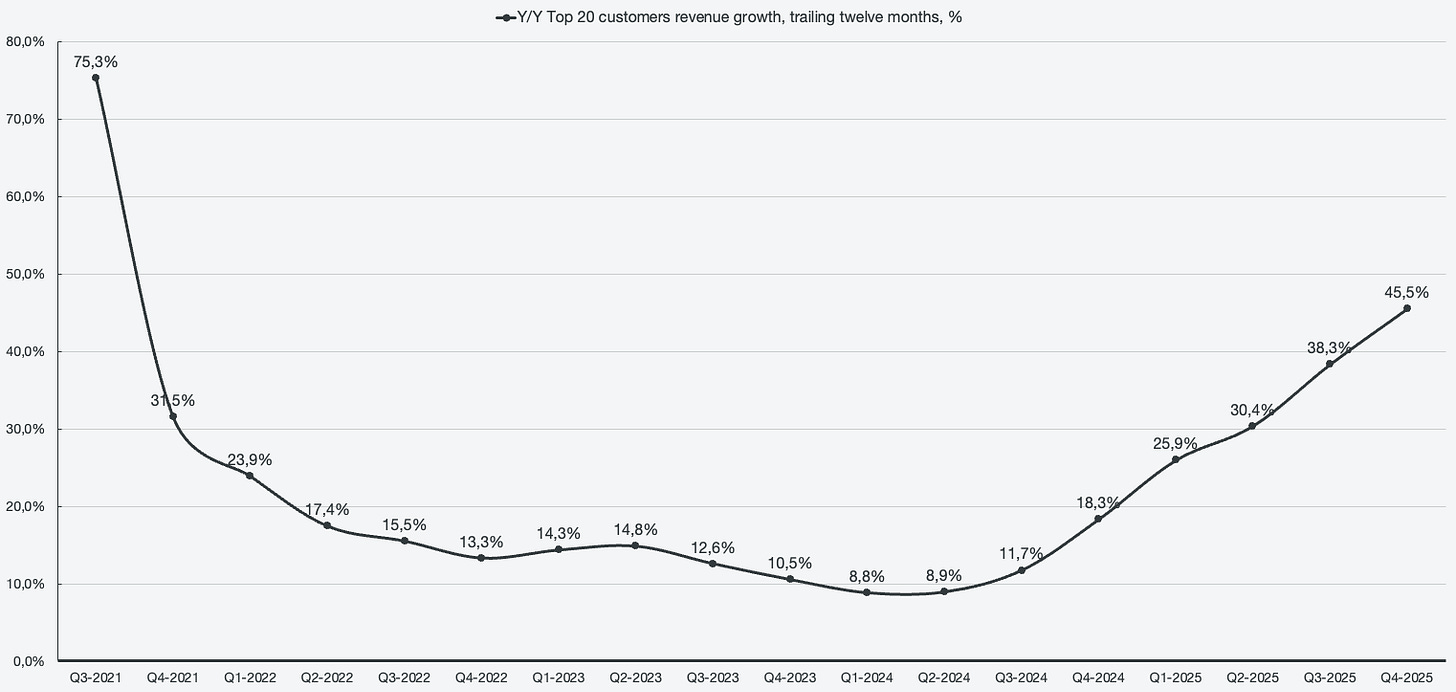

The actual dynamic unfolding is that the largest, most integrated customers are the ones elevating the NDR. 20 customers account for 42% of the business, and they are growing at 45% Y/Y on a TTM basis. The current NDR is 39%, meaning that the ones who are already paying the most are also the ones scaling faster than the average.

Figure 3: Top 20 customer cohort growth

In addition, Burry states that an earlier acquire-expand-scale strategy did not work, as NDR dropped off sharply until AIP was launched. Palantir spent large amounts of capital to acquire a customer, without reaping the benefits of scaling those very same customers before they dropped Palantir as a provider.

I agree that Palantir had to find an accelerator and a more streamlined way to onboard customers and scale them; that is the purpose of AIP. I do not see how this detracts from Palantir’s outlook; it simply confirms that Palantir identified a weakness and resolved it.

The customer count is low. Competitors have more customers and are better positioned to leverage competitive alternatives.

This is another claim that I believe should be framed differently to reflect reality. Palantir has managed to grow at an undeniably impressive rate without having to burn excessive amounts of capital to acquire customers.

If Palantir is able to grow at such a rate without a large influx of customers, what will growth look like when customer acquisition accelerates? Burry correctly identifies that deploying FDEs for onboarding creates a barrier to rapid expansion, since all inbound volume can’t be addressed simultaneously. However, Palantir is developing AI FDEs, which are able to build out ontologies and set up environments for customers, which will simultaneously handle volume and also decrease the costs associated with acquiring customers.

Salesforce is approaching 200,000 customers. Databricks and Snowflake have between 12,000 and 17,000 customers. Palantir is at a mere 954 customers with equivalent or higher revenues.

The implied customer acquisition cost payback time is 3 months as of Q4 2025, meaning a customer pays the acquisition cost within one period. The metric indicates a healthy dynamic where customers are being acquired at an increasingly profitable rate.

Stock-based compensation is rampant, and founders are enriching themselves at shareholders’ expense

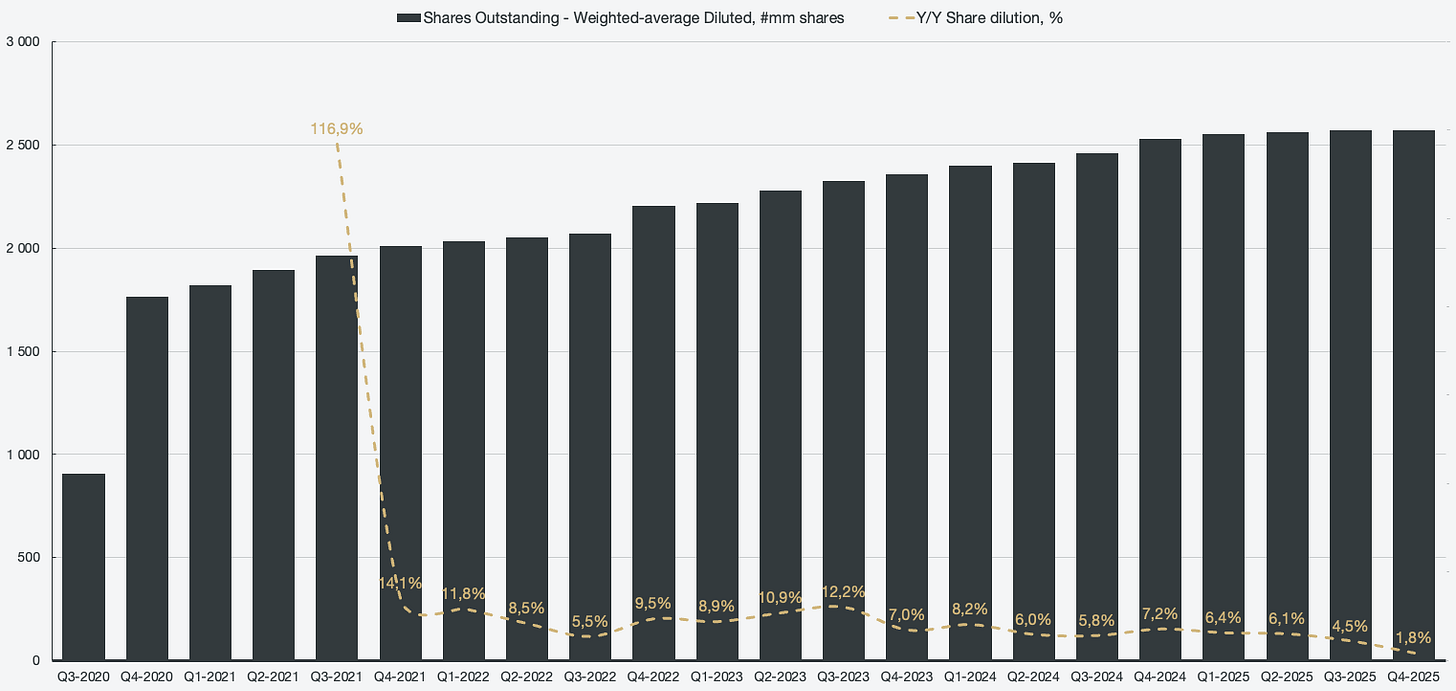

Michael Burry has modeled a 4% dilution rate for his intrinsic valuation. Actual Y/Y share dilution is down to 1.8%, and the trend indicates further decline. While Palantir has had high dilution rates historically, that is not the case currently.

Figure 4: Weighted-average diluted shares outstanding and share dilution rate

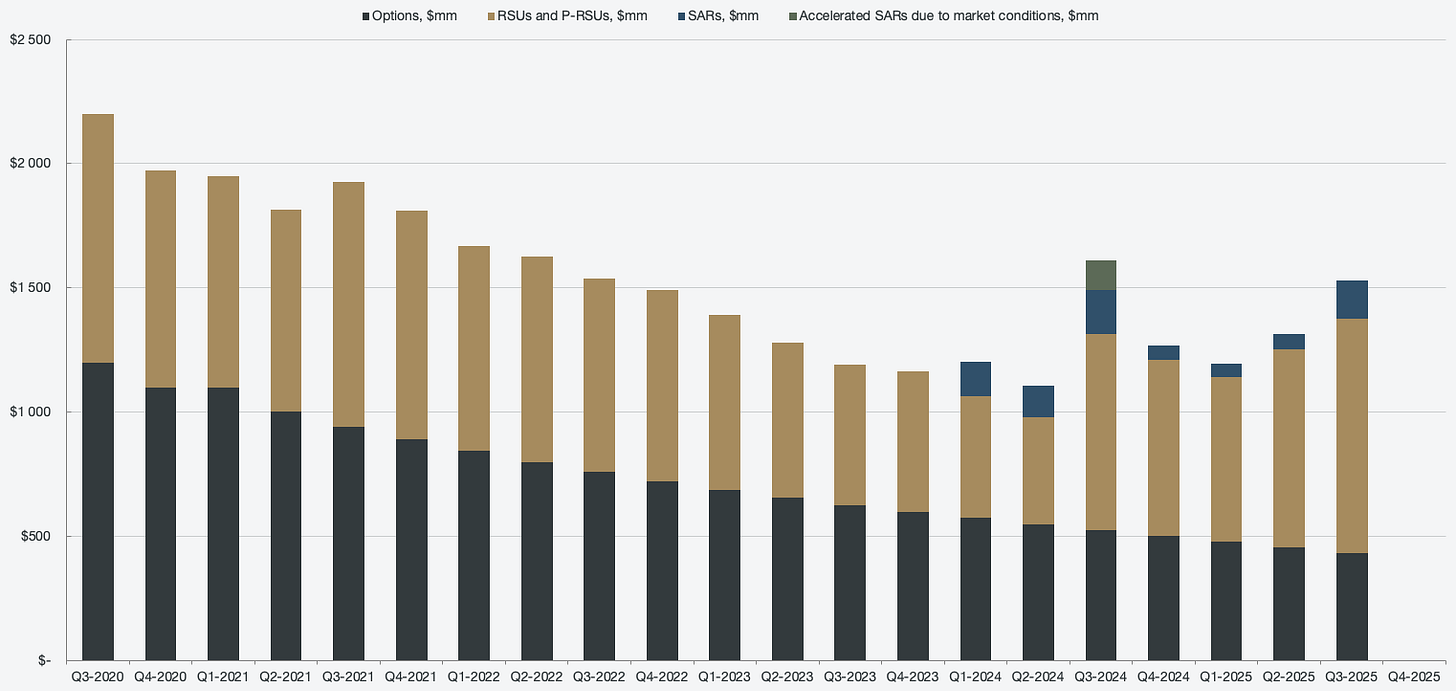

The option expense balance has been increasing, but it is not at a level where there is an implied 4% dilution rate each period over the next 15 years as Burry is forecasting. The 10K report is not out at the time of writing, which is why there are no Q4 2025 numbers.

Figure 5: Options expense balance

In addition, stock-based compensation as a percentage of revenues has dropped significantly and continues to trend downwards. As of Q4 2025, the SBC as a percentage of revenues is at 14%, which is significantly below the average for the SaaS peer group (around 23%).

Burry’s valuation

The key assumptions to Burry’s $46 fair intrinsic value are:

50% growth year 1-5, followed by 20% for year 6-15.

4% dilution rate.

16.6% discount rate.

4% terminal growth rate.

~43% FCFF margin each period.

As just discussed, Palantir is not indicating that a 4% dilution rate is probable over the next 15 years. Using ~4% over ~1% dilution rate erases about 40% from the fair intrinsic value.

The 16.6% discount rate is absurdly high and reflects a risk profile for the company that is not rooted in reality. The company is accelerating growth continuously, with contract balances implying a long run rate of high growth. In addition, while revenue is accelerating, the company is meaningfully expanding margins. Given what we know about the business, there are also no disruptive threats that Palantir is facing. Throughout all of this, there is no debt on Palantir’s balance sheet. A 16.6% discount rate reflects a distressed business facing many competitive threats, none of which are true for Palantir. Applying a discount rate that is based on February’s ERP, the current risk-free rate, and ~2% business-specific risk would triple the fair intrinsic value.

The growth is also anemic given what we know about balances such as RPO, RDV, billings, and inbound volumes referenced by management. The management has guided for US revenue to increase 10x over the next 5 years. Assuming ~50% CAGR that then drops after 5 years is too low given what we know about the business outlook. However, Burry even argues that he is being too generous regarding revenue.

Finally, reversing Burry’s assumptions implies that the FCFF margin is the same as recorded in 2025 for each period. That assumption seems unfair to make given how rapidly Palantir is expanding margins, and especially given how strong Palantir’s operating leverage and network effects are. There is seemingly no ceiling to Palantir’s margin expansion, as they are guiding to become even more efficient by accelerating growth while reducing headcount.

If we use more realistic assumptions while keeping Burry’s somewhat low growth assumptions intact:

2% annual dilution

55% FCFF margins (in line with Q4 2025)

10.45% discount rate

We would get a fair intrinsic value per share of $193, implying a 45.58% upside.

If you want to read my equity research detailing Palantir’s business in depth: